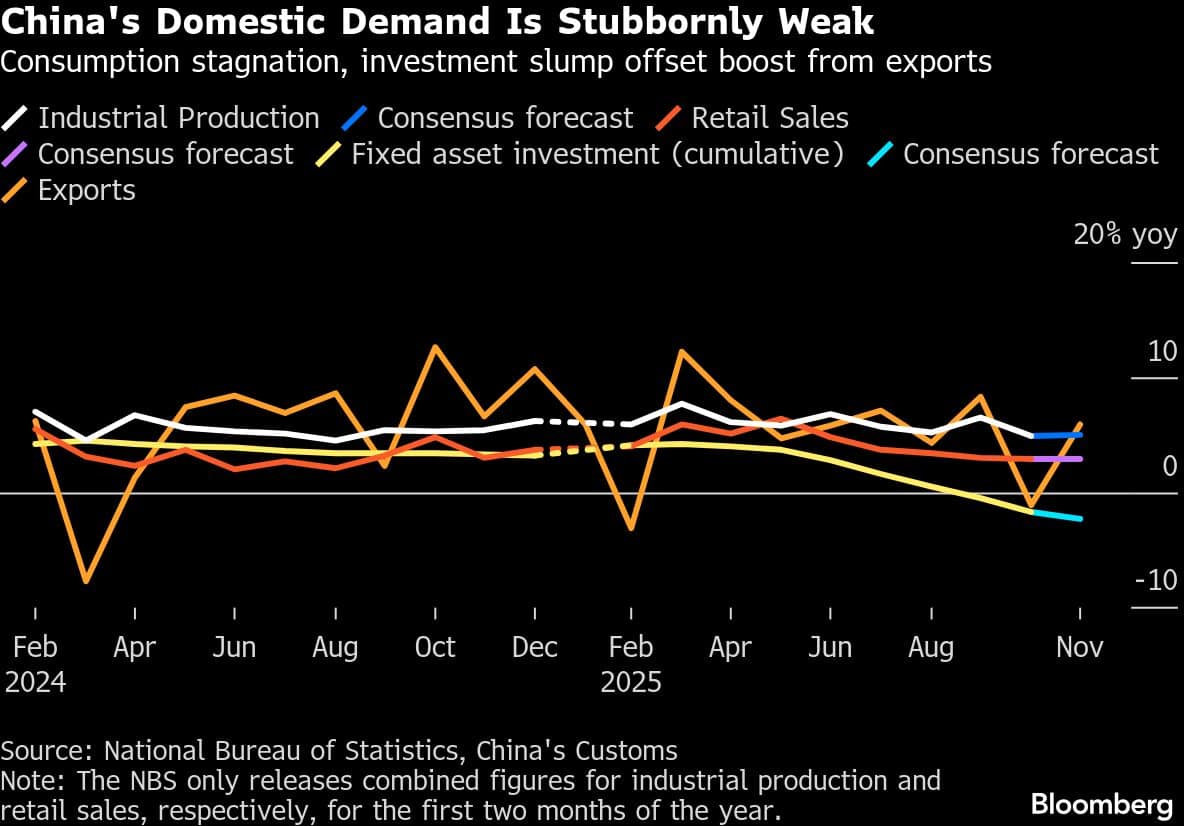

Key economic data for November are set to show China’s domestic demand remained subdued — or even weakened further — offsetting the country’s solid performance in exports.

Numbers to be released by the National Bureau of Statistics Monday are expected to show retail sales rose 2.9% in November from a year before, the median forecast of economists surveyed by Bloomberg shows. That would match the weakest gain since August last year.

Investment in fixed assets such as factories, new properties and machinery is seen contracting by 2.3% over the January-through-November period compared with a year before. That would mark a plunge unseen outside of the Covid crisis in figures going back to 1998, according to Bloomberg calculations. Much of that is thanks to China’s continuing property slump.

As for industrial production, a key metric for a Chinese leadership that prioritizes manufacturing prowess, that’s projected to rise 5% for November from the same month last year. That would be up only slightly from 4.9% in October, despite a rebound in export growth last month.

“Most activity indicators could have stayed lackluster,” Citigroup Inc. economists including Yu Xiangrong wrote in a recent note previewing the figures. While authorities have moved to inject stimulus, the effects may still be in “a very early stage” when it comes to the parts of the economy tied to construction, they wrote.

A weak set of data would highlight the risk of relying on foreign demand to propel the economy. Exports are broadly forecast to slow next year after a surprisingly strong 2025, as trade tensions with non-US markets intensify.

China’s top leaders, at key economic meetings held this week, listed boosting domestic demand as the top priority in the new year, signaling vigilance against uncertainties in foreign trade. They pledged to keep policies supportive for growth, although no aggressive measures appear to be on the cards as yet.

The projected moderation in November’s consumption growth was likely driven by a weakening in car sales and an earlier-than-usual start of the “Singles’ Day.” That calendar shift for online shopping promotion meant some demand moved into October, according to Goldman Sachs Group Inc. economists including Lisheng Wang.

Autos make up about 9% of China’s overall retail sales, one of the biggest among all categories. Retail vehicle sales dropped about 8% last month, a rare decline in what’s usually the busiest time of the year, data from the China Passenger Car Association has previously showed. The drop accelerated in the first week of December, with sales down 32% compared with a year before, the CPCA reported.

The downturn might be a symptom of the waning of a flagship government drive to spur consumer purchases of goods such as cars with subsidies.

“This sharp contraction signals an intensifying payback effect from the trade-in program,” Nomura Holdings Inc. economists including Lu Ting wrote in a note Thursday. The financial benefit was used in 52% of cars sold in the first 11 months of the year, they estimate.

China earmarked 300 billion yuan ($42.5 billion) — raised from issuing ultra-long sovereign special bonds — to fund the subsidies, double the amount granted last year.

UBS AG economists including Zhang Ning expect the government to further increase the funding to 400 billion yuan in 2026. The money may allow authorities to raise the cap on subsidies for some durable goods and provide more general benefits for certain non-durable goods and services.

“We still think an early disbursement of consumption subsidies next January may be possible to anchor expectations and mitigate high-base disruptions,” they wrote in a Friday note.

Turning to the more industrial side of the economy, October’s slide in investment spending puzzled observers last month. Goldman economists said the drop was partly due to a statistical correction by the NBS of previously over-reported data.

Goldman also pointed to the government’s “anti-involution” campaign — in which officials are trying to battle overcapacity and ruinous competition — and the property downturn.

The bank’s economists estimate fixed asset investment was down 9.5% last month from a year earlier, after tumbling 11.4% in October. The NBS doesn’t break out year-on-year monthly figures for that data series.

Earlier this week, at their Central Economic Work Conference, Chinese leaders vowed to shore up investment with measures such as increasing central government spending, optimizing the use of local special bonds and leveraging a financing tool for banks. They also promised to relieve local fiscal strains and steady the property market.

“We will push for investment to stop declining and stabilize,” policymakers said in a readout of the meeting, released Thursday.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.