SEBI-registered research analysts (RAs) are voicing their protest against the compliance requirements, particularly the ones that were released recently, and a few prominent names have announced their intention of winding up their services.

On January 8, the Securities and Exchange Board of India (SEBI) issued a circular titled Guidelines for Research Analysts. These, according to some of the RAs Moneycontrol spoke to, have lowered the threshold for people to register as an RA but have increased the compliance burden for existing RAs.

RAs fear that such a regulatory approach will introduce more bad apples into the ecosystem and will cause the regulator to keep tightening the screws by way of ever more supervision, making it impossible for the well-intentioned to run their business.

Sandeep Parekh, founder of Finsec Law Advisors and former head of the legal affairs and enforcement departments of SEBI, posted on microblogging site X that the market regulator is "going way overboard in its regulations and shutting down competent and honest advisors and researchers from the market". He added that, if it persists with this approach, "all that will remain will be incompetent and dishonest, or incompetent or dishonest advisors".

Parekh shared the posts of a few RAs who decided to cease operations, feeling burdened by the compliance asks. Among them was a post by Neeraj Marathe, proprietor of Sentinel Research. Marathe wrote that when the RA regulations were proposed last year, he had paused his research services and had hoped that the actual regulations would be better. He added, "Well, the actual regulations have turned out to be much worse!" Sharing another RA's decision to discontinue their service, Marathe wrote that he too would be doing the same.

