GTPL Hathway | Company sold its entire 51 percent stake in GTPL Shiv Network for Rs 20 lakh share transfer agreement.

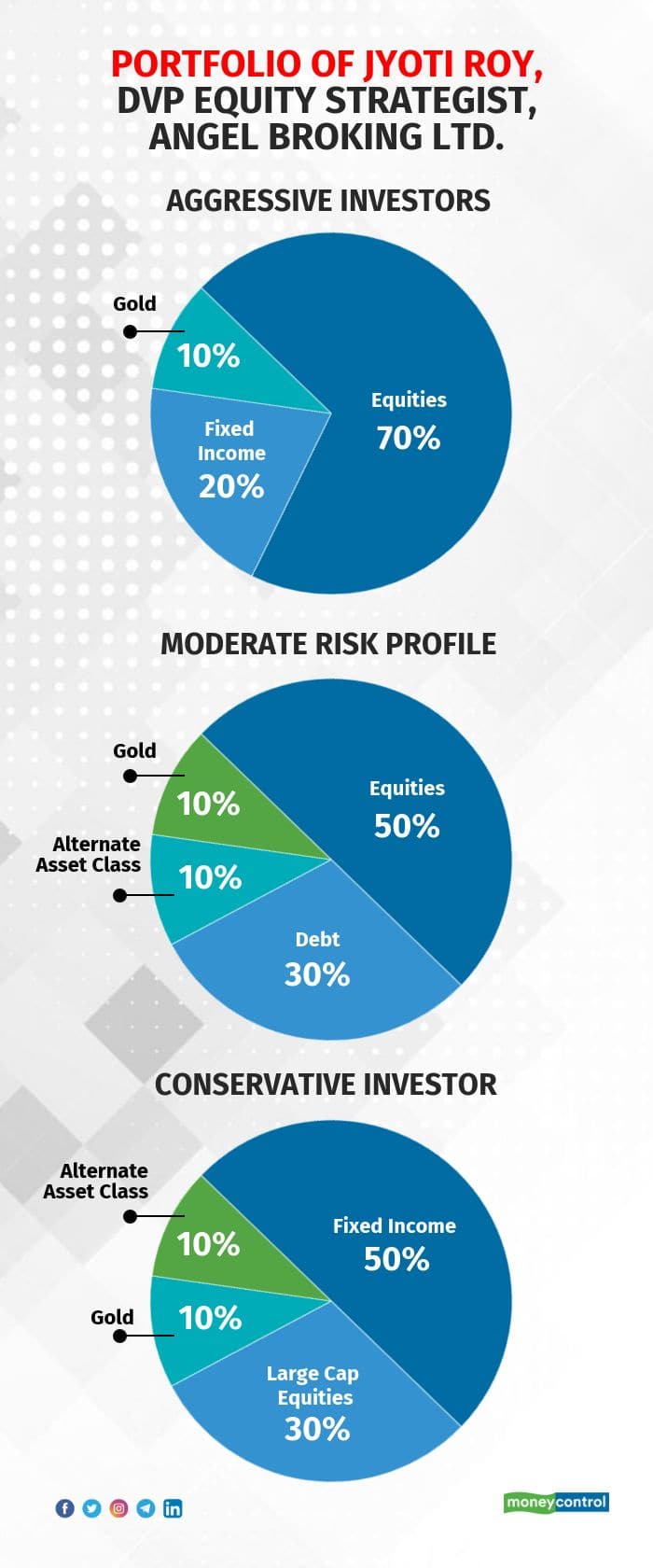

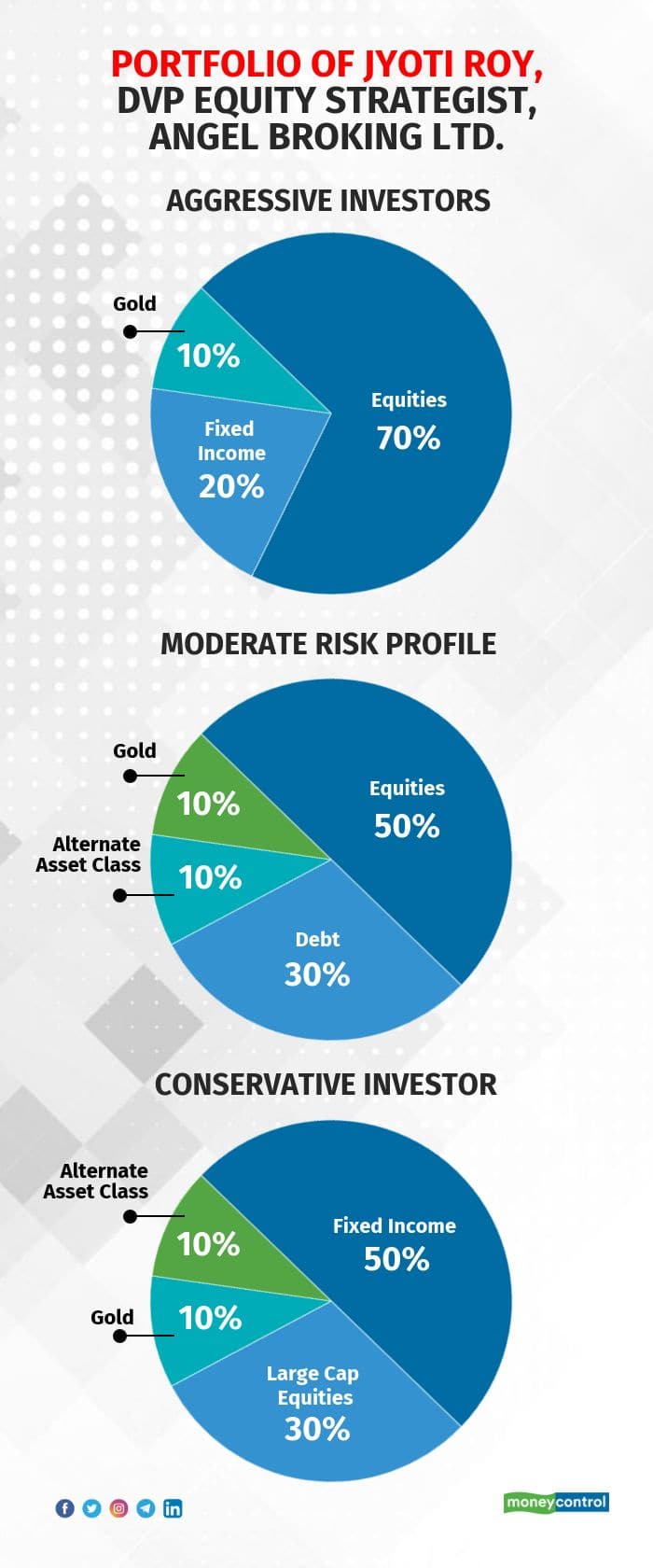

The market through 2020 was very volatile and uncertain but the year ended with benchmark indices rallying by about 15 percent each. While vaccination process has started in many parts of the world, the uncertainty with regards to COVID-19 still remains. The good news is that even if you have missed the rally in 2020 there is still some room for upside with regards to benchmark indices. But more than that, analysts advise investors to remain stock-specific and focus on asset allocation towards different asset classes. Asset allocation cannot be an umbrella approach for all investors with age groups as the risk-taking appetite will differ from one individual to another. Analysts have put immense focus on the real estate sector which has been an underperformer for the last few years. Low interest rates and abundant liquidity will help revive the real estate and infra sector. Interest rates have been trending lower over the last year, fixed deposit rates have dropped to 5.1% (1-year rate), while inflation averaged above the 6% mark. With growth