Taking Stock | Bears back in action; Sensex down 502 points, Nifty near 17,300

The BSE midcap and smallcap indices end with marginal losses.... Read More

| Index | Prices | Change | Change% |

|---|---|---|---|

| Sensex | 85,267.66 | 449.53 | +0.53% |

| Nifty 50 | 26,046.95 | 148.40 | +0.57% |

| Nifty Bank | 59,389.95 | 180.10 | +0.30% |

| Biggest Gainer | Prices | Change | Change% |

|---|---|---|---|

| Hindalco | 852.10 | 27.75 | +3.37% |

| Biggest Loser | Prices | Change | Change% |

|---|---|---|---|

| HUL | 2,260.60 | -45.00 | -1.95% |

| Best Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty Metal | 10536.45 | 269.55 | +2.63% |

| Worst Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty FMCG | 54490.80 | -128.85 | -0.24% |

The bears came back strong and Bank Nifty index witnessed stiff resistance at 41,000 where fresh call writing was visible. The index remains in a sell-on-rise mode as long it stays below the mentioned resistance zone. The index immediate support on the downside stands at 40,000 and if breached will lead to a further downside towards 39,500 levels.

Nifty continued its down move on March 02 after a one-day rise, pulled down by weak Asian cues. At close, Nifty was down 0.74% or 129 points at 17321.9. Volumes on the NSE were higher than recent average helped by bulk deals in Adani group stocks. Broad market indices fell less than the Nifty even as advance decline ratio fell to 0.75:1.

Adani group stocks ended in the positive after a series of bulk deals in some of them and order from Supreme court directing the SEBI to investigate allegations raised in PILs in the Adani group matter and also appointed a six-member panel for assessing if there has been regulatory failure in this situation.

A rally in global shares sputtered on Thursday, pressured by a pullback in Chinese stocks (as analysts look for more evidence to gauge the pace of economic recovery) and higher U.S. yields (10-year yield crossed 4%) amid fears the Federal Reserve will keep raising interest rates to combat sticky inflation.

Nifty needs to protect 17,255 in the near term to avoid further acceleration in selling. On upmoves, 17,440-17,468 band could offer resistance.

The Indian rupee in line with Asian currencies depreciated after gaining in the last two days amid higher crude oil prices, foreign fund outflows and a surge in bond yields. The hawkish comment from Federal Reserves and US economic data indicates higher interest rates for a longer time supporting the dollar bulls.

Back to home, spot USDINR has been consolidating between 82.50 to 83 since February 6. We expect the current consolidation in USDINR may continue for a few more days but the direction of the dollar against major currencies is pointing towards an upward move.

The Nifty opened on a weak note today and continued to drift lower throughout the day to close around the lows for the day down ~129 points. After a positive close in the previous trading session the Nifty did not witness follow through buying interest in fact it has closed below the low (17,345) of the previous trading session which is a sign of weakness.

On the hourly charts we can observe that the rise from the lows of 17,255 has been impulsive in nature indicating that a short term bottom is in place and this dip is a retracement of that rise. It is trading in the crucial Fibonacci support zone 17,336 – 17,300 which are the 61.82% retracement level (17,336) and 78.6% retracement levels (17,300) respectively and we expect the Nifty to hold on to this support and resume it next leg of up move. Overall, we believe that the Nifty is a counter trend pullback mode and the pullback is not complete yet.

Global markets turned back to selling mode with the US 10-year bond yield crossing 4% as a fresh set of US data suggested that inflation will remain elevated for a longer period.

Rising bond yields are driving foreign money out of emerging markets, and as a result, FIIs were net sellers in the domestic market for the sixth consecutive day. Mid- and small-cap stocks continued to show resilience with mild selling compared to their larger peers.

We expect a couple of rate hikes both from the Fed and the RBI and a pause for the rest of the year. With the yield curve flat at the moment, we are positioning at the short end with an opportunist shift to the long end when it spikes.

