Foreign portfolio flows are set to return to India in the second half of the current year, top brokerage Jefferies said in a note, adding that foreign institutional investors are now seeking 'new ideas' to park their money into, such as real estate, capital goods and PSUs.

Jefferies said it is finding heightened investors interest for India, given the 7 percent GDP growth path and a $5 trillion market-capitalisation has raised interest in opportunities.

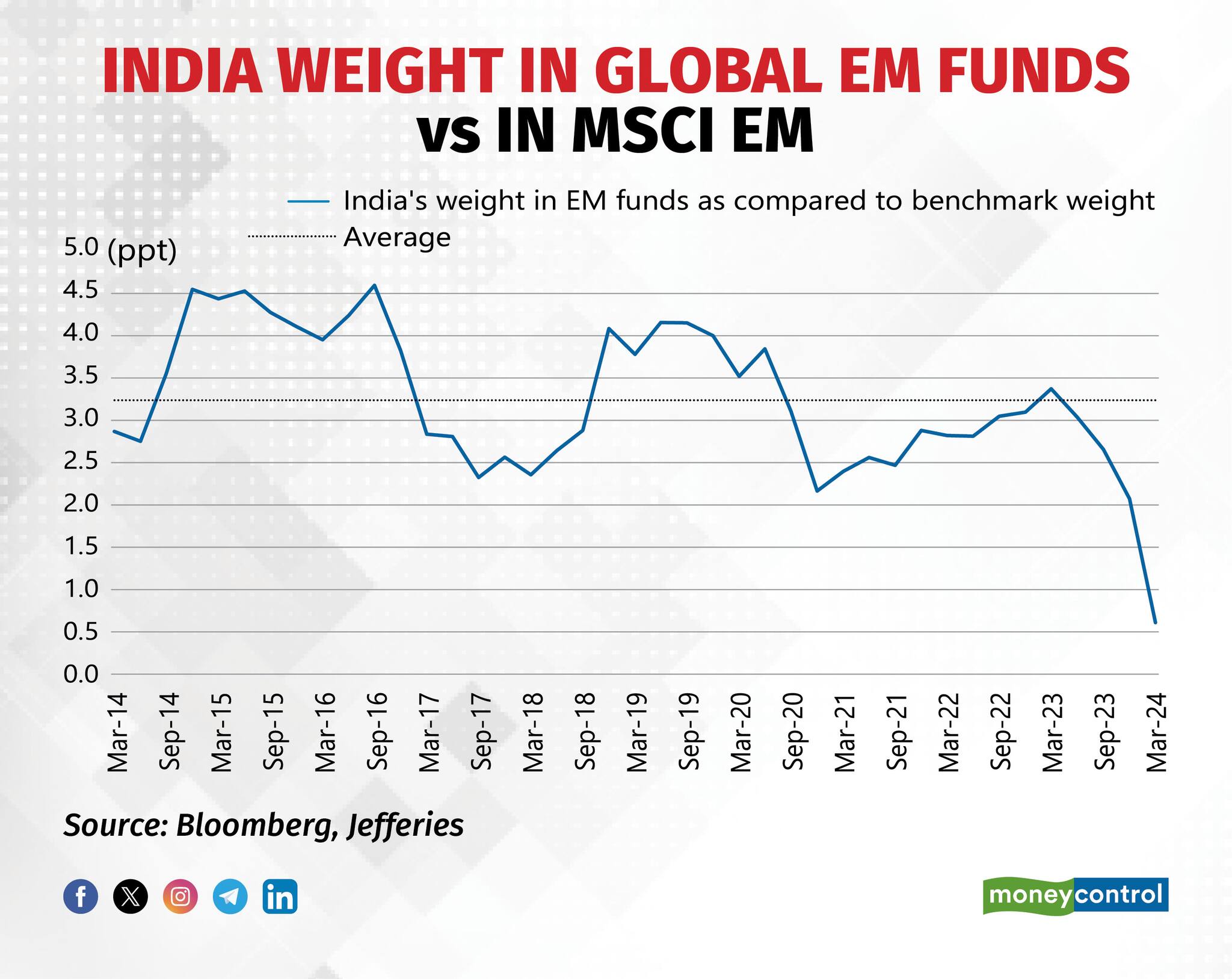

Jefferies gathers that EM funds are 'neutral' to slightly 'underweight' on India given lofty valuations, recent election-related volatility and a rise in the country's weightage in global indices.

So far in 2024, FPIs have offloaded shares worth Rs 1.27 lakh crore while DIIs have been net buyers, pumping in Rs 2.29 lakh crore into domestic equities. A key trigger for inflows would be a potential rate cut by the US Federal Reserve later in the year, leading to higher FPI flows into India.

Follow our market blog to catch all the live updates

The brokerage estimates relative positioning of FPIs to now be close to neutral, compared to the ~2 percentage point overweight that they have traditionally maintained.

Foreign investors are finding interest outside the traditional large-cap spaces of banking, IT or consumption stocks, the note said. Jefferies' overweight call on cyclicals and real estate has gained acceptance from FIIs.

"Interestingly, the FPIs seem more keen to invest in 'Consumption' driven capex themes such as residential real estate, airports, hotels, and malls with good appetite to invest in the SMID names in this space," said Jefferies.

Jefferies noted that in the all-cap non-US global indices, India's weight is 5.9 percent, but in the international small and midcap benchmark, this is higher at 8.5 percent, powered by a sharp rally in broader market names in 2024.

"While valuation remains a key concern, a potential slowdown in domestic retail flows, a part of which is unsustainable can create entry opportunities for FPIs," added the brokerage.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.