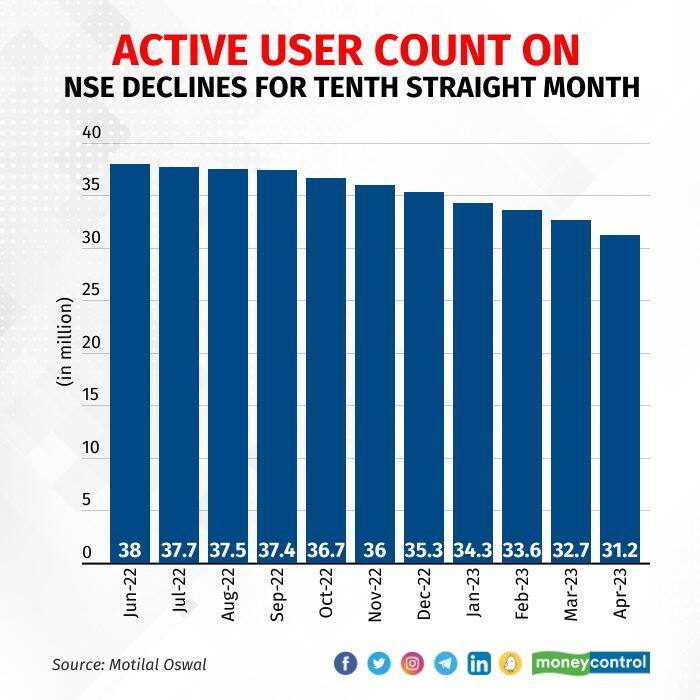

The National Stock Exchange (NSE) saw its active user count drop to 31.20 million in April from 32.70 million in March, the tenth straight month of decline.

The drop in April was more pronounced, with a decline of 1.5 million accounts compared to the previous month's fall of 0.9 million accounts, brokerage house Motilal Oswal said in a note.

Stock exchanges define an active user as one who has punched at least one trade in the past year. This number is net of new additions.

Experts point out that market participation has been affected by the uncertain economic environment, lacklustre one-year returns and declining retail enthusiasm, leading to a consistent fall in the number of active participants since July 2022.

Over the past nine-10 months, the Indian stock market has experienced sideways trading within a wide range. The volatility has been substantial, which often leads to newer participants, who typically enter the market with smaller capital, getting wiped out.

They struggle to predict the market direction accurately and end up losing money.

"Since October 2022, market returns, especially in IT stocks, have been unfavourable. Many market participants have found themselves trapped in these stocks for an extended period,” Anil Kumar Bhansali, an analyst at Finrex Treasury Advisors, said.

The advance-decline ratio has been tilted towards declines for the past nine-10 months, up until March 2023. While the markets have recently shown signs of recovery, most stocks remain stagnant within their previous ranges, failing to exhibit significant movement, he said.

“It appears that the funds of small investors have become stuck in these accounts, leading to a decline in active users on the NSE", Bhansali said.

In FY23, the 30-pack Sensex gained 0.7 percent, while the broad-based Nifty slipped 0.6 percent. BSE mid and small indices declined 0.18 percent and 4.46 percent.

Foreign investors sold shares worth $6.64 billion in FY23 against $17.06 billion in FY22.

Another contributing factor is the challenging environment for option sellers in recent months due to volatility.

"The significant swings in either direction can result in substantial mark-to-market (MTM) losses, potentially wiping out their capital. Option selling carries the risk of unlimited losses if not adequately hedged, Rahul Ghose, Founder & CEO, Hedged, an algorithm-powered advisory platform, said.

“Additionally, although to a lesser extent, the introduction of new margin norms, which require a minimum 50 percent cash component, could have also influenced the decrease in active user numbers.”

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.