It would not be unrealistic to expect a spike on the 10 year Gsec yield to between 7.8 and 8%. If that happens, duration comes into play and investors can shift their positions to the long end.

Indian rupee ended lower at 82.59 per dollar against previous close of 82.50.

Benchmark indices ended lower on March 2 with around 17,300 amid selling across the sectors barring realty, power and oil & gas.

At close, the Sensex was down 501.73 points or 0.84% at 58,909.35, and the Nifty was down 129 points or 0.74% at 17,321.90. About 1540 shares have advanced, 1824 shares declined, and 141 shares are unchanged.

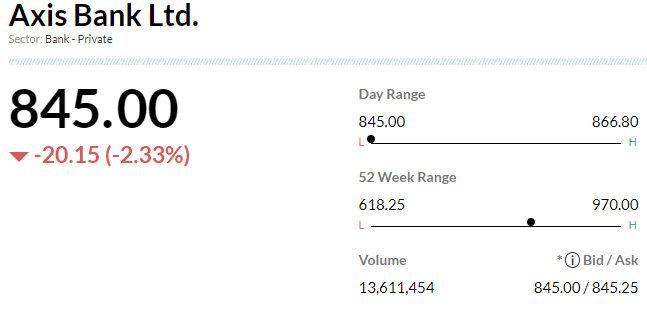

Maruti Suzuki, Axis Bank, TCS, SBI Life Insurance and M&M were among the biggest lowers on the Nifty, while gainers included Adani Ports, Adani Enterprises, Coal India, BPCL and Hero MotoCorp.

Among sectors realty index up 2 percent, while information technology, auto and bank indices down 0.8-1 percent.

BSE midcap and smallcap indices ended with marginal losses.

-Buy rating, target at Rs 1,250 per share

-Key positive post deal is reduced risk of an immediate capital raise

-Attrition in business was between 5-20 percent for cards & deposits

-Commentary did not suggest steep deterioration in customer retention ahead

-Management maintained profitability estimate at Rs 800-850 crore

-After 18 months of integration costs this deal should be RoE accretive

Gold prices were set to break their three-session winning run on Thursday, weighed down by a firmer dollar and as bullion's outlook remains clouded by prospects of further interest rate hikes from the U.S. Federal Reserve.

Spot gold was down 0.2% at $1,832.60 per ounce as of 0845 GMT, after hitting a one-week peak in the previous session. U.S. gold futures fell 0.4% to $1,838.30.

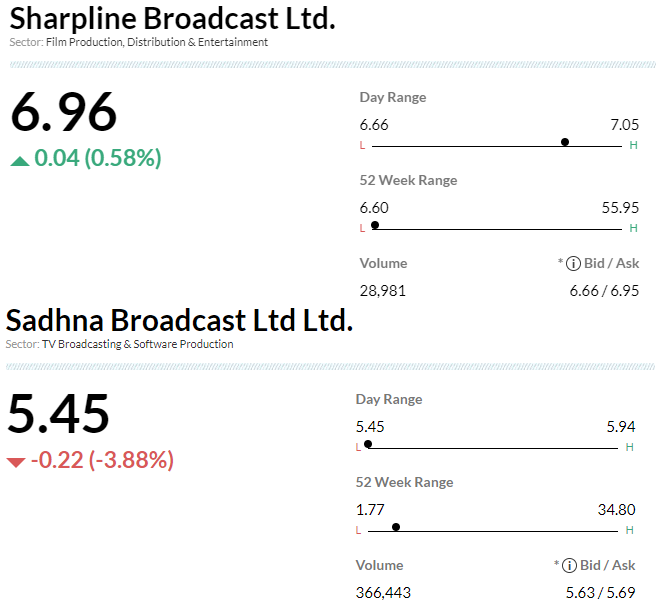

SEBI passed two orders w.r.t. stock price manipulation of Sadhna Broadcast & Sharpline Broadcast.

The notices included creators of Youtube channel, net sellers, profit makers & volume creators after false & misleading videos uploaded on Youtube recommending buying shares, reported CNBC-TV18.