"Repo" is an instrument for borrowing funds by selling securities with an agreement to repurchase the securities on a mutually agreed future date at an agreed price, which also includes interest for the funds borrowed.

"Reverse repo" is an instrument for lending funds by purchasing securities with an agreement to resell the securities on a mutually agreed future date at an agreed price which includes interest for the funds lent.

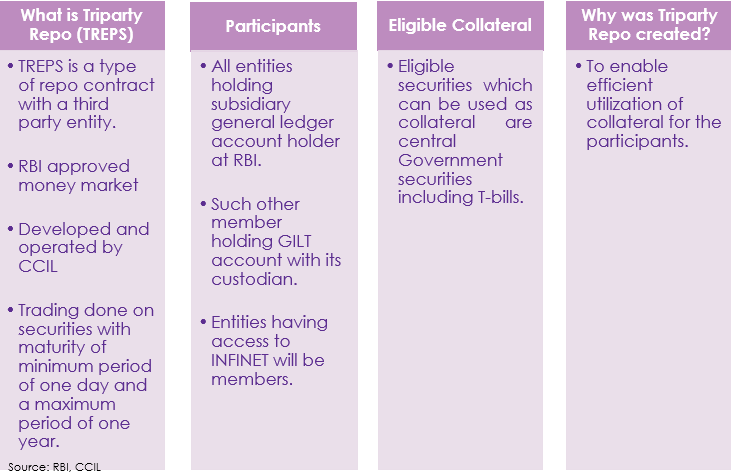

Tri-party repo or TREPS is a type of repo contract where a third entity (apart from the borrower and lender), called a tri-party agent, acts as an intermediary between the two parties to the repo to facilitate services like collateral selection, payment and settlement, custody and management during the life of the transaction.

Triparty repo was introduced on November 5, 2018. CBLO has been discontinued from November 2018.

The member needs to be registered with CCIL under TREPS Segment. They are required to contribute collateral in the form of cash and government securities as notified by CCIL from time to time.

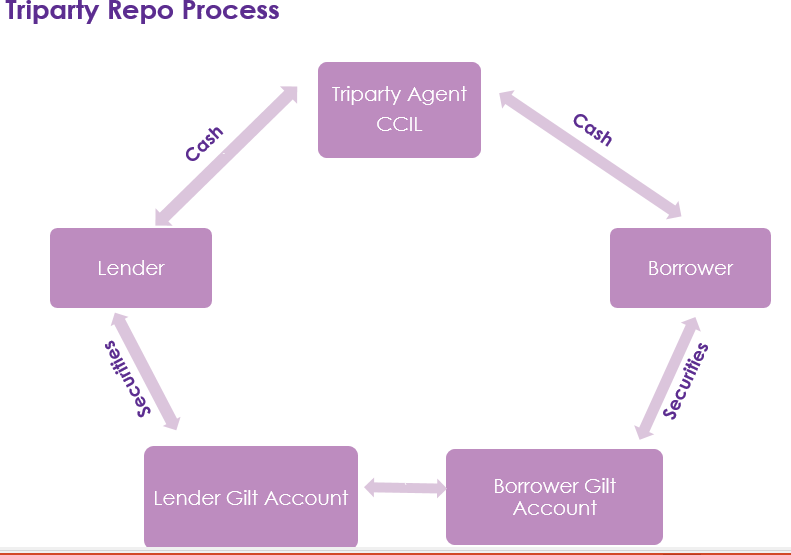

CCIL will maintain a gilt account for each member in its books and the securities shall be debited (for security withdrawals) and/or credited (for securities deposits) to the respective gilt account of the member.

CCIL will be a triparty repo agent, maintaining gilt accounts for members of securities segment who would be undertaking borrowing and lending of funds under triparty repo trades.

The member has to ensure the utilization towards borrowing limit by depositing adequate eligible collaterals. They also have to deposit the requisite initial margin.

Clearcorp provides the triparty repo dealing system. The triparty repo dealing system facilitates the dealing and trading on an anonymous basis i.e. where the identity of the original counterparties to a trade will not be disclosed at any time either on a pre-order and/ or a post-trade basis.

Once a lender and a borrower notifies the CCIL on the transactions, it matches the transaction amount, conditions and, if successful, processes the transaction. It automatically selects from the securities of account of the seller, sufficient collateral that satisfies the credit and liquidity criteria set by the buyer.

Key Features of triparty repoAll CBLO members/ participants have migrated to TREPS. Triparty repo is a type of repo transaction where a third entity, called “Tri-Party” agent, acts as an intermediary.

A major differentiating factor of triparty repo from repo is the presence of a triparty agent.

The triparty agent is responsible for taking care of services like collateral selection, payment, settlement, custody and management. Introduction of tri-party repos will likely contribute to better liquidity in the bond market, thereby providing markets an alternate repo instrument to government securities repo.

Tri-party repo will enable market participants to use underlying collateral more efficiently and facilitate development of the term repo market in India.

The author is Head – Sales and Marketing at IDFC AMC.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.