Along with detailing its second-quarter earnings of FY23 on Thursday, Infosys announced its share buyback plan as well.

The IT major has approved an open market share buyback programme amounting to Rs 9,300 crore. This is the fourth buyback announced by the company since listing in 1993.

The maximum price set for the buyback is Rs 1,850 per share — a 30 percent premium to Thursday’s closing price.

Enthusiasm over strong results and the buyback plan was evident from the 5 percent bump in the firm’s stock price. The scrip had settled at Rs 1,419.75, down 0.6 percent, on the BSE on Thursday.

Read here | Infosys in spotlight after declaring results and buyback: Should you buy or sell?CLSA, a brokerage and investment firm, believes the buyback is attractive and expects downside support from the proposed buyback.

Earlier, Jefferies had drawn attention to the possibility of Infosys announcing a buyback in its IT sector results preview. According to the foreign brokerage firm, the buyback was to be valued between Rs 8,700 crore and Rs 9,500 crore. Morgan Stanley had also envisaged a potential buyback worth $1-1.4 billion Rs 8,200-11,500, likely through an open offer.

Multiple fund managers believed that the buyback would be at a premium of about 10-25 percent to the current market price (CMP).

The scrip has witnessed selling pressure thus far in 2022. It has declined about 14 percent in the past one year, and 22 percent year-to-date (YTD).

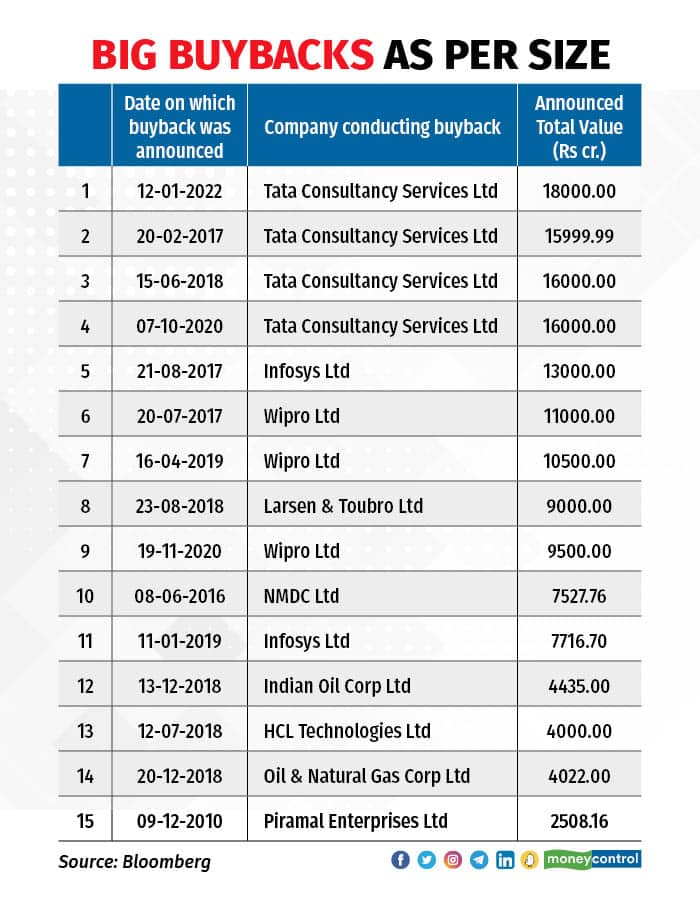

“The record of previous buybacks by Infosys is quite encouraging. In 2017 they bought back stocks worth 13,000 crore, while in 2019 and 2021 they spent 8,260 crore and 9,200 crore, respectively,” said Chirag Kachhadiya, of Ashika Institutional Equities.

Read here | Infosys: Is the IT major gearing up for a buyback?

In the past five years, the company’s buybacks have provided strong support to the stock price and helped outperform peers, he added. “It is also ROE (return on equity) and EPS (earnings per share) accretive,” he explained

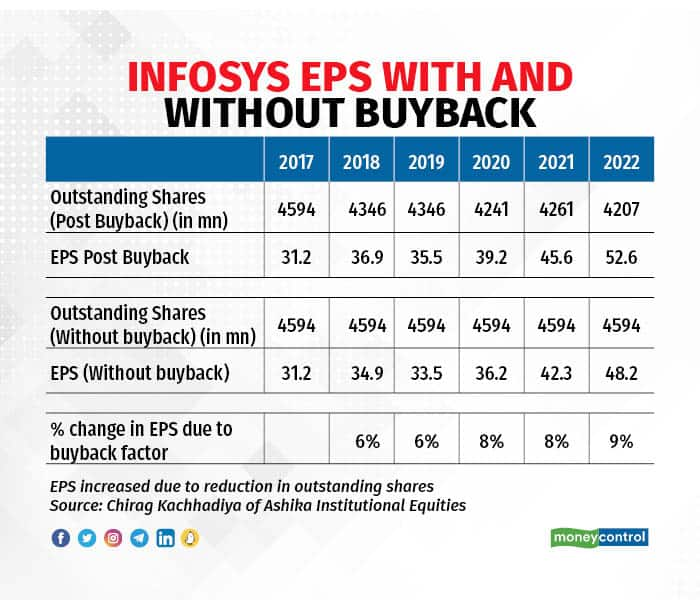

The logic behind an improvement in the ROE after a buyback is that the buyback reduces the number of outstanding shares, and since the outstanding equity is less, the ROE increases. Additionally, the EPS also rises with a reduction in the number of shares outstanding.

However, these are just cosmetic improvements through a spot of financial engineering, and not any fundamental or material improvement. Fundamental improvements are visible, only after a few years.

The table above shows what the EPS would be with/without a buyback. One can see that the EPS increases in the event of a buyback.

Per the table, EPS improved 6 percent in 2018 due to Infosys' share buyback, and by 9 percent in 2022.

Read here | Infosys Q2 FY23 – Why investors should exercise caution despite stellar numbers, buybackAccording to the annual report of Infosys, effective fiscal 2020, the technology firm expects to return approximately 85 percent of the free cash flow cumulatively over a five year period through a combination of semi-annual dividends and/or share buyback and/or special dividends.

During previous buybacks, the technology major’s stock rose between 10-22 percent from the announcement of the buyback to its closure, and outperformed the Nifty IT index on two out of the past three occasions.

A buyback means that a company is buying back its shares from existing shareholders. It happens when the company is confident about its business prospects and believes its shares are undervalued. It is usually seen as an alternative, tax-efficient way to return money to shareholders. There are two ways to execute a buyback — a tender and an open market offer.

Analysts believe that with likely global recession, revenue growth outlook for IT companies has moderated. Given this backdrop, a buyback by Infosys is efficient use of surplus cash lying on its books.

A buyback would arrest the fall in stock prices in the near term, especially if it is at a premium to the CMP, as it would give confidence to investors, explained a portfolio manager at a global investment management firm.

“It should limit downside to the stock price in the near term. In the current economic environment, buyback appears to be an efficient utilisation of cash reserves to boost shareholder return,” said YES Securities.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.