At a time when Delhivery is navigating the swirling currents of a cutthroat market, Ekart, the supply chain arm of Flipkart, has announced its entry into the B2B delivery and pick-up services domain.

B2B or Business-to-Business are transactions between companies, rather than between a company and individual consumers.

Ekart is the third e-commerce logistics player to enter Express and Part Truck Load (PTL) shipments after Delhivery and Xpressbees.

When a company needs to utilise the entire space of a truck to transport goods, it usually chooses Full Truck Load (FTL) as the shipping method. FTL is ideal for businesses that require ample space to transport their goods to a specific destination. On the other hand, a Part Truck Load involves consolidating orders from multiple companies into a single truck. This means that multiple businesses share a single truck for deliveries to different locations.

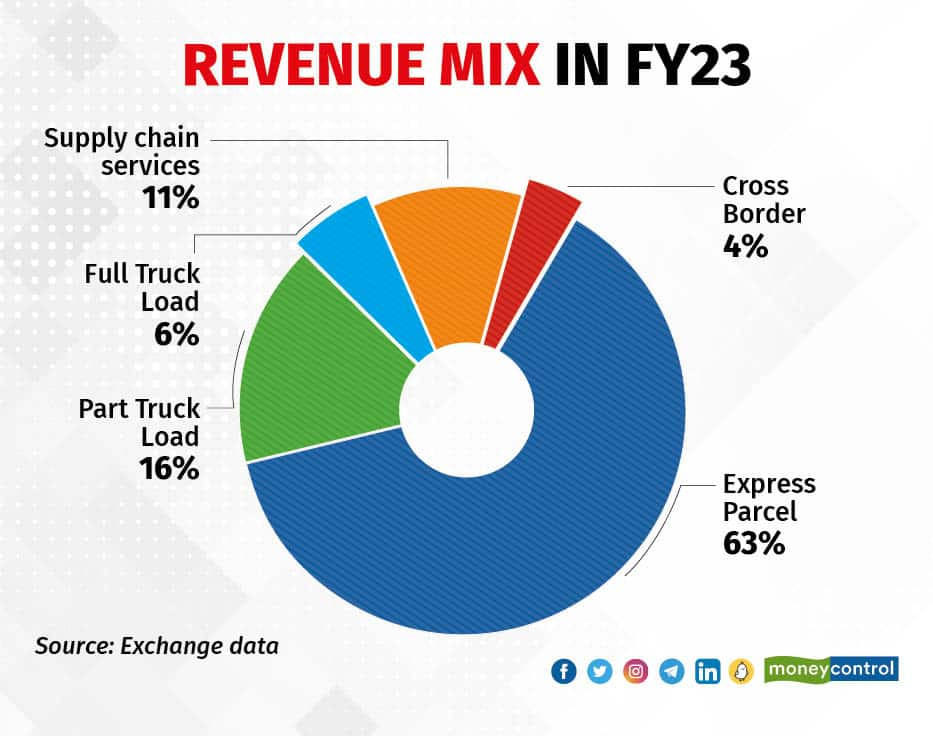

Delhivery leads the non-captive Business to Customer (B2C) Express logistics market with a market share of approximately 22-24 percent. It has expanded into complementary sectors, leveraging its B2C success, and now offers integrated specialised logistics services covering Express, PTL, FTL, cross-border markets, and end-to-end supply chain management.

The logistics player’s express parcel business is equipped to handle packages weighing up to 10 kg, offering both same-day and next-day delivery options. For long-distance orders across over 18,540 pin codes, deliveries are completed within 48-96 hours. The company also provides specialised services, including product replacement/exchange, oversize delivery, and high-value product delivery.

Cross-border transportation relies on air and ocean shipping, while supply chain solutions integrate warehousing, transportation, and advanced data science capabilities.

Revenue mix in FY23

Revenue mix in FY23

ICICI Securities predicts strong growth for Delhivery’s Express division, a solid recovery in the PTL segment, and promising prospects for newer businesses such as FTL, SCM, and Cross-border services, driven by innovative offerings such as the FTL exchange, called Orion.

But Ekart could play spoilsport.

Read more | Delhivery: A reality check on the growth hype

What industry trackers think

“Ekart's move into the B2B delivery sector could pose a challenge for Delhivery,” said Sonam Srivastava, smallcase manager and founder, of Wright Research.

