Nifty50 rose 7.6 percent in March 2019 and in terms of dollar returns, it is up 6.9 percent YTD largely led by massive inflows from foreign investors (FPIs).

“Nifty50 has witnessed a pre-election rally, broadly driven by foreign portfolio investors (FPIs), buying equities worth Rs 339.81 billion, while domestic institutions turned sellers in the equity markets, selling equities worth Rs 13,930 crore in March 2019,” Standard Chartered said in a report.

“The Bank Nifty index touched a new high earlier this week in anticipation of a favourable outcome of general elections, US-China trade talks, the dovish stance by the US Federal Reserve and the reduced intensity of geopolitical tensions with a neighbouring country,” it said.

The global investment bank is of the view that going forward, the two major events which will give a new direction to the market are Q4FY19 results and the outcome of the central elections.

The markets are currently discounting any favourable outcome of the general elections. We believe the earnings will have to catch up for the markets to continue their bull run, it said.

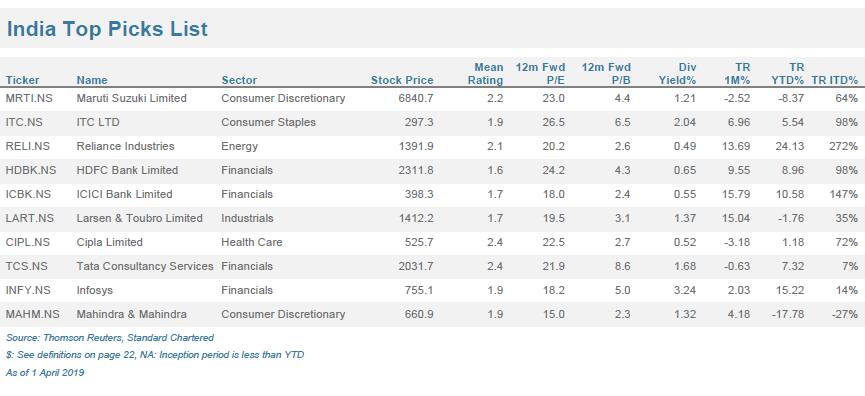

Here are top 10 picks from Standard Chartered: Maruti Suzuki India: Maruti relationship has moved a step further with both the companies announcing the sharing of technology in the global markets and in India. Both the automotive giants from Japan will utilise each other’s expertise to bring out new products in the markets globally, including India. Maruti will benefit from the Share Hybrid Electric Vehicle (HEV) technology through local procurement of HEV systems, engines and batteries, which will help Maruti Suzuki to launch hybrid vehicles in India. The Indian market will see a slew of new products as a result of the new collaboration, including the rebadged versions of popular vehicles like Maruti Suzuki Baleno and Maruti Suzuki Ciaz. It will also get access to the luxury segment with the launch of Toyota Corolla, which will be retailed by Maruti Suzuki In India. The global investment bank expects this slew of new initiatives to drive demand for the automaker. Mahindra & Mahindra: Riding on new launches, including the compact sports utility vehicle, XUV 300, dispatches at Mahindra & Mahindra (M&M) saw a year-on-year increase of 16 percent to 26,109 units in February 2019. Initial booking numbers indicate M&M has been able to make a big splash in the competitive compact sport utility vehicle (SUV) market. The firm has received more than the 13,000 bookings for the XUV300 in a month after its launch. It also said the new model entered the No.3 spot in the compact SUV segment in the first month of its launch. M&M is looking to bring an electric car based on a platform of Ford with which it has an agreement to develop products jointly to add to its portfolio. The government’s pre-election consumption spending, reduced raw material costs and interest rate booster by the RBI are likely to have a positive impact on tractor volume. ITC: ITC increased the price of its three brands - Bristol, Flake Excel, and Capstan - at the beginning of March 2019. Price hikes for these three brands are in the range of c.7 percent-c.14 percent and contribute c.20 percent of the total ITC’s cigarettes volume. However, an average price hike for the cigarettes portfolio is estimated at 2 percent. ITC's cigarette business has seen strong volume recovery (c.5 percent YoY growth) in FY19 with no tax hikes. This was a much-needed breather for the company as c.17 percent tax hike CAGR in the last six years saw cigarette volumes declining by c.20 percent YoY from the peak. The recent price hikes by ITC, including minor price increases in regional brands in Q2 and Q3, are likely to improve realisation and operating profit margin, provided there is no tax increase going ahead, besides offsetting the increase in tobacco costs. Other businesses, i.e. FMCG, paper, and hotels, are also witnessing a gradual uptick in growth and profitability. Cipla: Cipla’s leadership in the high-margin respiratory portfolio and fast-growing segments such as gastro, gynaecology, and neurology are the key factors driving the stock in our India Top Picks list. Domestic business (c.40 percent of total revenues) is likely to remain robust with the US business continuing to grow at a higher pace on a low base. In fact, the US operations have also been transformed into a front-end based model, especially through the acquisition of InvaGen. In other geographies, Cipla is moving away from the tender-based model, which typically earns lower margins. Consensus expects margins to remain under pressure as revenues from the tender business and Emerging Markets are likely to remain soft. HDFC Bank: HDFC Bank is likely to continue its branch expansion strategy even after completing 24 years in operation and opening 5000 branches. The bank is targeting to take its services to one lakh villages, the CEO of HDFC bank told reporters without specifying a timeline. Capital constraints of public sector banks will provide private sector banks an opportunity to increase their market share and outperform in the banking and financial services space. Furthermore, we expect HDFC to be a major gainer of the current crisis in the NBFC space as it has best-in-class liability franchises along with superior customer outreach across business segments. ICICI Bank: ICICI Bank’s liability and asset franchise have strengthened over the years with de-risking of its loan portfolio, rising market share in CASA, increased competitiveness in the cost of funds relative to peers and an improvement in capital efficiency. Management expects incremental loan growth to be driven by retail and SME segments, which should further be supported by a corporate credit growth recovery. The sector as a whole may face some increased competition from PSU