The market shows sideways momentum amid some cautiousness which seeped in ahead of the earnings season that starts this week.

On Monday, July 10, the indices traded with volatility, edging towards the green zone backed by strong support from Reliance Industries (RIL) shares, according to analysts. As of 10:45 am, the Nifty traded 92 points or 0.48 percent up at 19,424.40, while the Bank Nifty also traded 100.55 points or 0.22 percent up at 45,025.55.

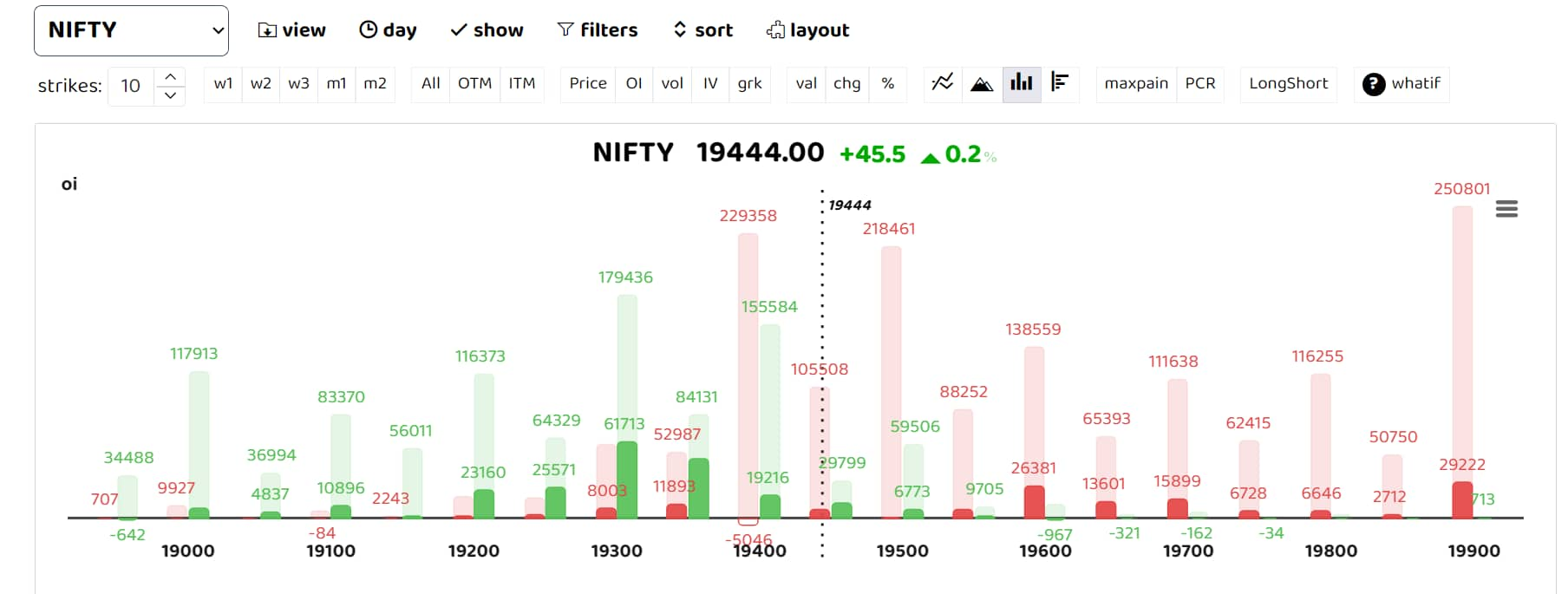

Red bars show call option OI and green put option OI.

Red bars show call option OI and green put option OI.Amid volatility, option data shows sideways momentum, with 19,400 levels becoming a battleground in Nifty where both call and put writers are in a tussle. The key support level was seen at 19,300, while the first resistance was at 19,500 levels. The range of 19,500-19,600 appears to be an immediate hurdle for the anticipated consolidation, while the major breakout levels around 19,000-18,900 serve as a strong foundation for the market.

Rahul K Ghose, Founder and CEO of Hedged, an algorithm-powered advisory platform, believes that the 19,000 puts still have very heavy put writing and will act as support for the Index. "The 19,000 level also coincides with the 20-day EMA, which is another support it has. For initiating fresh longs, one should wait for the Index to stabilise around the 19,100-19,200 band," he stated.

Among individual stocks, long trades were seen in Reliance, Jindal Steel, Hindalco Industries, and Tata Steel. While Hindustan Petroleum, India Cements, and PVR Inox saw short build-up.

According to Rajesh Shrivastava, a derivatives trader, there is strong traction in ACC stock. After a long move, some solid positions are visible, and it is a key stock to track today in the derivatives space.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Disclaimer: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.