“For Delhivery, this could mean stiffer competition and a potential hit on revenues and market share, especially if Ekart undercuts pricing or provides superior service,” she explained, adding that the company will need to innovate and respond effectively to retain its market position.

In Kotak Institutional Equities’ view, “While it being a low probability event, the success of Flipkart’s endeavors in logistics (ecommerce fulfilment earlier and now Express B2B) can alter medium-term growth and economics of Delhivery”.

Independent expert, Kush Ghodasara, CMT believes “the entry of Ekart into the market of Delhivery poses additional challenges for the latter, particularly in terms of maintaining higher profit margins”.

Moreover, Kotak Institutional Equities has deferred Free Cash Flow break-even by a year for Delhivery to FY27. It has double-downgraded its rating on the stock to ‘reduce’ from ‘buy’ following the recent rally.

The other side of the fence

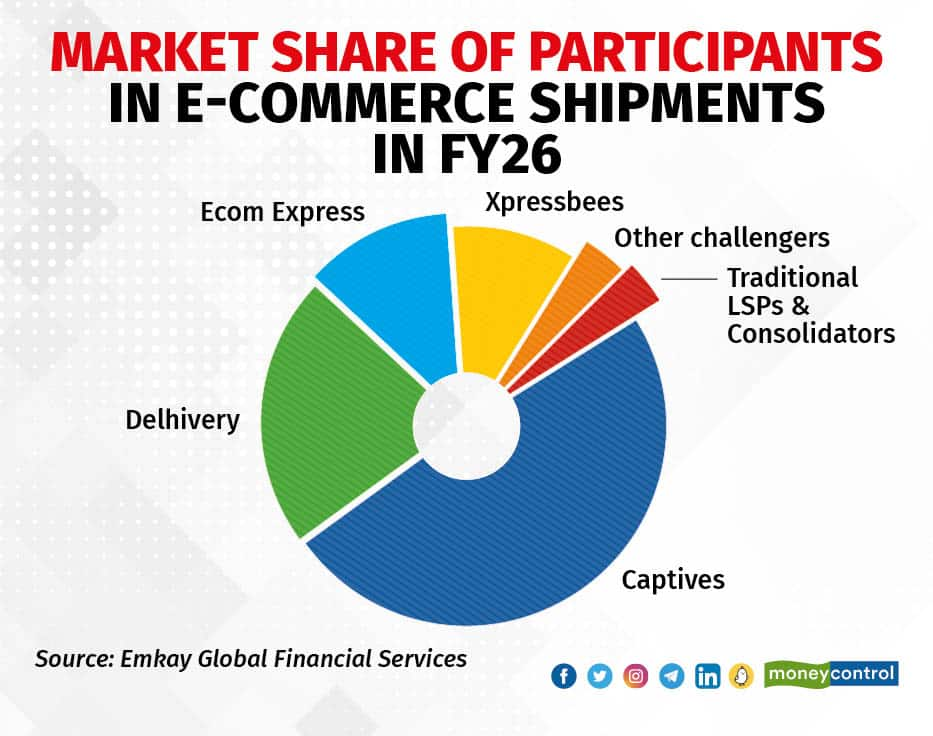

Delhivery is a dominant market leader in non-captive third-party logistics (3PL) for e-commerce shipments. It boasts an impressive overall market share of around 22 percent (including captives) as of FY23. In simple terms, non-captive third-party logistics for Delhivery means providing logistics services to external businesses and clients, rather than only serving Delhivery's operations or direct clients. It involves offering logistics solutions to multiple companies as an independent service provider.

Market share of participants in e-commerce shipments in FY26

Market share of participants in e-commerce shipments in FY26

“While the company faces significant challenges, its potential for growth is enormous,” says Srivastava. Compared to its peers, Delhivery has a unique positioning in a commoditised market and could provide significant returns if it can successfully leverage its strengths.

Even foreign brokerage firm Macquarie had said as much in a report last month. “Discussions with the management team and line managers reinforce our view on Delhivery's ability to maintain or grow its market share,” it noted. Macquarie expects integrated operations to drive cost competitiveness for Delhivery. Further, the global brokerage firm has maintained its ‘outperform’ recommendation with a target price of Rs 460.