banks. However, the impact on ICICI Bank is expected to be minimal as the SME and business banking segments contribute only c.8 percent to overall advances. Management is confident of achieving an RoE of 15 percent by June 2020, driven by moderation in credit costs and an increased impetus on the pricing of loan products. Larsen & Toubro: Larsen & Toubro (L&T) has shown significant improvement in its balance sheet, execution pick-up and robust order inflows over the years. In March, LT entered into a definitive agreement to acquire the shares of MindTree Ltd. LT is likely to buy a c.20.32 percent stake in Mindtree at Rs 980 per share, aggregating to Rs 32,700 crore, and has also offered to buy an additional stake up to c.15 percent, subject to regulatory approval. The Mindtree acquisition is in line with LT’s stated strategy of focusing on services and unlocking capital to have an asset-light business model to drive profitable future growth. LT remains our top Pick as it has consistently been delivering in terms of bagging orders, strong execution of backlog and at the same time improving the quality of its balance sheet, thereby generating reasonable cash flows. Reliance Industries: Reliance Industries (RIL) telecom and retail businesses are gaining strength. Its low exposure to the oilretailing business has insulated RIL’s earnings over cycles, and should play out well going forward as well. RIL has been able to demonstrate healthy GRMs, beating Singapore refinery margins with wider margins. RIL is planning to double sales from Reliance consumer business, Reliance Jio, and Reliance Retail in about seven years. Reliance Retail is still the fastest growing organised retailer across consumer formats this financial year, and growth may accelerate as it scales up key formats and launches its digital platform integrating kirana stores. Unlocking of value by non-energy businesses remain the key triggers to watch going ahead. Disclaimer: Reliance Industries Ltd. is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments Ltd.Infosys: Latest media interactions of CEO Salil Parekh point out that INFY is not likely to compromise on margins to push up revenue growth, and its current investment in people and building up digital capabilities will not affect its margins in any form, rather make the company future-ready. The firm is strengthening its marketing muscle by hiring more number of people as part of its go-to-market strategy, apart from adding more locals in key client geographies. Tata Consultancy Services: Tata Consultancy Services (TCS) is confident of delivering double-digit growth in CC over the medium term. The demand environment remains healthy and has not yet been impacted by emerging macro concerns. TCS expects to achieve the guided EBITM range of 26-28 percent in the medium term as newer services gain scale and currency movement reflects the inflation differential between markets. TCS expects double-digit growth to sustain on the back of a healthy demand environment, strong deal wins and deal pipeline, and continued traction in digital (growing at ~50 percent YoY). Improving market positioning and win rates give management confidence that it would be able to deliver fairly stable and predictable revenue growth in the medium term. Disclaimer: Reliance Industries Ltd. is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments Ltd.The views and investment tips expressed by investment expert on moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Maruti Suzuki India: Maruti relationship has moved a step further with both the companies announcing the sharing of technology in the global markets and in India. Both the automotive giants from Japan will utilise each other’s expertise to bring out new products in the markets globally, including India. Maruti will benefit from the Share Hybrid Electric Vehicle (HEV) technology through local procurement of HEV systems, engines and batteries, which will help Maruti Suzuki to launch hybrid vehicles in India. The Indian market will see a slew of new products as a result of the new collaboration, including the rebadged versions of popular vehicles like Maruti Suzuki Baleno and Maruti Suzuki Ciaz. It will also get access to the luxury segment with the launch of Toyota Corolla, which will be retailed by Maruti Suzuki In India. The global investment bank expects this slew of new initiatives to drive demand for the automaker. Mahindra & Mahindra: Riding on new launches, including the compact sports utility vehicle, XUV 300, dispatches at Mahindra & Mahindra (M&M) saw a year-on-year increase of 16 percent to 26,109 units in February 2019. Initial booking numbers indicate M&M has been able to make a big splash in the competitive compact sport utility vehicle (SUV) market. The firm has received more than the 13,000 bookings for the XUV300 in a month after its launch. It also said the new model entered the No.3 spot in the compact SUV segment in the first month of its launch. M&M is looking to bring an electric car based on a platform of Ford with which it has an agreement to develop products jointly to add to its portfolio. The government’s pre-election consumption spending, reduced raw material costs and interest rate booster by the RBI are likely to have a positive impact on tractor volume. ITC: ITC increased the price of its three brands - Bristol, Flake Excel, and Capstan - at the beginning of March 2019. Price hikes for these three brands are in the range of c.7 percent-c.14 percent and contribute c.20 percent of the total ITC’s cigarettes volume. However, an average price hike for the cigarettes portfolio is estimated at 2 percent. ITC's cigarette business has seen strong volume recovery (c.5 percent YoY growth) in FY19 with no tax hikes. This was a much-needed breather for the company as c.17 percent tax hike CAGR in the last six years