The sell-off in the market continued for the sixth consecutive week that ended on March 27.

However, losses were curtailed to a large extent due to short covering/value buying for four days in a row, after the biggest ever single-day loss seen on March 23 due to the novel coronavirus pandemic-led panic across the world.

The Rs 1.7 lakh crore welfare package announced by the Finance Ministry and the Rs 3.7 lakh crore liquidity stimulus package from the Reserve Bank of India (RBI) soothed sentiment. However, benchmark indices underperformed their global peers as investors remained cautious over growth after a 21-day nationwide lockdown was announced earlier in the week to stop the spread of COVID-19.

While the BSE Sensex was down 100.37 points at 29,815.59, the Nifty50 dropped 85.20 points to 8,660.25. But, the broader markets fell significantly with the Nifty Midcap and Smallcap indices plunged 7-8 percent.

After over a 38 percent fall from record highs seen in January, the market sharply rebounded. But, experts maintained cautious stance and expect the volatility to remain high till COVID-19 fears recede.

"The recent bounce was expected given that markets were deeply sold into virus fear. However, we expect the bounce to be approximately 38-50 percent of the fall in the next two-three weeks," Jimeet Modi, Founder & CEO at SAMCO Securities & StockNote told Moneycontrol.

If the situation escalates further, there will be more gloom and, in that case, markets can certainly make fresh lows, he added. "But for now, Government’s complete lock down is acting as a ray of hope for the bulls to come back."

The market will remain closed on April 2 on account of Ram Navami.

Here are the 10 key factors that will keep traders busy in this truncated week:

Concerns over coronavirus continue

Concerns over the novel coronavirus, or COVID-19, seems to be unabated. Globally, the total number of reported cases has risen to over 6.6 lakh. At least 30,700 people have died so far.

The bigger concern is that infections have been spreading rapidly in the United States and Europe, among other countries. In fact, positive cases in US and Italy have surpassed China's numbers.

Hence, investors will continue to monitor updates related to COVID-19 as the global economy is likely to face recession, experts feel, even though governments and central banks globally have announced several big fiscal stimulus packages to support people and to fight the virus.

Follow our LIVE blog for the latest updates on the novel coronavirus pandemic and its impact

Global markets

After pricing in relief packages, Indian equities are expected to start focussing on global peers' mood in the coming weeks.

Globally too, after a rout, equity markets have rebounded. In fact, they have outperformed India after US' $2 trillion coronavirus economic relief package. Now, investors will closely watch the impact and spread of the pandemic as most global experts feel that the bottom is yet to be formed.

European and US markets closed 3-5 percent lower on March 27 as after the stimulus, investors focussed on COVID-19 again. Dow Jones Futures traded more than 900 points down, which indicated that Asian markets, including India could see selling pressure on March 30.

Next stimulus may be for industries

The Centre announced welfare packages for poor and daily wage earners who are said to be suffering the most because of the lockdown. The RBI released a big bang liquidity stimulus, with 75bp repo rate and 100bp CRR cut. But, there is no package particularly for the industries which have closed offices and manufacturing plants due to the lockdown.

Experts feel that the government could announce major economic relief package for industries in the coming days as the pandemic is expected to hit their earnings in the coming quarters, which would damage the economy too.

Finance Minister Nirmala Sitharaman said at a press conferences that the government had talked to several industries and was are looking into the matter.

"So industry-specific measures are likely to be announced in the next package. The government is prioritising,” VK Vijayakumar, Chief Investment Strategist at Geojit Financial Services told Moneycontrol.

"A package from the government has to address three broad areas (1) protecting livelihoods, (2) protecting businesses, and (3) strengthening the healthcare infrastructure for COVID-19. To this end, the government needs to provide for viability of businesses and employees which will be at the highest risk from social distancing and lockdown such as hotel, restaurants, transport, entertainment, etc.,” Suvodeep Rakshit, Vice President & Sr. Economist, Kotak Institutional Equities said.