Long-term investing compromised

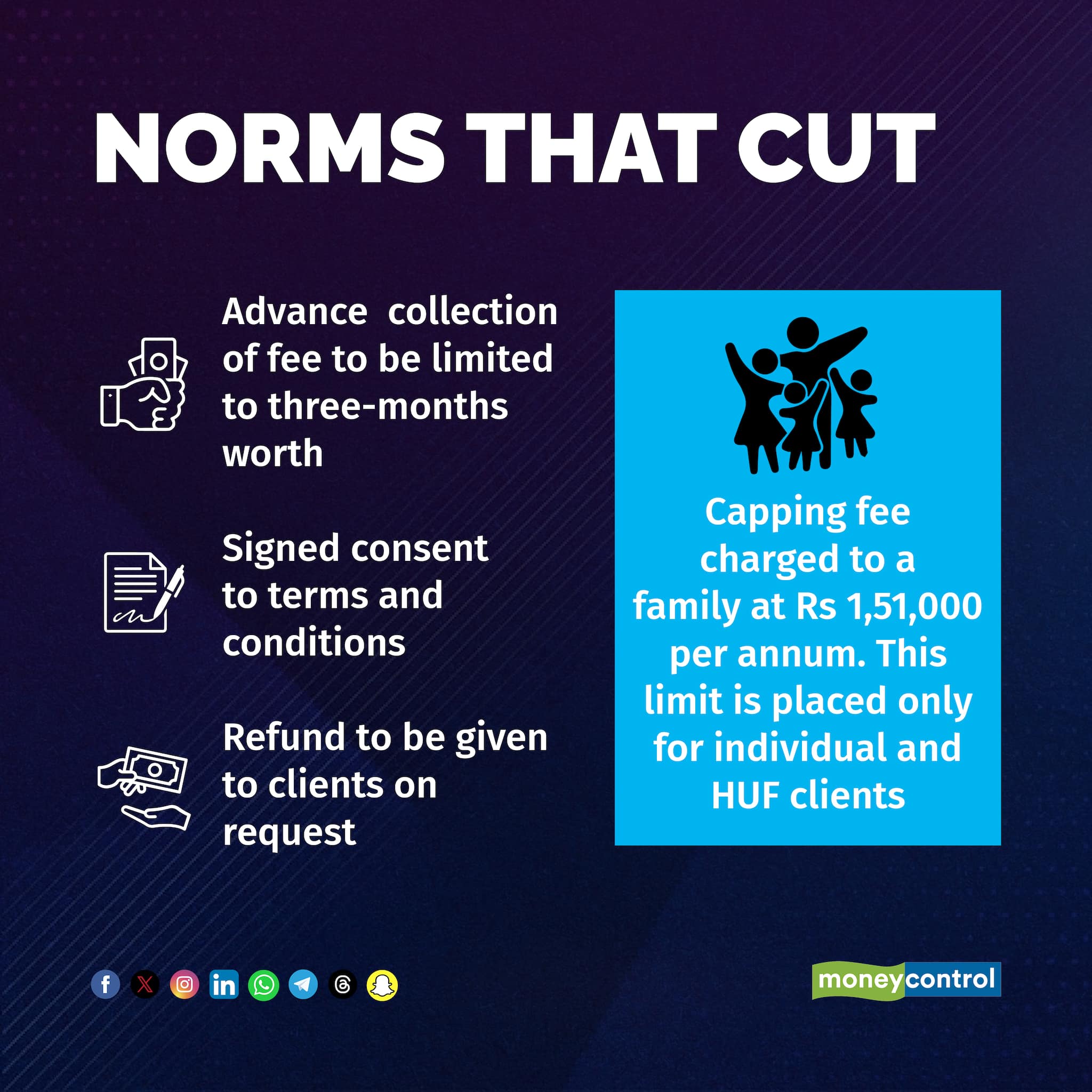

One of the chief concerns being raised has to do with the restriction placed on advance collection of fees. The circular says, "If agreed by the client, RA may charge fees in advance. However, such advance shall not exceed fees for more than one quarter."

When announcing the shutting down of research service, Stalwart Advisors wrote, "The additional operating costs & effort for client onboarding (Agreement, KYC, CKYC, etc), benchmarking, validation, audit etc is still manageable. The deal breaker for us is the risk of focus shifting to short-term activity in order to justify quarterly renewals (unintended consequence)."

They added, "We clearly understand that the big money is not in constant buying or selling, but waiting patiently for the right opportunities and then riding them." They pointed out that their average investment horizon is three to five years, and that staying invested is what has led to many multibaggers.

They added, "The unintended consequence of hyper activity will be terrible for our investors—we don’t want to end up becoming another ‘tip provider’."

Capping of fee

Nitin Mangal, an independent RA, described the new norms as a "disaster".

Among the first concerns he cited was the capping of the fee that RAs are allowed to charge per family. According to the January 2025 guidelines, RAs can charge a maximum of Rs 1,51,000 per annum per family in the case of clients who are individuals or classified as Hindu Undivided Family(HUF). The fee limit is open to revision by the Research Analyst Administration and Supervisory Body (RAASB) once in three years based on the Cost Inflation Index (CII) after due consultation with SEBI.

"How can they cap the fee people charge in a service industry? Not everyone provides the same kind of service. Some of our research reports takes 15 to 20 days to prepare, with a lot of travel involved. There may be others who give intraday tips. How can the regulator club all of us together?" asked Mangal.

He also pointed out how placing this limit on the fee charged to an entire family is unreasonable.

On the advance collection of fee restriction, he said that this will shift the focus of both RAs and clients to short-term investing goals. "We give long-term investing advice, which require clients to stay invested for at least a year. Under the new system, if the client does not see results in three months, they may discontinue the service. Also, I have clients who are FIIs (foreign institutional investors), their systems are different and not tuned for renewal for every three months," Mangal said.

Stalwart Advisors too underlined the problem of inconvenience caused to clients arising from this requirement. They compared the requirement of frequent renewal of services to asking a hotel to knock on their guest's door every hour, even though the intention of the guest right from the start is to stay at least 24 hours, if not longer.

Other concerns

The other operational issues RAs cite are the directions to issue refunds to clients who want to discontinue their service, which they say can either create a cashflow problem or can be gamed by ill-meaning clients; to get terms and conditions of service signed either in person or through the e-signature facility, which they say is a functionality that will need to be introduced by their payment gateways; and to get their performance validated by a third-party agency, which is yet to be set up.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.