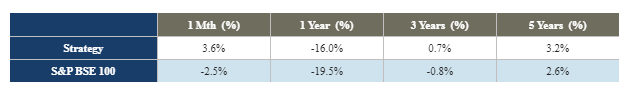

Data as on May 31, 2020. Index Data Source: BSE.(Returns less than 1-year are absolute, greater than 1 year are on annualized basis. Past performance may or may not be sustained in the future. The Strategy performance mentioned above is the aggregate performance of all clients in the Strategy using the time weighted rate of return (TWRR) methodology and the performance of an individual client may vary significantly from the above.) Q) Markets have turned volatile following the coronavirus outbreak and growth has slowed down across the world. Did you tweak your portfolio strategy to minimise the impact of volatility?

Data as on May 31, 2020. Index Data Source: BSE.(Returns less than 1-year are absolute, greater than 1 year are on annualized basis. Past performance may or may not be sustained in the future. The Strategy performance mentioned above is the aggregate performance of all clients in the Strategy using the time weighted rate of return (TWRR) methodology and the performance of an individual client may vary significantly from the above.) Q) Markets have turned volatile following the coronavirus outbreak and growth has slowed down across the world. Did you tweak your portfolio strategy to minimise the impact of volatility?A) One of the primary reasons for alpha generation in the past few months is that the portfolio has been extremely underweight to banks and finance.

We had begun reducing exposure to financials since the beginning of November 2019, as the sector seemed to look overvalued. This has helped limit the downside considerably when the market corrected.

The portfolio has been overweight on pharma, this helped capture an upside that we have seen in pharma stocks. Post the sharp rally, we have reduced our exposure to the pharma sector.

We were also overweight on telecom and gradually increased exposure to select consumer names, which have helped the portfolio in the past few months.

Active sector rotation has helped the Strategy not only to limit a downside but to capture an upside as well.

Q) The Strategy, which started off in March 2009, has given a stable performance of more than 8 percent in CAGR terms. What were your key learnings from the last decade and how can we relate to the current environment?A) One of our key learning’s has been to invest in companies where you understand the business and its track record of efficient capital allocation. This can be derived from their business dealings.

In addition, businesses having low leverage, low CAPEX requirement and low working-capital leakage are generally preferred. This, in turn, may lead to good operating cash flows and the least possible interest cost.

Businesses having a sizable market share in their respective sectors are also an important factor.

Based on our experience, we believe that the best time to buy such companies is during a bad phase of the market or due to a big negative external event or forced non-fundamental selling. This is what we believe could be a recipe for generating better returns.

Q) Largecap stocks have become slightly more expensive because money is now chasing only those companies that have a strong balance sheet and robust growth prospects, especially at a time when growth has taken a hit amid COVID-19 outbreak. What are your views?A) Certainly, money is likely to flow to the companies that exhibit the potential to ride out the current crisis. While having a healthy balance sheet and growth prospects is important, it is equally important to focus on companies that are able to generate sustainable cash flow and at the same time have low debt on their balance sheets. No one knows how this pandemic will pan out.

Thus, the priority shifts towards companies that are in a position to survive in case of a prolonged economic slowdown. We prefer companies with a proven business model, run by effective management having a strong competitive edge and which have been able to maintain a sustainable market share.

Even in our ICICI Prudential PMS Contra Strategy, we are now focusing on large companies, where valuations seem to be reasonable, which are likely to generate cash flows and which are believed to be least impacted by the lockdown.

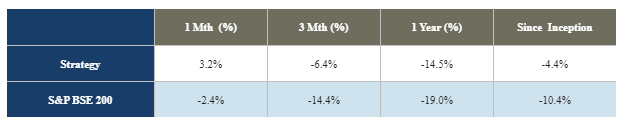

In the past month, this Strategy, too, has managed return 3.24% vs a negative 2.42% over the S&P BSE 200 benchmark.

Q) What differentiates the Contra Strategy?A) ICICI Prudential PMS Contra Strategy is a diversified Strategy that has the flexibility to invest across market caps and is sector agnostic. We aim to invest in companies that are currently not in favour in the market but are expected to do well in the long run.

We also aim to invest in sectors where entry barriers are high, sectors that are in consolidation or companies in special situations.

The Contra Strategy was launched on September 14, 2018, and has outperformed the benchmark with an alpha of about 6 percentage points since its inception period as on May 31, 2020 (refer the table below for performance).

Aggregate Performance of ICICI Prudential PMS Contra Strategy (Strategy)

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.