saw cigarette volumes declining by c.20 percent YoY from the peak. The recent price hikes by ITC, including minor price increases in regional brands in Q2 and Q3, are likely to improve realisation and operating profit margin, provided there is no tax increase going ahead, besides offsetting the increase in tobacco costs. Other businesses, i.e. FMCG, paper, and hotels, are also witnessing a gradual uptick in growth and profitability. Cipla: Cipla’s leadership in the high-margin respiratory portfolio and fast-growing segments such as gastro, gynaecology, and neurology are the key factors driving the stock in our India Top Picks list. Domestic business (c.40 percent of total revenues) is likely to remain robust with the US business continuing to grow at a higher pace on a low base. In fact, the US operations have also been transformed into a front-end based model, especially through the acquisition of InvaGen. In other geographies, Cipla is moving away from the tender-based model, which typically earns lower margins. Consensus expects margins to remain under pressure as revenues from the tender business and Emerging Markets are likely to remain soft. HDFC Bank: HDFC Bank is likely to continue its branch expansion strategy even after completing 24 years in operation and opening 5000 branches. The bank is targeting to take its services to one lakh villages, the CEO of HDFC bank told reporters without specifying a timeline. Capital constraints of public sector banks will provide private sector banks an opportunity to increase their market share and outperform in the banking and financial services space. Furthermore, we expect HDFC to be a major gainer of the current crisis in the NBFC space as it has best-in-class liability franchises along with superior customer outreach across business segments. ICICI Bank: ICICI Bank’s liability and asset franchise have strengthened over the years with de-risking of its loan portfolio, rising market share in CASA, increased competitiveness in the cost of funds relative to peers and an improvement in capital efficiency. Management expects incremental loan growth to be driven by retail and SME segments, which should further be supported by a corporate credit growth recovery. The sector as a whole may face some increased competition from PSU banks. However, the impact on ICICI Bank is expected to be minimal as the SME and business banking segments contribute only c.8 percent to overall advances. Management is confident of achieving an RoE of 15 percent by June 2020, driven by moderation in credit costs and an increased impetus on the pricing of loan products. Larsen & Toubro: Larsen & Toubro (L&T) has shown significant improvement in its balance sheet, execution pick-up and robust order inflows over the years. In March, LT entered into a definitive agreement to acquire the shares of MindTree Ltd. LT is likely to buy a c.20.32 percent stake in Mindtree at Rs 980 per share, aggregating to Rs 32,700 crore, and has also offered to buy an additional stake up to c.15 percent, subject to regulatory approval. The Mindtree acquisition is in line with LT’s stated strategy of focusing on services and unlocking capital to have an asset-light business model to drive profitable future growth. LT remains our top Pick as it has consistently been delivering in terms of bagging orders, strong execution of backlog and at the same time improving the quality of its balance sheet, thereby generating reasonable cash flows. Reliance Industries: Reliance Industries (RIL) telecom and retail businesses are gaining strength. Its low exposure to the oilretailing business has insulated RIL’s earnings over cycles, and should play out well going forward as well. RIL has been able to demonstrate healthy GRMs, beating Singapore refinery margins with wider margins. RIL is planning to double sales from Reliance consumer business, Reliance Jio, and Reliance Retail in about seven years. Reliance Retail is still the fastest growing organised retailer across consumer formats this financial year, and growth may accelerate as it scales up key formats and launches its digital platform integrating kirana stores. Unlocking of value by non-energy businesses remain the key triggers to watch going ahead. Disclaimer: Reliance Industries Ltd. is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments Ltd.Infosys: Latest media interactions of CEO Salil Parekh point out that INFY is not likely to compromise on margins to push up revenue growth, and its current investment in people and building up digital capabilities will not affect its margins in any form, rather make the company future-ready. The firm is strengthening its marketing muscle by hiring more number of people as part of its go-to-market strategy, apart from adding more locals in key client geographies. Tata Consultancy Services: Tata Consultancy Services (TCS) is confident of delivering double-digit growth in CC over the medium term. The demand environment remains healthy and has not yet been impacted by emerging macro concerns. TCS expects to achieve the guided EBITM range of 26-28 percent in the medium term as newer services gain scale and currency movement reflects the inflation differential between markets. TCS expects double-digit growth to sustain on the back of a healthy demand environment, strong deal wins and deal pipeline, and continued traction in digital (growing at ~50 percent YoY). Improving market positioning and win rates give management confidence that it would be able to deliver fairly stable and predictable revenue growth in the medium term. Disclaimer: Reliance Industries Ltd. is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments Ltd.The views and investment tips expressed by investment expert on moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions. Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.