The year 2019 saw the domestic economy stutter and stall.

To put it in the words of former RBI governor Dr Raghuram Rajan, we are in the middle of a "Growth Recession".

Household, corporate, bank and government balance sheets are all stressed at the same time. Private consumption has slowed, private CAPEX is virtually non-existent and exports have failed to pick up.

Corporates are wary of investing and banks are wary of lending.

Despite all the current gloom, we remain optimistic about the economy bouncing back in 2020.

It is not likely to be a V-shaped recovery but we are likely to see a gradual revival if policymakers play the cards right.

Several structural reforms being unleashed at once have strangulated the economy. It is important that the policymakers ensure that the structural reforms go the full distance without resorting to quick fixes at this stage.

It is crucial that we make the most of the slowdown i.e. deleverage and re-leverage in a manner that makes the future economic growth enduring and sustainable.

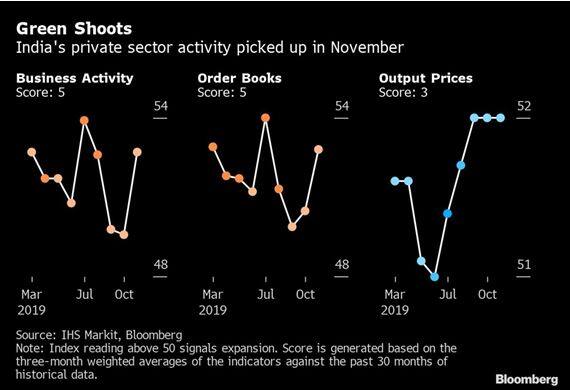

We are seeing some green shoots in the form of a sequential rise in auto sales, domestic air traffic and fuel demand.

A rise in headline CPI has been primarily on account of higher vegetable prices. Higher headline CPI and stable core CPI would help in correcting the terms of trade for farmers and this should aid the rural economy.

We would watch for progress on following themes to calibrate our growth outlook for the coming quarters:

Unclogging of credit channelsDespite abundant liquidity in the system, banks are still averse to lending.

Thanks to the asset quality review, we now have a fair idea of the full extent of NPAs in the system.

Addressing a few big accounts expeditiously would go a long way in shifting banks' focus from NPA resolution to lending. The resolution of Essar Steel under the Bankruptcy Code is an encouraging sign.

The decision to admit financial institutions into the resolution mechanism is a step in the right direction. However, we need a different mechanism for the resolution of stressed SME loans as it would be very time consuming if all of them are put through the same process.

Besides recognition and resolution, we also need reforms and tighter regulations.

Merging of public sector banks needs to be followed up with ensuring that their credit due diligence process is revamped. Recapitalising PSBs without strengthening their corporate governance would be a quick fix and a moral hazard.

Land & labour reformsThough these are politically difficult to pull off, they are the need of the hour.

Ease of doing business cannot be achieved in a true sense without addressing the issues pertaining to the two most important factors of production.

Large scale mega infrastructure projects would not see the light of the day unless and until land reforms are initiated.

We would not be able to invite the global firms looking to restructure their supply chains to look at India until we enhance our competitiveness through these reforms.

The Land Acquisition Rehabilitation and Resettlement Bill had failed to pass through the Rajya Sabha in 2015. This government has shown the will and courage to enact tough socio-political reforms. It is now time for tough economic reforms.

Judicious use of fiscal spaceThe government exhausted precious fiscal space by cutting corporate taxes this year.

Though this was a much-needed reform as Corporate taxes in India were much higher than the OECD average, the timing of it was questionable.

A temporary cut in indirect taxes would have been more effective in stimulating the stalling economy by pushing up demand.

However, it is important now that the government ensures that it increases the share of capital expenditure as a part of total expenditure in the upcoming budget.

Government spending was the engine that prevented Q2 growth numbers from looking even worse. As long as the spending is directed towards infrastructure, the markets would not be too perturbed even if it entails higher fiscal slippage.

We believe a fiscal deficit of 3.7-3.8 percent for FY20 is already being priced in by the bond markets.

A Rs 100 lakh crore investment in infrastructure sounds ambitious. Even a fraction of it would be welcome at this point.

On the income side, the government should continue working towards ensuring GST compliance, widening the tax base and also continue with its focus on strategic stake sales.

Monetary policy transmissionDespite the 135bps rate cut in the current cycle, lending rates to the real economy continue to remain almost unchanged.

This is because the banks are risk-averse and are looking to repair their balance sheets.

They have therefore not passed on the benefit of rate cuts to borrowers. Transmission into bonds has been weak as well due to fiscal slippage concerns. The spread of the 10y benchmark yield over the Repo is extremely high.

The RBI has attempted to address this by recently announcing a switch/twist wherein it would sell shorter maturity papers and buy long-maturity bonds (the current on the run 10y benchmark to be precise).

This is intended to flatten the yield curve. A lot of borrowing is linked to the 10y year benchmark G-sec yield.

Keeping it suppressed would reduce the cost of borrowing for long gestation capital intensive infrastructure projects.

We expect more such switches going forward. We believe we are at the bottom of the current rate cycle as inflation prints could surprise on the upside in the next few months. However, we expect the RBI to remain on a prolonged pause.

Opening up of capital accountConsidering the need for channelizing foreign savings into domestic assets, we expect gradual opening up of our capital account.

We expect FDI norms to be liberalized and FPI limits in bonds to be increased. However, FPIs are currently utilizing only 75 percent of their available limit in Government bonds and 60 percent in corporate bonds.

Therefore, an increase in FPI limits may have to be accompanied by other reforms to increase the allure.

There is a possibility of inclusion in a global bond index in a phased manner.

Availability of a wider array of hedging options onshore, an extension of FX market timings would also facilitate FPI participation.

We expect the trend of overseas fundraising by Indian corporates in the form of ECBs/FCCBs/Equity to continue in 2020.

The RBI is likely to continue mopping up inflows to prevent the Rupee from appreciating in relative terms and to shore up its FX kitty.

Market viewGiven the importance of capital inflows, we expect the RBI to perform a delicate balancing act of keeping the rupee competitive and containing volatility.

The “RBI put” in USD-INR is likely to continue in 2020 as well. We expect the downside in USD-INR to be limited.

The level of 10 on CNH-INR is likely to act as a floor. We expect USD-INR to trade in a 69.65-75.20 range through 2020.

The US Federal Reserve is expected to keep rates on hold through 2020. Unless a possibility of the Fed hiking earlier than 2021 emerges, we do not see a runaway move higher in USD-INR.

We expect the 10y benchmark bond yield to trade in 6.25-7.25 percent band in 2020 and expect the spread of corporate bonds over government bonds to narrow.

In the equities segment, we expect the Nifty to consolidate its gains in 2020 and see the broader markets catching up with the index.

The key risks to the above view would be a break out in crude prices above $85 per barrel and earlier than expected tightening by the US Federal Reserve.

(The author is CEO & founder, IFA Global. Views do not represent those of Moneycontrol.com)Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.