Reliance Industries Ltd's shares have given a reversal breakout after correction in falling channel. On May 24, Reliance's shares gained over 0.29 percent to trade above Rs 2,963.55.

Falling channel is a chart pattern used in technical analysis to describe the price action of a security that is moving downwards within a bounded range. Traders use falling channels to identify potential buying opportunities at the lower trendline (support) and selling opportunities at the upper trendline (resistance). The pattern continues until the price breaks out of the channel, which can signal a potential trend reversal or continuation."The stock seems to have completed the correction in the falling channel," said Jay Thakkar, Head Derivatives and Quant Research at ICICI Securities.

He recommends taking a bull call spread strategy on Reliance scrip to capture this momentum.

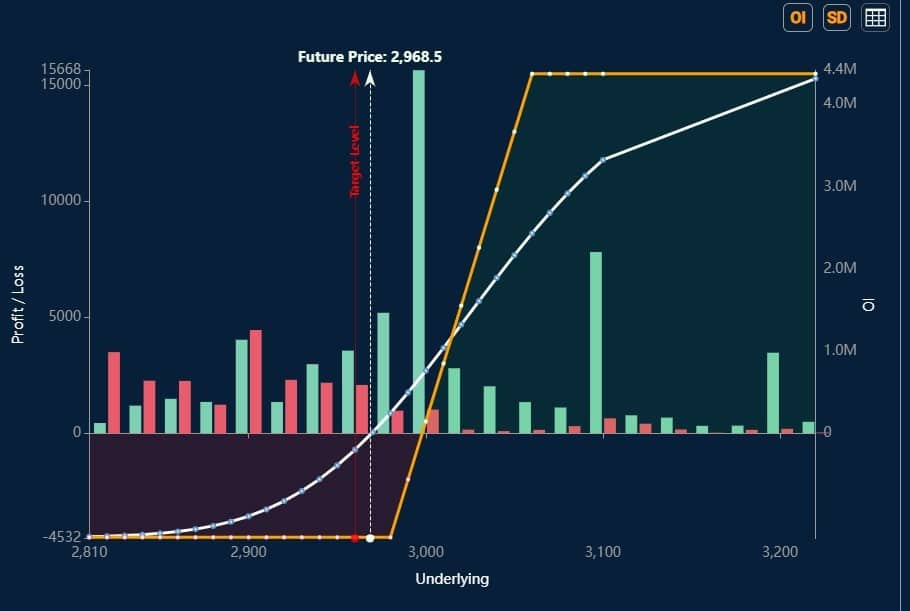

"Since, next week is the monthly expiry week, so one can buy 1 lot 2980 CE at 23.5 and sell 1 lot of 3060 CE at 5.55, hence the total outflow will be of 18 points, which is the maximum risk whereas maximum gain will be of 62 points, so the risk: reward ratio is more than 1:3," he said.

Strategy Recommended:Reliance Spread Trade: (Bull Call Spread: May 30 Expiry)

Buy 2980 CE at Rs 23.5 and

Sell 3060 CE at Rs 5.5

Total Outflow (Max Risk): 18 points

Maximum Potential Gain: 62 points

Risk reward ratio: 1:3

Payoff chart

Also read: Mid-tier PSU banks' price volume chart hints at big upside in coming months

Technical View:"The daily momentum indicator MACD has also returned to buy mode, which is a positive sign in the short term. The stock faces a minor hurdle around the 3000 level, which, once surpassed, could take it to 3,100 levels. On the lower side, the stock has immediate support in the 2,850-2,900 range," said Thakkar.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Disclosure: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.