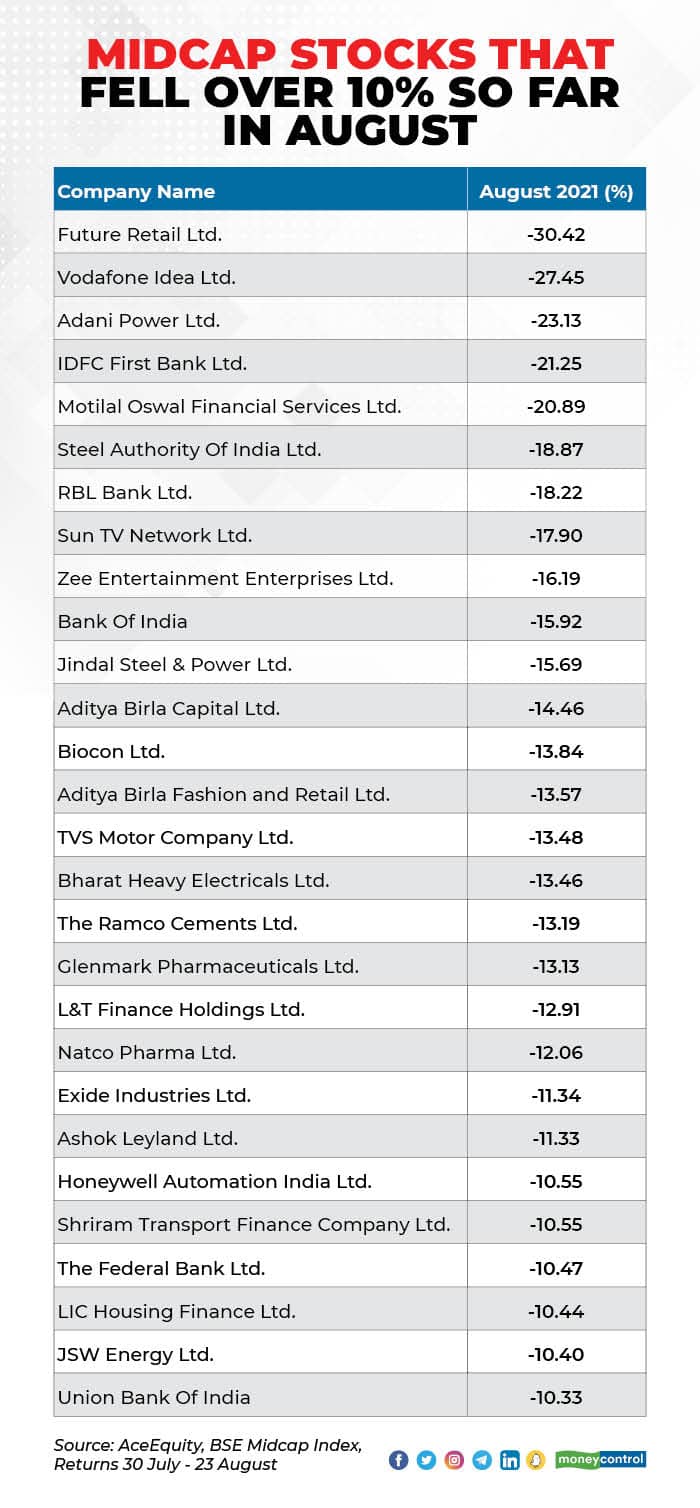

"The dominant trend in the market in August so far has been the weakness in the broader market and a flight to the safety of largecaps, particularly IT and defensives like FMCG stocks,” Dr V K Vijayakumar, Chief Investment Strategist, Geojit Financial Services, said. “This is a sharp correction, which was expected (in small & midcaps), and, therefore, warning about this development was given in time. The Nifty is likely to face resistance at higher levels since FIIs are in a sell mode,” he said. In the last 12 months, mid and smallcap indices have risen by 50 percent, and 70 percent, respectively, compared to the 45 percent rally seen in the Nifty50 in the same period. In the last five years, midcaps have outperformed by 6 percent. In P/E terms, the Nifty Midcap 100 is trading at a 3 percent premium to the Nifty, said a Motilal Oswal report. Smart money moving towards largecaps The S&P BSE Largecap index has risen more than 3 percent in the last month when the broader market indices were reeling under selling pressure. Experts are of the view that smart money seems to be moving towards largecaps. Hence, investors should remain cautious in the small & midcap space. “There are some reasons for correction in the midcap and smallcap space but the most important reason is that the market is not charitable enough to give you easy money and the last few months were like everyone can find a stock where he/she can make 5-10 percent easily in a couple of days,” he said. “So the recent selloff in the midcap and smallcap space is a shakeout phase where the market is taking out weak hands before resuming its classical bull run,” he said. Meena further added that some rotation is also visible where money is moving towards some quality largecap stocks from the midcap/smallcap space as there is a technical breakout in most of the counters after an underperformance of many months. Alok Agarwal, Senior Fund Manager, Equity, PGIM India Mutual Fund, also said that as of July 2021 end, on a two-year CAGR basis, the Nifty Small Cap has beaten the Nifty by 19 percent. Historically, only 8 percent of the months had a two-year CAGR outperformance of over 19 percent, with the median 2-year outperformance being 0. “Given the historical move, there is a limited scope for earnings surprises, and the risk-reward ratio is increasingly shifting in favour of largecaps,” he added.

"The dominant trend in the market in August so far has been the weakness in the broader market and a flight to the safety of largecaps, particularly IT and defensives like FMCG stocks,” Dr V K Vijayakumar, Chief Investment Strategist, Geojit Financial Services, said. “This is a sharp correction, which was expected (in small & midcaps), and, therefore, warning about this development was given in time. The Nifty is likely to face resistance at higher levels since FIIs are in a sell mode,” he said. In the last 12 months, mid and smallcap indices have risen by 50 percent, and 70 percent, respectively, compared to the 45 percent rally seen in the Nifty50 in the same period. In the last five years, midcaps have outperformed by 6 percent. In P/E terms, the Nifty Midcap 100 is trading at a 3 percent premium to the Nifty, said a Motilal Oswal report. Smart money moving towards largecaps The S&P BSE Largecap index has risen more than 3 percent in the last month when the broader market indices were reeling under selling pressure. Experts are of the view that smart money seems to be moving towards largecaps. Hence, investors should remain cautious in the small & midcap space. “There are some reasons for correction in the midcap and smallcap space but the most important reason is that the market is not charitable enough to give you easy money and the last few months were like everyone can find a stock where he/she can make 5-10 percent easily in a couple of days,” he said. “So the recent selloff in the midcap and smallcap space is a shakeout phase where the market is taking out weak hands before resuming its classical bull run,” he said. Meena further added that some rotation is also visible where money is moving towards some quality largecap stocks from the midcap/smallcap space as there is a technical breakout in most of the counters after an underperformance of many months. Alok Agarwal, Senior Fund Manager, Equity, PGIM India Mutual Fund, also said that as of July 2021 end, on a two-year CAGR basis, the Nifty Small Cap has beaten the Nifty by 19 percent. Historically, only 8 percent of the months had a two-year CAGR outperformance of over 19 percent, with the median 2-year outperformance being 0. “Given the historical move, there is a limited scope for earnings surprises, and the risk-reward ratio is increasingly shifting in favour of largecaps,” he added. Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.