The Nifty50 has rallied over 40 percent from the lows of 7,500 recorded earlier in March to reclaim 11,000 levels in July. The rally has been fast as it did not give much time for investors to react.

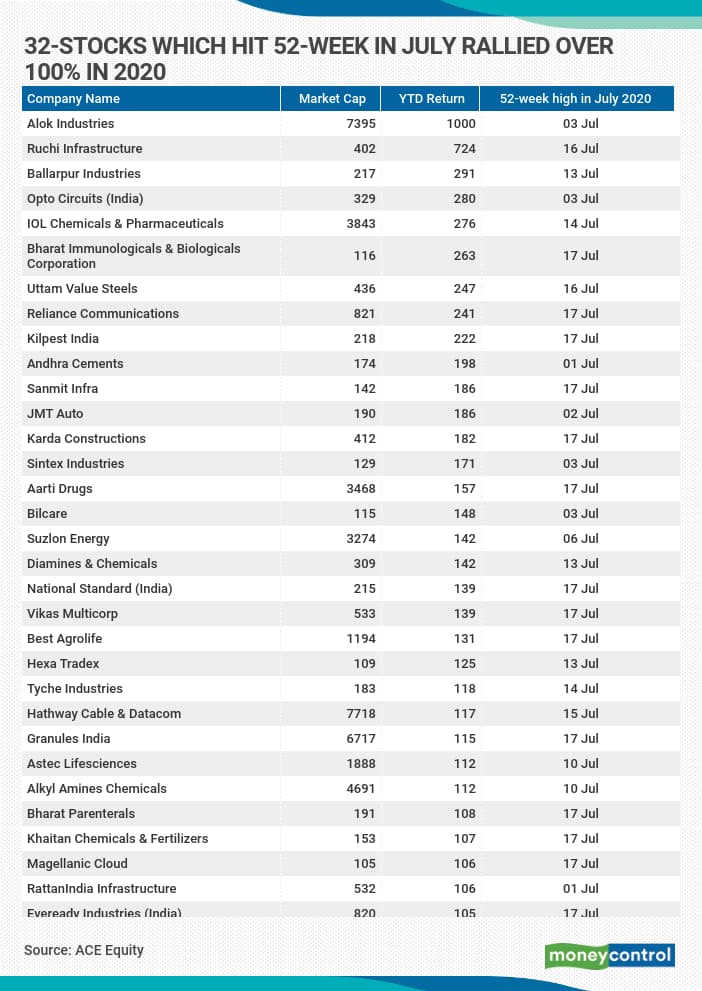

Tracking the momentum, more than 160 BSE stocks hit a fresh 52-week high in the month of July when Nifty reclaimed Mount 11K. Out of 160, as many as 32 rallied more than 100 percent year-to-date.

A large part of the stocks that have rallied are from the small & midcap space. These include Alok Industries, Opto Circuits, IOL Chemicals, Reliance Communications, JMT Auto, Aarti Drugs, and Suzlon Energy.

Liquidity wave might have taken the smallcap stocks higher ahead of fundamentals. Hence, partial profit booking is advisable at current levels if someone is already invested.

“Most of these companies are small-cap companies and have run ahead of their fundamentals. We would advise investors to book profits in most of these companies,” Atish Matlawala, Sr Analyst, SSJ Finance & Securities told Moneycontrol.

By nature, market is forward-looking, and it discounts everything in advance. Be it recovery in the economy or hope of a new vaccine or earnings growth. Smallcaps were in a bear market since 2018 and because of recent price erosion valuations became slightly more attractive.

However, experts feel that in case investors have already made the money in the recent price surge, it does make sense to partially exit the stock.

“We believe that on a risk-reward basis it makes sense to take some chips off the table after this hot streak even with the underlying momentum in these stock prices and book profits,” Siddharth Panjwani, Chief Strategy Officer, Pickright Technologies told Moneycontrol.

Large & Midcaps make more sense:It makes more sense for traders to venture into small-caps, but for investors, large or quality midcaps are better play for the long term.

There are 29 such stocks with a market cap of more than Rs 10,000 cr that hit a fresh 52-week high in July which include names like RIL, TCS, Infosys, Cipla, Bayer Cropsciences, Coromandel International, Biocon, TCS, PI Industries, Ipca Laboratories, etc. among others.

“Stocks in sectors such as Agriculture, Fertilizers, FMCG, Pharma have performed well in COVID led crises due to the high demand for products. The majority of the stocks mentioned in the list are from these sectors hence they are showing signs of momentum,” Ajit Mishra, VP- Research, Religare Broking Ltd told Moneycontrol.

“We believe, these players would continue to benefit from increasing demand and growth from rural. Investors holding these stocks can continue to hold however fresh investments should be made on dips,” he said.

Panjwani of Pickright Technologies is of the view that from a long-term basis, rather than recommending stocks which are at highs, we would rather recommend stocks that have better profitability profiles and balance sheets than attractive price action.

“We would be more comfortable in recommending large-cap stocks with defensive characteristics and risk forward under-performance in the short term than be in a position to lose significant capital were the 'hopes' of Mr. Market not materialize,” he said.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.