April 27, 2023 / 16:11 IST

Shrikant Chouhan, Head of Equity Research (Retail), Kotak Securities:

Markets turned extremely bullish on the F&O expiry day, which shows that investors are willing to bet big on local stocks irrespective of the current global macroeconomic challenges. It looks like strong FII participation also contributed to the broad market surge as IT, realty and select metal stocks attracted significant buying.

Technically, post the intra-day breakout of 17,820 level, the positive momentum intensified. The index has also formed a bullish candle on daily charts which is grossly positive.

As long as the Nifty is trading above 17,820, the positive sentiment is likely to continue. Above the same, the market could move up to 18,000-18,050. However, below 17,800, the index could slip till 17,750-17,725.

April 27, 2023 / 16:02 IST

Rupak De, Senior Technical Analyst at LKP Securities.

The Bank Nifty continues to move higher during the day. On the daily chart, the index has remained above the consolidation breakout point. Besides, the index has remained above the critical moving average.

On the higher end, Bank Nifty might move towards 43,300/43,500 over the near term. On the lower end, support is placed at 42,750.

April 27, 2023 / 15:53 IST

Jatin Gedia, Technical Research Analyst, Sharekhan by BNP Paribas:

The Nifty opened on a flat note and continued to inch higher throughout the day and closed with handsome gains of ~100 points. More importantly it is closed above the previous swing high of 17,863 which confirms that it has started the next leg of upmove. On the way up, Nifty is likely to target levels of 18,100 from short term perspective.

On the daily charts, the momentum indicator has triggered a fresh positive crossover which is likely to provide speed to the current upmove. Thus, both price and momentum indicator are now in sync and suggest that the current rally is likely to continue.

As long as the Nifty continues to trade above 17,720 – 17,700 support zone, we expect the positive momentum to continue.

April 27, 2023 / 15:50 IST

Ajit Mishra, VP - Technical Research, Religare Broking

Market traded firm on the monthly expiry day and gained nearly half a percent. After the flat start, the Nifty index gradually inched northward and finally settled around the day’s high to close at 17,915.05 levels.

The majority of sectors contributed to the move wherein realty, IT and auto were the top gainers. The broader indices traded in sync with the trend and gained in the range of 0.5 percent-0.8 percent.

Nifty has surpassed the hurdle at 17,850 and looks set to inch toward the 18,100+ zone now. Though it is still a banking-led recovery, we are seeing a marginal improvement in participation from other sectors as well. Participants should continue with a stock-specific trading approach and align the positions according to the trend.

April 27, 2023 / 15:45 IST

Vinod Nair, Head of Research at Geojit Financial Services

The domestic market is gradually shifting towards a positive terrain, supported by FIIs inflows and positive Q4 earnings from banks. On the global front, the US Q1 GDP number which will be unveiled today is anticipated to moderate on a QoQ basis amid concerns over banking contagion and a slowing economy.

The next week's Fed policy will be keenly monitored. The FED may further hike by 25 basis points, but the expectation is that this will represent the peak and a long pause.

April 27, 2023 / 15:42 IST

Rupak De, Senior Technical Analyst at LKP Securities

The headline index Nifty has moved up higher towards the closing. On the daily chart, the index has given an inverted head and shoulder pattern, suggesting a bullish reversal. Besides, the index has remained above the critical moving average.

On the higher end, Nifty might move towards 18,000/18,100 over the near term. On the lower end, support is placed at 17,800.

April 27, 2023 / 15:32 IST

Rupee Close:

Indian rupee ended marginally lower at 81.84 per dollar on Thursday versus previous close of 81.76.

April 27, 2023 / 15:30 IST

Market Close

: Benchmark indices ended higher with Nifty above 17900 on April F&O expiry day.

At close, the Sensex was up 348.80 points or 0.58 percentat 60,649.38, and the Nifty was up 101.40 points or 0.57percentat 17,915. About 1,970 shares advanced, 1,421 declined, and 126 were unchanged.

Bajaj Auto, Bajaj Finance, BPCL, Bajaj Finserv and Bharti Airtel were among the biggest gainers on the Nifty, while losers included HDFC Life, HUL, Power Grid Corp, Adani Ports and Axis Bank.

Except for power, all other sectoral indices ended in the green with auto, pharma, realty, information technology, capital goods, metal up 0.5-1 percent.

The BSE midcap and smallcap indices added 0.5 percent each.

April 27, 2023 / 15:26 IST

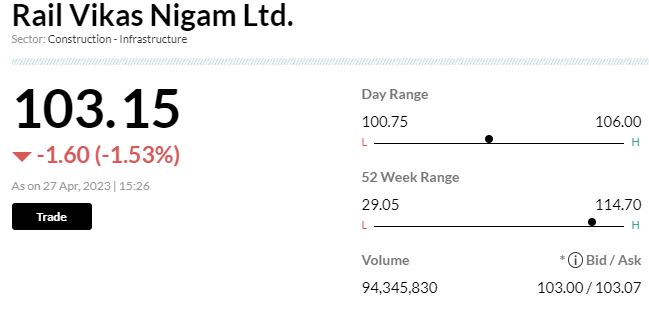

RVNL bags order worth Rs 121 crore from North Central Railway

Rail Vikas Nigam has received Letter of Acceptance(LOA) for “Provision of E1 based Automatic Signaling with continuous track circuiting and other associated worksincluding suitable Indoor alteration in Electronic Interlocking/RRI/PI stations enroute in Jhansi (incl)-Gwalior (Incl.)

section of Jhansi Division of North Central Railway.

The cost of project is Rs121,05,77,446.

April 27, 2023 / 15:24 IST

Morgan Stanley View On SBI Life Insurance Company

-Overweight rating, target at Rs 1,650 per share

-VNB better-than-expectations owing to sharp decline in proportion of ULIP in APE

-Retail protection APE shrank YoY & has been sluggish in Q2 & Q3 as well

-Negative Eco variance was higher than peers with increased interest rate sensitivity

SBI Life Insurance Company was quoting at Rs 1,138.20, up Rs 21.25, or 1.90 percent.

April 27, 2023 / 15:21 IST

BSE 500 Stocks touched 52-week high

April 27, 2023 / 15:19 IST

Morgan Stanley View On L&T Technology Services

-Underweight rating, target at Rs 3,200 per share

-Q4 better than consensus estimates

-FY24 organic revenue growth guidance of double-digit YoY shows resilience

-Despite positive management commentary, see limited upside to consensus estimates

-Remain underweight owing to moderating EBIT growth

-Dilution in free cash flow conversion from acquisition of SWC keep us underweight

L&T Technology Services was quoting at Rs 3,736.55, up Rs 288.60, or 8.37 percent on the BSE.