Shabbir Kayyumi

Average true range (ATR) is a volatility indicator originally developed by J. Welles Wilder, Jr. for commodities. It indicates how much an asset moves over a given time frame. The indicator aids in the placement of orders and can be used as a trailing stop loss. The average true range is an N-day smoothed moving average (SMMA) of the true range values. Default value is taken as a 14-period. Wilder proposed ATR in his 1978 book, New Concepts in Technical Trading Systems.

What is an ‘Average True Range (ATR)’?

The ATR indicator moves up and down as price moves in an asset become larger or smaller. The ATR describes how much a stock typically moves over the course of the day. The indicator does not provide an indication of price trend, simply the degree of price volatility. This Volatility measure is used to improve order placement and market analysis.

Day traders can use this information for plotting profit targets and determining whether a trade should be taken on.

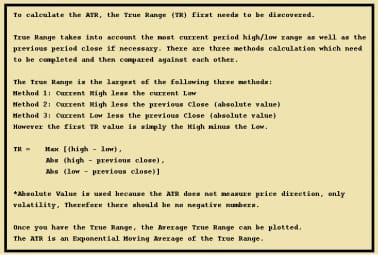

Construction of ATR Indicator

The true range indicator is taken as the greatest of the following: current high less the current low, the absolute value of the current high less the previous close and the absolute value of the current low less the previous close. The average true range is then a moving average, generally using 14 days, of the true ranges.

Important features and Uses of ATR Indicator

Uninspiring moves can be accompanied by relatively narrow ranges. As such, ATR can be used to validate the enthusiasm behind a move or breakout.

A bullish reversal with an increase in ATR would show strong buying pressure and reinforce the reversal.

A bearish support break with an increase in ATR would show strong selling pressure and reinforce the support break.

The volatility and ATR of the markets is always changing.

Stock moves from a period of low volatility to high volatility (and vice versa).

Average True Range is a continuously plotted line and usually kept below the main price chart window. The way to interpret the Average True Range is that the higher the ATR value, then the higher the level of volatility.

The look back period to use for the ATR is at the trader's discretion; however 14 days is the most common parameter used.

ATR can be used with varying periods (daily, weekly, intraday etc.) however daily is typically the period used.

Stock experiencing a high level of volatility has a higher ATR, and a low volatility stock has a lower ATR.

The indicator does not indicate the price direction; rather it is used primarily to measure volatility caused by gaps and limit up or down moves.

The ATR is fairly simple to calculate and only needs historical price data.

It is possible to use the ATR approach to position sizing that accounts for an individual trader's own willingness to accept risk as well as the volatility of the underlying market

Trading & ATR

ATR & Trailing Stop Loss

A trailing stop loss is a way to exit a trade. Assume you take a long trade and the price is rising as you expect. A trailing stop loss gets you out if the price drops by a certain amount. In other words, it reduces risk or locks in a profit as the price moves in your favour. ATR is commonly used as a trailing stop loss. At the time of the trade, look at the current ATR reading. Place a stop loss at a multiple of the ATR. Two is common multiple, meaning you place a stop loss at 2 x ATR below the entry price if buying, or 2 x ATR above the entry price if shorting.

The stop loss only moves to reduce risk or lock in a profit. If long, and the price moves favorably, continue to move the stop loss to 2 x ATR below the price. The stop loss only ever moves up, not down. Once it is moved up, it stays there until it can be moved up again, or the trade is closed as a result of the price dropping to hit the trailing stop loss level. The same process works for short trades. The stop loss is only moved down.

The use of the ATR is commonly used as an exit method that can be applied no matter how the entry decision is made. One popular technique is known as the "chandelier exit" and was developed by Chuck LeBeau. The chandelier exit places a trailing stop under the highest high the stock reached since you entered the trade. The distance between the highest high and the stop level is defined as some multiple times the ATR.

Use in Position Sizing

Apart from being a trend strength gauge, ATR serves as an element of position sizing in financial trading. Current ATR value (or a multiple of it - x) can be used as the size of the potential adverse movement (stop-loss distance) when calculating the trade volume based on trader's risk tolerance. In this case, ATR provides a self-adjusting risk limit dependent on the market volatility for strategies without a fixed stop-loss placement.

A less volatile market has a larger trading position in comparison to a more volatile market in a portfolio.

Explosive breakout & ATR

Steps to follow to find out explosive breakout trades using ATR

Wait for volatility to reach at lows (on the weekly timeframe)

Identify the range during this time period

Trade the break of the range

Traders should use the MFI in conjunction with other technical indicators to maximize their odds of success.

The author is Head - Technical & Derivative Research at Narnolia Financial Advisors Ltd.

Disclaimer: The views and investment tips expressed by investment experts on moneycontrol.com are their own, and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.