Macquarie suggests that there is potential for consolidation in the 3PL segment.

Delhivery's strong market position is supported by its cost advantages, allowing it to offer competitive pricing. With a wide national reach and significant investments in automation and technology, Delhivery is expected to increase its market share to 24 percent by FY26, according to Emkay Global Financial Services.

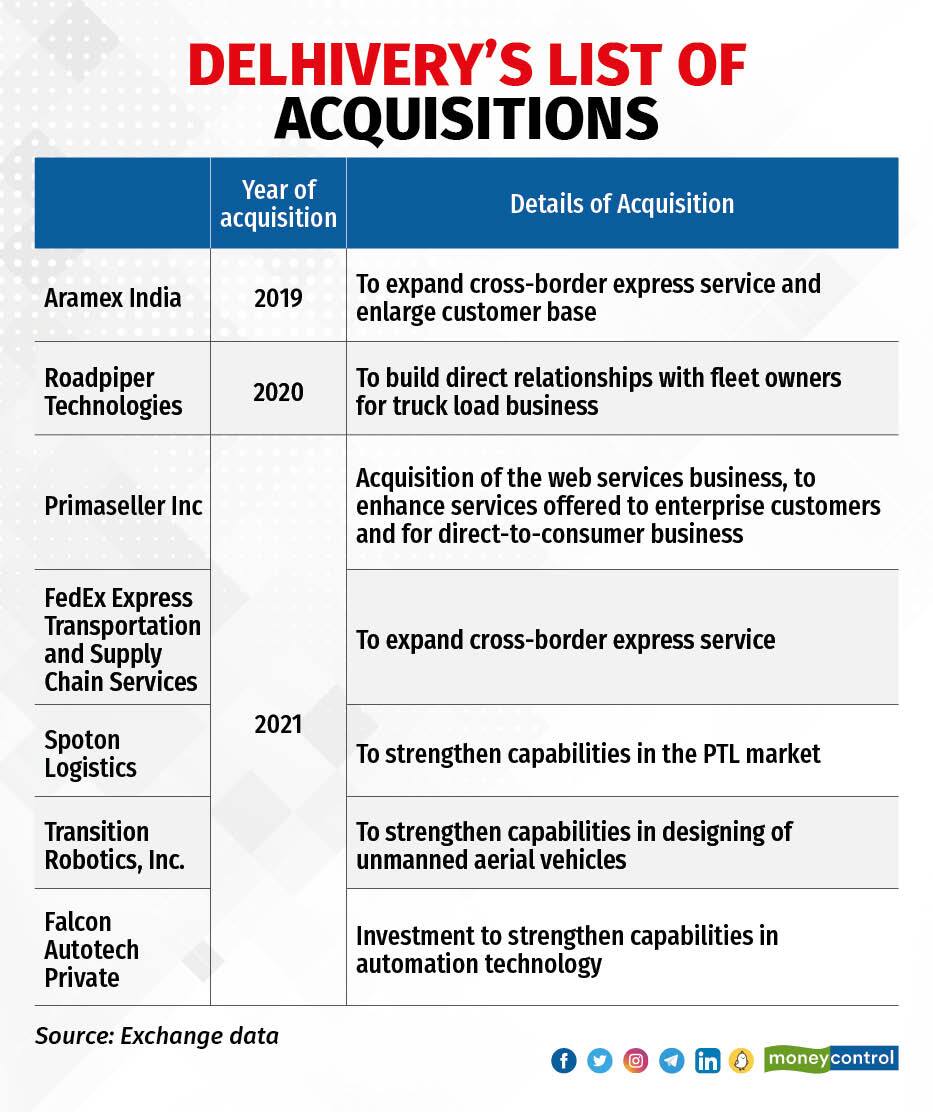

What’s more, Delhivery has expanded its global reach through strategic alliances, creating a captivating tapestry of collaboration. Each partnership unlocks new possibilities, fuelling a symphony of growth that resonates across borders.

Given the company’s history of cross-selling, analysts believe these partnerships have the potential to significantly boost Delhivery’s other business segments. Having said that, the expectation is that capital expenditure intensity will taper as past investments bring in future efficiencies along with scale benefits.

