Indian benchmark indices are trading moderately positive on June 4, with Nifty up 80.40 points, or 0.33 percent, at 24,366.90 on expiry day.

Experts believe that the short-term support for Nifty is between 24,100 and 24,150, with resistance between 24,450 and 24,500.

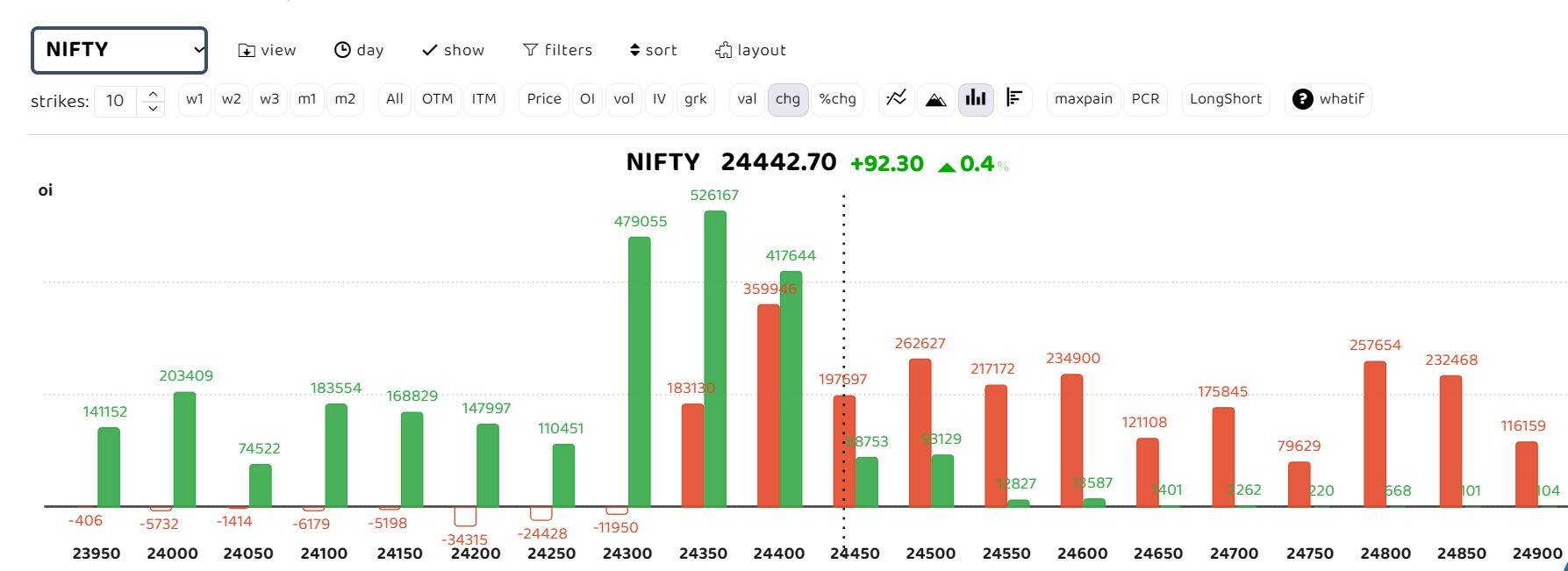

Options data shows heavy call writing across the 24,500 to 24,900 strikes, forming stiff resistance.

Derivatives trader Santosh Pasi believes that Nifty will expire within the 24,311 - 24,439 range in today's expiry. He recommends taking a broken wing short iron condor strategy to play the expiry:

NIFTY June 4 expiry: View rangebound expiry

Short Put 24,350

Short Call 24,400

Long Put 24,300

Long Call 24,500

Worst-case loss is Rs 1,510.

Maximum profit potential is Rs 992.

Rahul Ghose, Founder of Hedged.in, believes that, "Nifty index is not able to sustain the day's highs, showing weakness in the index for today. Yesterday's high can act as a support, which, if broken, can make the index fall further."

Nifty pivot has jumped to 24,267. "The sell zone is trading in the range of 24,375 to 24,420, from where NIFTY saw selling pressure today," said Ghose.

