With the NSE Nifty 50 commencing the week surpassing the previous swing highs, and hitting a new all-time high of 22,186, technical charts show the benchmark index may be on the verge of an upside breakout, eyeing 22,500 as its next stop. While it pared some intraday gains towards the end of February 19 trading session, the Nifty successfully closed above 22,100 with a gain of approximately 0.4 percent.

In the last one month, the Nifty has gone through a time-wise corrective phase where it faced resistance in the 22,150-22,100 range twice. However, the intermediate declines from that hurdle were not that sharp. The index took support around the 40-day EMA and resumed its up move.

The Nifty Consumer Durable and Pharma sectors led the upward trend, while the Realty index fell. Participation from midcaps in broader markets also pushed the Nifty index higher.

Here's how technical analysts are watching the index for the upcoming sessions:

Technical chart of Nifty index showing Ascending Triangle pattern| Source: 5Paisa

Technical chart of Nifty index showing Ascending Triangle pattern| Source: 5Paisa

"The index has formed an 'Ascending Triangle' pattern and is on the verge of a breakout. Thus, the follow-up move in the next few days will be crucial. If the index sustains at higher levels, it would result in a continuation of the uptrend. In such a scenario, the retracement measurement hints at potential targets of 22,500 in the Nifty," said Ruchit Jain, Lead Research at 5paisa.com.

In the derivatives segment, Jain highlights that the 22,000 strike put option in the current weekly series has the highest open interest, indicating it to be the immediate support. "FIIs have reduced some of their net short positions in the last few days, but still more than 60 percent of their positions are on the short side. Since the index has resumed momentum, if they cover the short positions, that could be supportive for a continuation of the upmove in the index."

Intraday Nifty Levels to watch outNifty exhibits key support levels at 22,030 and 21,940. While on the upside, the index faces resistance at 22,200 followed by 22,280.

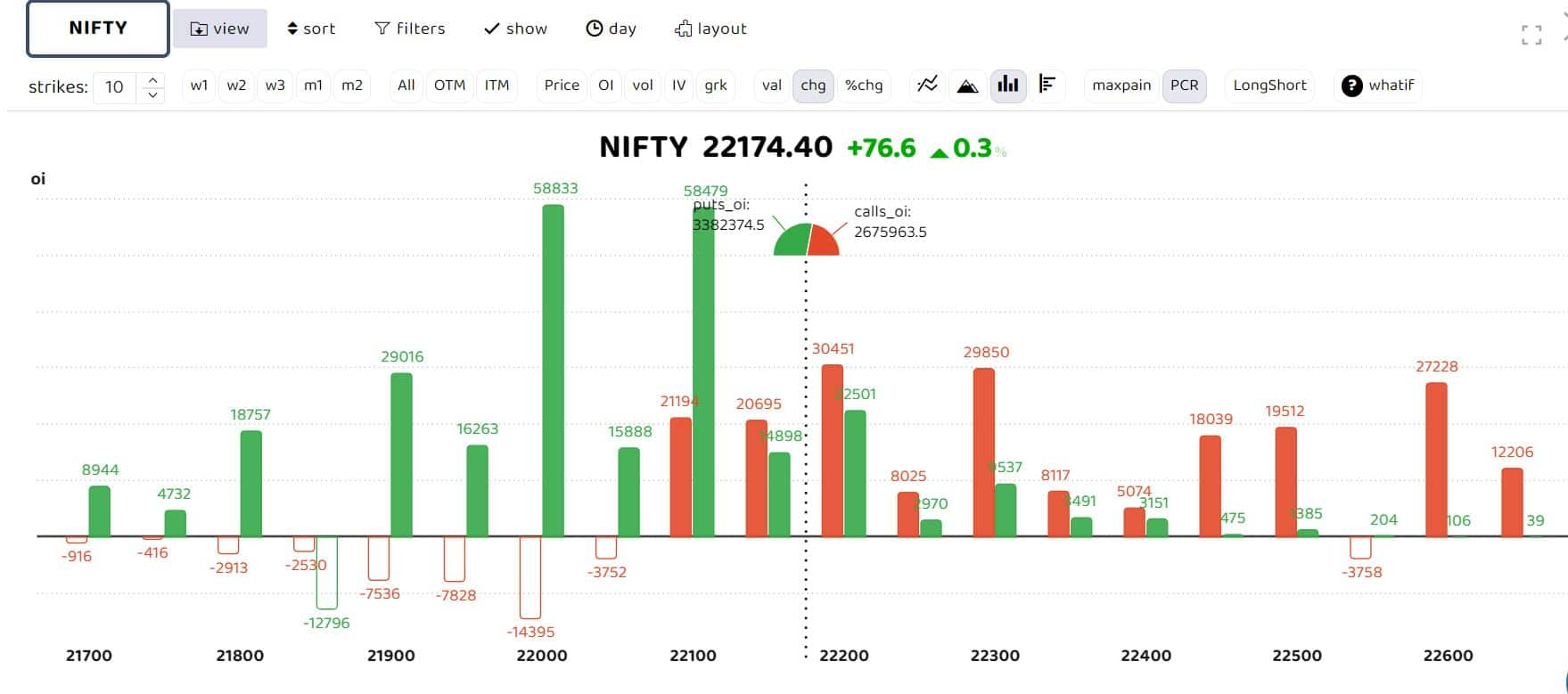

Bars in red indicate the change in open interest (OI) of call writers, while the green bars show the change in OI of put writers

Bars in red indicate the change in open interest (OI) of call writers, while the green bars show the change in OI of put writersOsho Krishan, Senior Analyst in Technical and Derivative Research at Angel One, said, "Regarding the levels, with Nifty settling at record highs and an 'Ascending Triangle' pattern forming on the daily chart, we anticipate the momentum to persist unless any disruptions from the global markets intervene. The continued upward trajectory may potentially open doors for the 22,380 - 22,500 zone in the comparable period. On the downside, the 22,000 mark is expected to act as an intermediate support zone, followed by 21,950-21,900 on an immediate basis."

Krishan emphasised that while the markets are at new highs, the major contributor - banking - remains a laggard.

"Unless we witness a decisive breakthrough from this sector in the next couple of sessions, we may not see sufficient strength in Nifty to sustain its upward trajectory. Therefore, for higher levels like 22,400 - 22,600 to materialise, banking needs to contribute. If it fails to do so, we may either observe consolidation in the benchmark, with stock-specific movements continuing, or find it challenging for the bulls to maintain their dominance," he explained.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.