clearly a priority for RBI and the government, interest rates will continue to remain lower for CY2021. “While asset allocation is a matter of individual preference, depending on age, financial capabilities, risk profile and other factors, the current scenario narrows down the investment choices to certain specific avenues,” Gopal Kavalireddi, Head of Research, FYERS told Moneycontrol. “Real estate sector in India is showing signs of positivity, due to continued regulatory support, lowest home loan rates in years and customer demand emanating out of the Coronavirus pandemic. After a sharp rise over the last 2 years, gold prices trended down in recent months owing to improving economic activity,” he said. Ideal asset allocation should include a substantial portion to equities (direct equity, ETF’s as well as mutual funds) along with a lower allocation to gold, and debt. Some amount of money should be in cash to capitalize on the dips. “At the beginning of 2021, we believe that a moderate profile investor should ideally have a 50% allocation to equities and 30% allocation to fixed income. We would also recommend 10% allocation each to gold and other alternative asset classes,” Jyoti Roy, DVP Equity Strategist, Angel Broking Ltd told Moneycontrol. “Right asset allocation is the key to generate wealth in the long run. Given the sharp rally in the markets we believe that the New Year is the right time for investors to revisit and realign their portfolio based on their predefined asset allocation strategies,” he said.

For investors who do not have any asset allocation strategy in place, we believe that this would be the right time to formulate one. We spoke to different experts and they have suggested the following asset allocation strategy for the year 2021:

Expert: Jyoti Roy, DVP Equity Strategist, Angel Brokiing Ltd.Asset allocation is a function of an individual’s risk profile which is largely dependent upon the individual’s age. For individuals with an aggressive risk profile, we would recommend a 70% allocation to equities, 20% allocation to fixed income, and a 10% allocation to gold and other alternative asset classes.

Similarly, for investors with a moderate risk profile, we would recommend a 50% allocation to equities, 30% to debt, and 10% allocation each to gold and alternate asset classes.

For a conservative investor, we would recommend a 50% allocation to fixed income, 30% allocation to large-cap equities along 10% allocation to gold, and other alternative asset classes.

