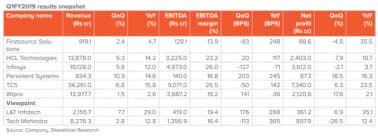

In Q1FY2019, Tata Consultancy Services (TCS) continued to deliver another strong constant currency (CC) revenue growth, while the remaining top five Indian IT companies reported CC revenue growth on expected lines or ahead of our modest expectations. The higher incremental revenue contribution from TCS has been a major driver for the acceleration of overall CC revenue growth of the top five IT companies, registering 9.9 percent Y-o-Y growth in Q1FY2019 against 5.3 percent and 7.9 percent Y-o-Y growth in Q1FY2018 and Q1FY2017, respectively.

However, reported revenue in dollar terms growth remained weak during the quarter, owing to cross currency headwinds (impact of 130 BPS to 250 BPS on a Q-o-Q basis). TCS again led the pack in terms of CC revenue growth, with CC revenue growth of 4.1 percent Q-o-Q, followed by HCL Tech (2.7 percent Q-o-Q, organic revenue growth of 0.7 percent Q-o-Q), Infosys (2.2 percent Q-o-Q), Tech Mahindra (Tech Mahindra, 0.3 percent Q-o-Q) and Wipro (0.1 percent Q-o-Q).

Cognizant delivered revenue growth of 2.4 percent Q-o-Q at the lower-end of its revenue guidance band. Mid-size IT companies continued to impress with strong revenue growth in Q1FY2019, with 5.1 percent Q-o-Q CC growth for L&T Infotech and 5.7 percent Q-o-Q growth in dollar terms for Persistent Systems.

Margin: Headwinds largely offset by currency tailwinds: EBIT margin of most companies under our coverage remained in-line/marginally better than our estimates despite wage hikes, higher visa costs, seasonality in portfolio companies and integration issues, driven by rupee tailwinds and operational efficiencies.

EBIT margins of top five companies declined on a sequential basis during the quarter except Wipro (adjusted EBIT margin) and HCL Tech. TCS reported higher-than-expected margin performance, while Infosys and HCL Tech delivered on expected lines. Wipro and Tech Mahindra reported marginally better than our modest expectations.

Mid-cap IT companies (L&T Infotech and Persistent Systems) continued to beat our estimates on account of change in business mix, gaining efficiencies, higher realisation and rupee tailwind. The benefit from rupee depreciation has helped to mitigate the sector update good quarter IT Q1FY2019 results review pressure from renewals, wage revision, investments in digital and local hires in key developed markets.

BFSI on track to healthy revival: Management commentary of most IT companies remained optimistic on the revival of BFSI vertical in the remaining period of FY2019, though the performance of BFSI vertical was volatile for top five IT companies (strong growth for TCS/Tech Mahindra, weak for Wipro/Cognizant and decline for HCL Tech and Infosys) during Q1FY2019.

TCS and Infosys expect pick-up in BFSI revenue in the coming quarters because of signing of large deals, higher demand from regional banks, stabilisation of insourcing concerns, embracing of digital technologies by large banks in the US for growth and rising adoption of digital from insurance customers. Demand outlook in the retail vertical remains healthy on account of large deal wins and higher adoption of digital by brick and mortar players to compete with online players.

Though revenue growth of the communication vertical continued to disappoint during the quarter, management of Tech Mahindra sees positive growth in its telecom segment for the remaining FY2019 (signed LOIs with two customers). With healthy demand outlook in key verticals, management commentary across the board indicated better overall performance in FY2019 backed by robust TCV of deal wins (USD 4,900 million for TCS, USD 1,100 million for Infosys, record bookings for HCL Tech, and USD 270 million for Tech Mahindra) and strong client additions during Q1FY2019.

Despite positive outlook for the remaining period of FY2019, Infosys, HCL Tech and Cognizant have retained their revenue growth and margin guidance for FY2019, whereas Wipro provided in-line revenue guidance for Q2FY2019.

Outlook: On a positive foothold: Acceleration of the overall industry’s CC revenue growth in Q1FY2019 validates our earlier conviction on better revenue growth for the industry in FY2019E compared to FY2018. Management commentary around record bookings/deal flows (though almost equal distribution of new and renewals), improving environment in the US, revival in BFSI space and continued growth momentum in the digital business during the quarter also provides optimism on the revenue growth trajectory in FY2019E. However, increasing deflationary pressure in the non-digital segment (around 67-74 percent of revenue), renewal pressures, account-specific issues, and aggressive investments/acquisitions in non-strategic areas remain key hurdles for the overall industry’s growth.

Most global companies are gradually embracing new-age digital technologies to realign their business models, creating tremendous opportunities for the Indian IT sector. Rupee depreciation against USD will benefit margins in the near term, though we believe material rupee benefit will be tapered off with the additional investment in building capabilities and renewal negotiations with clients going ahead.

Valuation: Earnings acceleration to support stock performance: YTD outperformance of CNXIT index of 30 percent to all other broader market indices reflects the improving demand environment, convergence of gap in relative valuations compared to other sectors and rebalancing of overall institutional ownership.

Further, strong deal inflows, recovery in hiring and rupee depreciation provide incremental support to investors’ optimism. We believe mid-cap companies would continue to maintain their track record for double-digit revenue growth in FY2019. In order of preference, we are positive on TCS (leading organic growth), Infosys (expect growth to accelerate), HCL Tech (reasonable valuation) and Tech Mahindra (turnaround in the telecom space) in the large-cap space; while in the mid-cap space, we remain positive on L&T Infotech (superior earnings growth) and Persistent Systems (higher digital penetration).

Q1FY2019 Leaders: TCS, HCL Tech, Infosys, L&T Infotech and Presistent Systems

Q1FY2019 Laggards: Wipro and Tech Mahindra

Preferred picks: TCS, Infosys, HCL Tech and Tech Mahindra (in the large-cap space); LTI and PSL (in the mid-cap space).

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.