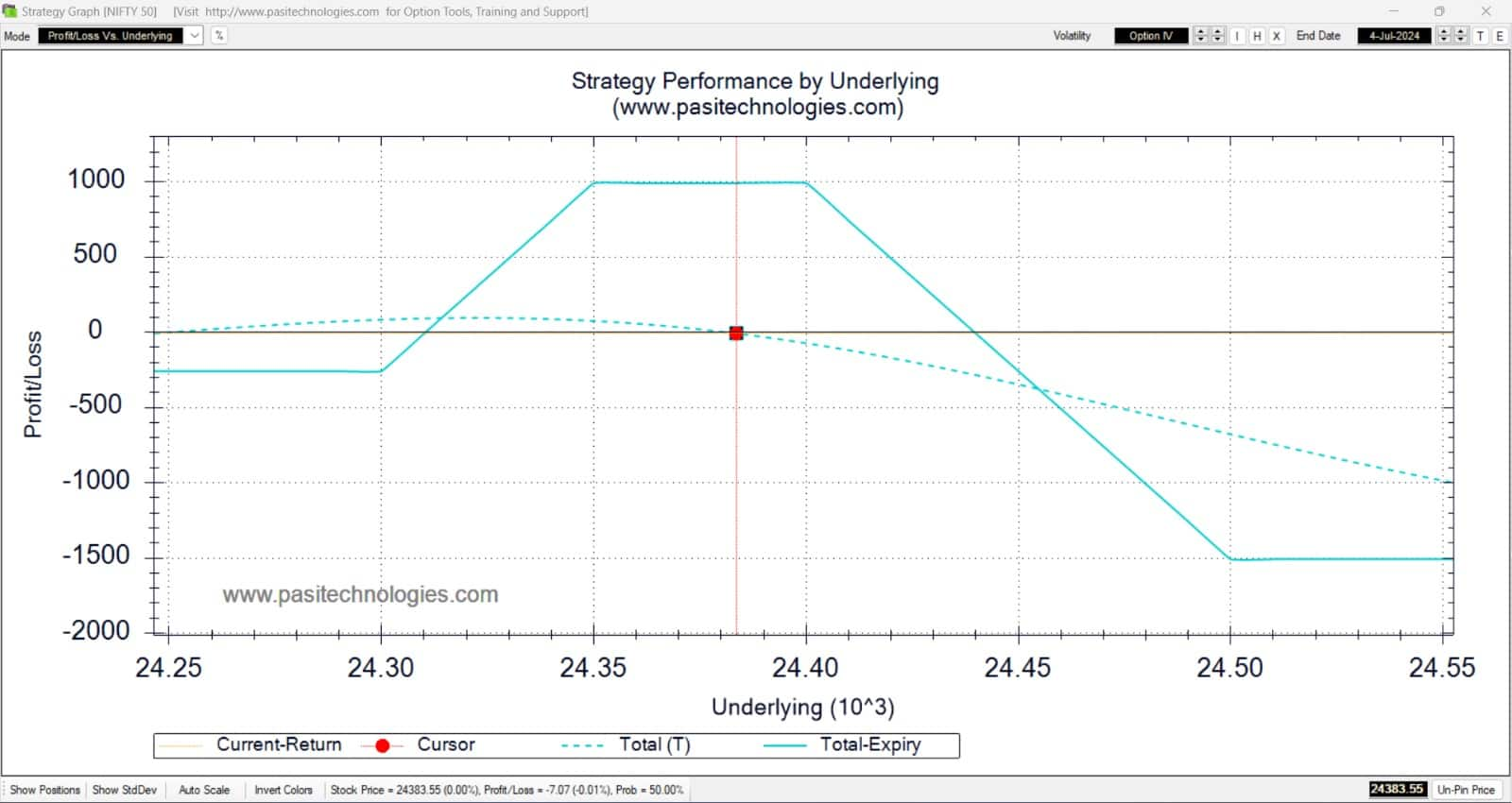

View: Moderate downside

With the view mildly on the downside, Ghose recommends a low-risk options strategy that makes money if the NIFTY moves down by the end of today's expiry. Even if the Nifty moves up or sideways, the strategy barely loses any money, with risk in the trade being Rs 300 only.

Strategy recommended: NIFTY Expiry Butterfly

Trade Structure:

Buy 1 lot of the 4th July expiry 24,300 PE

Buy 1 lot of the 4th July expiry 24,150 PE

Sell 1 lot of the 4th July expiry 24,250 PE

Sell 1 lot of the 4th July expiry 24,200 PE

Trade rules:

The capital required in the trade is Rs. 25,600.

This trade can be entered today if the Nifty is trading between the levels of 24,250 and 24,350.

The maximum loss in the trade is Rs 300, and the target is 2 to 4 percent on the capital.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.