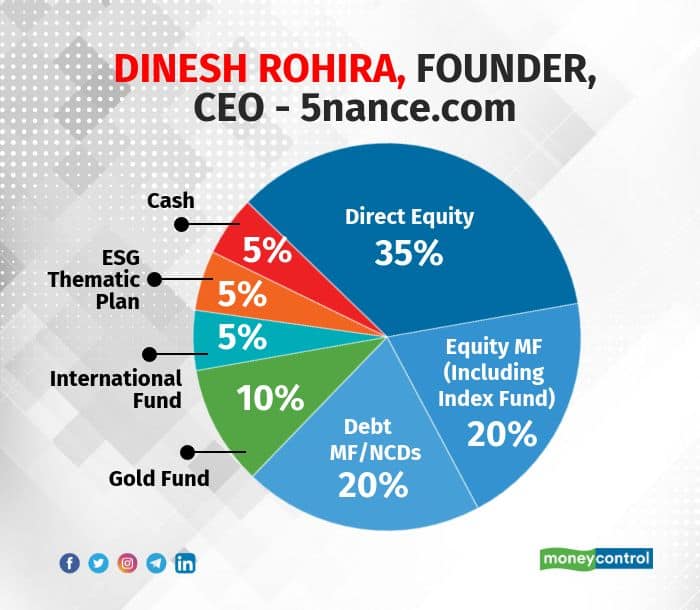

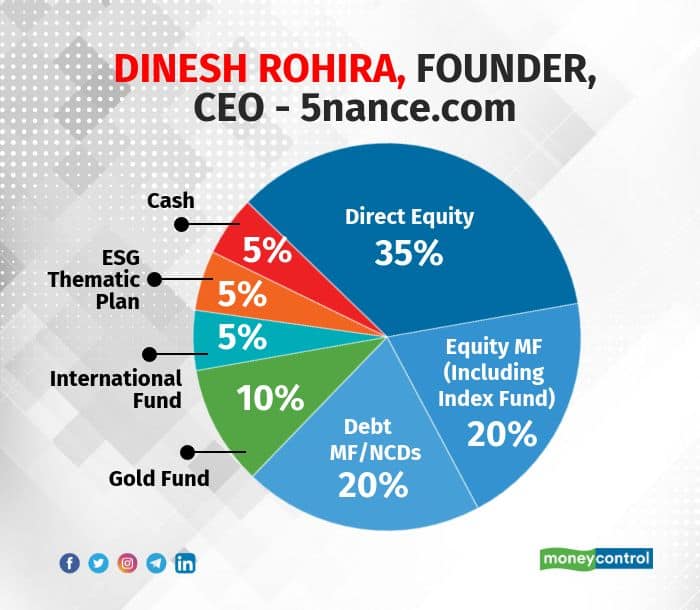

Expert: Dinesh Rohira - Founder, CEO - 5nance.com

Expert: Dinesh Rohira - Founder, CEO - 5nance.com The allocation in each asset class will largely depend on the investors prevailing state with an emphasis on risk-taking capacity, the objective of the investment, and knowledge of the market/assets to make informed decisions. The ESG theme and International Fund is evolving in the domestic market which offers an opportunity to hedge against geography risk, and also offer long-term growth prospects as the world grapples with climate issues as well as trade wars. Considering a long term portfolio (more than 5-7 years), the ideal asset allocation in the portfolio will be as follows:

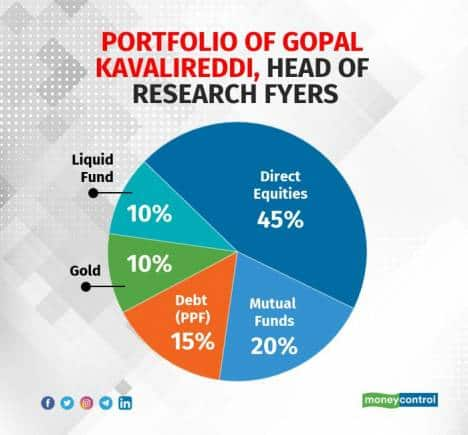

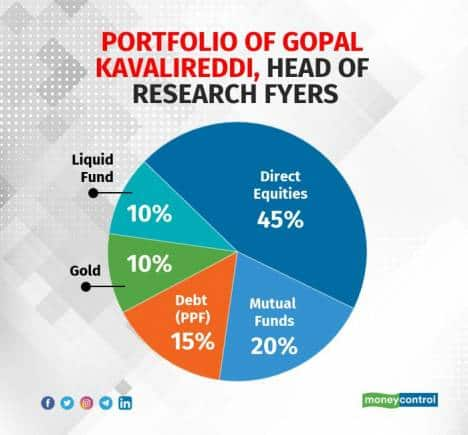

Expert: Gopal Kavalireddi, Head of Research, FYERS

Expert: Gopal Kavalireddi, Head of Research, FYERS Assuming that a younger investor is planning to invest a sum of Rs.10 lakh afresh in the New Year, a larger portion, roughly 65%, of the allocation can be made into equities. The ideal allocation could be 45% in direct equities, 20% in equity mutual funds, 15% in debt (possibly using PPF option), 10% in gold, and 10% cash (liquid fund). Investing in equity mutual funds can be in the form of a SIP, spread equally between 1 large-cap fund, 1 mid-cap fund, 1 small-cap fund, and 1 index fund/ETF. For investors with higher risk propensity, mutual fund allocation can be done a follows -- 1 IT sector fund, 1 Pharma sector fund, 1 FMCG fund, and 1 auto sector fund.