Auto sales

At a time when it was moving towards normalcy, sales in the automobile sector hit a roadblock in March due to the coronavirus pandemic. As the government announced a nationwide lockdown, the sector is expected to feel the heat for a longer period now, experts feel.

Bajaj Auto, Hero MotoCorp, Tata Motors, Maruti Suzuki, M&M, TVS Motor, Eicher Motors, etc. will declare their March sales on April 1. But the numbers are not comparable.

Crude and Rupee

Oil prices have been lingering around 17-year low levels for over a week now due to low demand globally, which is the biggest lottery for the government if they store it the maximum or book in a one-year futures contract. But we need to see how much the government has to spend on economy due to pandemic crisis.

India imports around 85 percent of oil requirement. International benchmark Brent crude futures posted a fifth consecutive weekly loss to close tad below $25 a barrel.

Meanwhile, the Indian Rupee after closing at lowest ever level of 76.29 a dollar on March 23, strengthened by 144 paise in last four days due to government measures and RBI's liquidity stimulus. The major depreciation in rupee is largely dependent on the severity of virus spread and till then it is expected to remain in range of 74-76 a dollar.

"INR-USD may breach 80 only if the virus disrupts the economy beyond a quarter. The concerns on the depreciation of the rupee are not significant on a relative basis since dollar outflows are rampant across the developing nations," Acuite Ratings said.

FII selling

The FII outflow receded in the week gone by, as they net sold Rs 7,165 crore worth of shares against major sell-off in previous four consecutive weeks. In fact, they turned net buyers on March 27 to the tune of Rs 355.78 crore after consistent selling in previous 23 sessions.

Hence, whether the intensity of selling has really cooled off or not will be closely watched in coming sessions given the wide-spreading pandemic globally.

On the contrary, DIIs remained net buyers for fifth consecutive week, net purchasing more than Rs 4,300 crore of shares last week.

Technical view

The Nifty50 closed with a percent loss for the week, but formed bullish candle on weekly scale as closing was much higher than opening levels, while on March 27, there was a bearish candle formation as closing was lower than opening.

Experts feel the broader structure still looks weak though there was a recovery in last four consecutive sessions.

"One should refrain from creating any sort of aggressive long positions. We have already seen a strong pullback from the lower levels, so risk and reward is not in favour of the longs. Although, we are expecting pullback which is unlikely to sustain at higher levels and we may see another leg on the downside once this pullback gets over," Nilesh Ramesh Jain, Derivative analyst - Equity Research at Anand Rathi Share and Stock Brokers told Moneycontrol.

F&O cues

The Nifty started the April series with just one crore shares, which is the lowest open interest at inception in more than a decade. As it is the beginning of a new series, option data is scattered at various strikes.

Maximum Call open interest was at 10,000 then 9,000 strike while maximum Put open interest was at 7,500 then 8,000 strike. Minor Call writing was seen at 9,500 followed by 10,000 strike while no major activity was seen on the Put side.

"The major open interest concentration is placed at Put 8,000 and Call 9,000 and 9,500 strikes for the coming week. We expect the Nifty to find it tough to move beyond 9,500 in the ongoing recovery," Amit Gupta of ICICI Direct said.

India VIX cooled off from 86 to 70 levels percent during the week. "But it is still at elevated levels with market volatility likely to continue," he said.

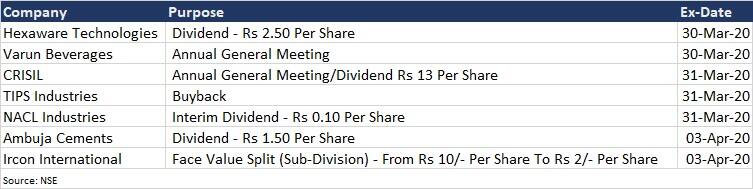

Corporate action and macro data

Here are key corporate actions taking place in the coming week:

Fiscal deficit and infrastructure output for February, and external debt for Q4FY20 will be released on March 31, while Markit Manufacturing PMI for March will be announced April 2.

Global cues

Here are key global data points to watch out for next week:

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.