Read more | Union ministries yet to sort out funds, land issues for logistics plans under NLP

Integrated approach equals lesser risks

Delhivery's integrated approach not only fosters sales growth but also mitigates concentration risks and minimises the effects of business cyclicality, analysts believe.

Unlike other logistics service providers focused on e-commerce, Delhivery's entry into the PTL segment diversifies its risk exposure. The business-to-business (B2B) PTL market experiences a surge in volume during the month-, quarter-, and year-end periods, while the business-to-customer (B2C) Express market thrives during festive seasons and flash-sale days. This complementary nature allows Delhivery to optimise resources and effectively handle both low-demand and peak-demand situations, providing an advantage over competitors serving a single customer group.

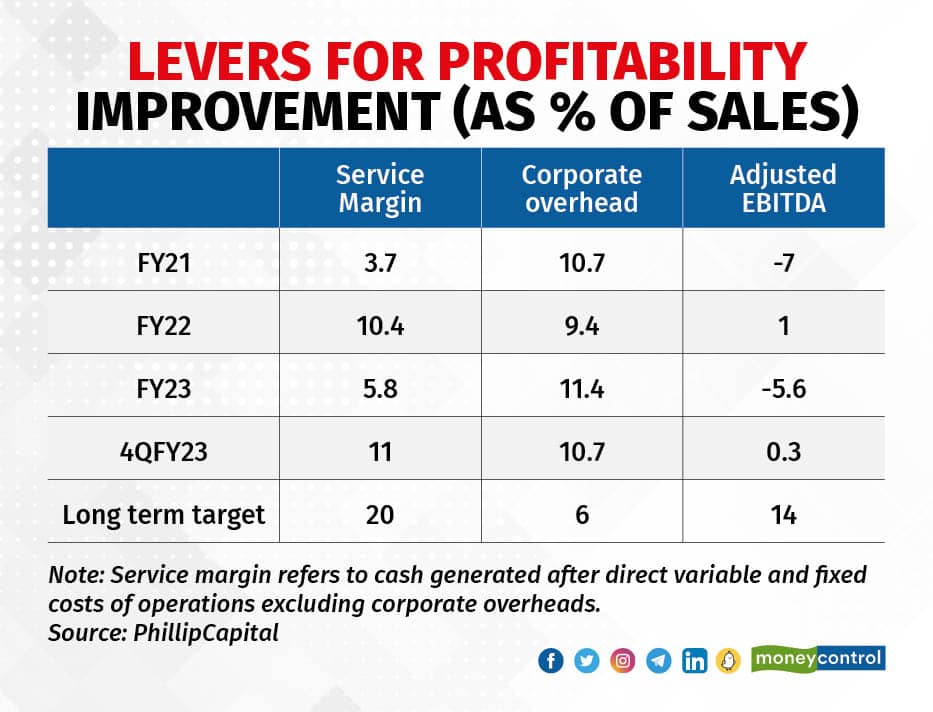

Trek to profitability

Delhivery is prioritising network utilisation and volume growth to lower operational costs and maintain its competitive edge, as noted by PhillipCapital. The management also aims to enhance service margins to 20 percent and reduce overhead costs as a percentage of sales to 6 percent in the medium to long term.