Expert: Gaurav Garg, Head Research, CapitalVia Global Research

Expert: Gaurav Garg, Head Research, CapitalVia Global Research I am seeing opportunities where growth might drive value stocks. I recommend going with leaders of respective sectors especially in the technology, auto, and banking space. A minimum 45% allocation to the equity that is Rs 4.50L from Rs 10L in one’s portfolio with limited exposure in fixed income and gold with 15% in each asset. The rest of the exposure should be in real estate. However, one should identify the correct asset allocation basis his/her age, investment objective, and time horizon, risk appetite, stability/continuity of income, etc.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Expert: Dinesh Rohira - Founder, CEO - 5nance.com The allocation in each asset class will largely depend on the investors prevailing state with an emphasis on risk-taking capacity, the objective of the investment, and knowledge of the market/assets to make informed decisions. The ESG theme and International Fund is evolving in the domestic market which offers an opportunity to hedge against geography risk, and also offer long-term growth prospects as the world grapples with climate issues as well as trade wars. Considering a long term portfolio (more than 5-7 years), the ideal asset allocation in the portfolio will be as follows:

Expert: Dinesh Rohira - Founder, CEO - 5nance.com The allocation in each asset class will largely depend on the investors prevailing state with an emphasis on risk-taking capacity, the objective of the investment, and knowledge of the market/assets to make informed decisions. The ESG theme and International Fund is evolving in the domestic market which offers an opportunity to hedge against geography risk, and also offer long-term growth prospects as the world grapples with climate issues as well as trade wars. Considering a long term portfolio (more than 5-7 years), the ideal asset allocation in the portfolio will be as follows:  Expert: Gopal Kavalireddi, Head of Research, FYERS Assuming that a younger investor is planning to invest a sum of Rs.10 lakh afresh in the New Year, a larger portion, roughly 65%, of the allocation can be made into equities. The ideal allocation could be 45% in direct equities, 20% in equity mutual funds, 15% in debt (possibly using PPF option), 10% in gold, and 10% cash (liquid fund). Investing in equity mutual funds can be in the form of a SIP, spread equally between 1 large-cap fund, 1 mid-cap fund, 1 small-cap fund, and 1 index fund/ETF. For investors with higher risk propensity, mutual fund allocation can be done a follows -- 1 IT sector fund, 1 Pharma sector fund, 1 FMCG fund, and 1 auto sector fund.

Expert: Gopal Kavalireddi, Head of Research, FYERS Assuming that a younger investor is planning to invest a sum of Rs.10 lakh afresh in the New Year, a larger portion, roughly 65%, of the allocation can be made into equities. The ideal allocation could be 45% in direct equities, 20% in equity mutual funds, 15% in debt (possibly using PPF option), 10% in gold, and 10% cash (liquid fund). Investing in equity mutual funds can be in the form of a SIP, spread equally between 1 large-cap fund, 1 mid-cap fund, 1 small-cap fund, and 1 index fund/ETF. For investors with higher risk propensity, mutual fund allocation can be done a follows -- 1 IT sector fund, 1 Pharma sector fund, 1 FMCG fund, and 1 auto sector fund.  Expert: Gaurav Garg, Head Research, CapitalVia Global Research I am seeing opportunities where growth might drive value stocks. I recommend going with leaders of respective sectors especially in the technology, auto, and banking space. A minimum 45% allocation to the equity that is Rs 4.50L from Rs 10L in one’s portfolio with limited exposure in fixed income and gold with 15% in each asset. The rest of the exposure should be in real estate. However, one should identify the correct asset allocation basis his/her age, investment objective, and time horizon, risk appetite, stability/continuity of income, etc.

Expert: Gaurav Garg, Head Research, CapitalVia Global Research I am seeing opportunities where growth might drive value stocks. I recommend going with leaders of respective sectors especially in the technology, auto, and banking space. A minimum 45% allocation to the equity that is Rs 4.50L from Rs 10L in one’s portfolio with limited exposure in fixed income and gold with 15% in each asset. The rest of the exposure should be in real estate. However, one should identify the correct asset allocation basis his/her age, investment objective, and time horizon, risk appetite, stability/continuity of income, etc.  Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.