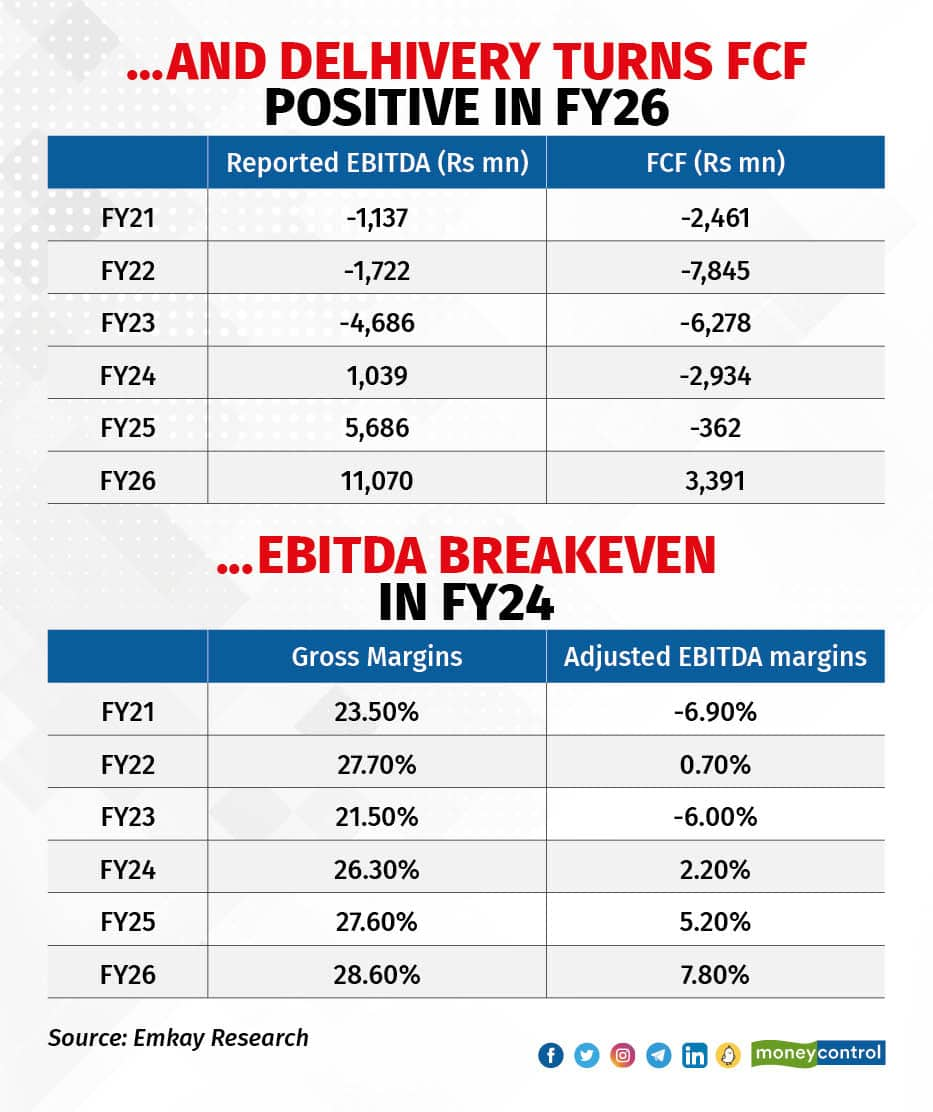

The logistics company is expected to reach adjusted EBITDA breakeven by FY24 and achieve net profitability and positive free cash flow by FY26, riding on operating leverage, network stabilisation, and reduced capital expenditure. Emkay Global Financial Services highlights that in a competitive market with standardised offerings, the operator with the lowest costs is likely to experience significant growth and profitability.

The domestic brokerage firm’s analysis indicates that in the B2C Express segment, Delhivery has a transportation cost that is approximately 20 percent lower than its competitors.

Delhivery's cost advantage stems from its innovative business model, combining B2C Express and B2B PTL networks, a large-scale network that reduces delivery costs, and a strategic emphasis on maximising direct routes to minimise distance and expenses, explained Emkay Global Financial Services.

Read more | Unique small-cap stocks held by top small-cap MF schemes

Far flung from the peak

Many market participants believe the primary challenges for Delhivery, such as increasing competition in the logistics sector, especially from established players such as Ekart, and the need for continued heavy investment in infrastructure and technology, are likely factored into the current stock price, given its 20 percent rally in the last three months.

While Delhivery’s stock is still over 40 percent away from its peak, its fundamentals look promising. The company is at the forefront of integrating technology into logistics, potentially revolutionising the sector, some market experts said.

While the company is still investing heavily in infrastructure and IT, the potential for returns on these investments could be substantial. However, its ability to generate free cash flows remains a concern, Srivastava pointed out.

Morgan Stanley highlighted some catalysts that would be keenly watched in the second half of FY24. Volume recovery in the express parcel and PTL business, market share gains, high incremental gross margins, and operating leverage could lead to further improvement in profitability, it believes.

The foreign brokerage firm expects room for further operating leverage to play out with higher incremental gross margins. “We think the stock is more than pricing in the current slowdown, and with improving execution we see the potential for the stock to re-rate,” it added.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.