Lux Industries is one of India’s major innerwear cum leisurewear brands for men. Investments in brand building, ability to sell more high-value products to a diverse customer base, and cost efficiencies are key to Lux’s earnings.

Given expensive valuations, investors would be better off accumulating the stock on corrections.

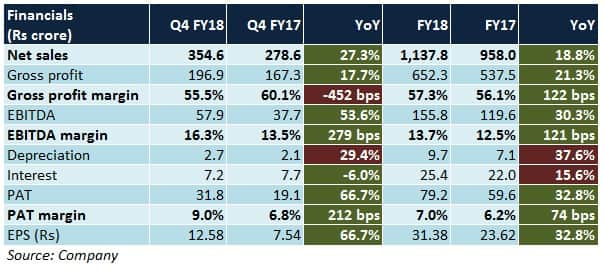

FY18 was a good year for Lux, with strong volume growth boosting the top-line. Volume growth accounted for 16 percent of the total 19 percent growth in sales year-on-year (YoY) growth. This helped neutralize higher raw material costs. Margin improvement was primarily attributable to a higher chunk of premium product sales, cost savings and forex gains.

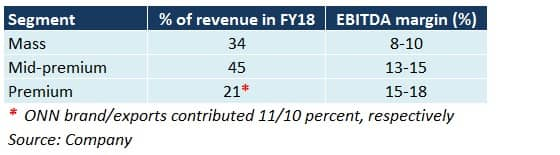

Since this segment caters to price-sensitive buyers, competition from unorganised players is high. Post-GST, organised players such as Lux are well placed to gain market share, as the economics turn unfavourable for the non-compliant units. The company will try to make up for lower margins by trying to sell higher volumes.

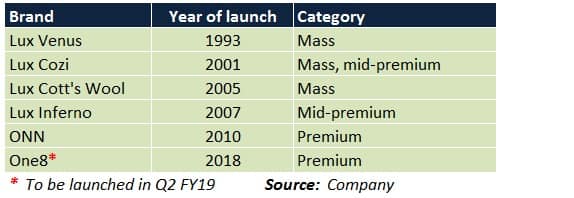

Product mix changeAt present, premium products account for 21 percent of the Lux’s sales. The company plans to increase this share, as it will help improve overall margins over the next 2-3 years.

In the second half of FY18, Artimas Fashions, Lux’s wholly owned subsidiary, signed a deal with ‘One8’, a brand launched by Virat Kohli. Lux will manufacture and sell premium quality socks, innerwear and sleepwear under the co-brand ‘One8 by ONN’ globally from Q2FY19. This partnership will enable the company to tap the youth market by leveraging its distribution strengths.

Network augmentationFor Lux, historically, the key markets have been northern, eastern and western India. To ensure adequate brand visibility in the southern states of the country (an under-penetrated market in comparison), the company will add 30-40 distributors in the region each year. This will strengthen its existing network of over 900 long-term distributors, 160 large format stores and 9 exclusive brand outlets.

MarketingLux will invest heavily in advertisements through its celebrity brand ambassadors (Amitabh Bachchan for the mass segment, Varun Dhawan for the mid-premium segment) to connect with buyers of different age groups and varied preferences. Around 7-8 percent of the company’s annual turnover will be spent on promotional campaigns.

Cost savings100 percent of Lux’s manufacturing activities are done in-house to achieve inter-process integration and derive benefits of scale through technological automation. Stitching operations for mass and mid-premium products, being less capital-intensive and cheaper, are outsourced. These measures should yield higher asset turns and better returns on capital.

ExportsUntil now, Lux exported premium men's innerwear products mainly to clients in the Middle East and Africa. The company’s focus is now shifting towards expanding its market to European nations. A weak rupee should improve realisations too. Gradually, the contribution of exports to total sales is estimated to increase from 10 percent in FY18.

MergerLux announced an organisational restructuring strategy in March 2018. Under this, two knitted apparel manufacturing entities (J.M. Hosiery and Company, Ebell Fashions Private Ltd) of Lux’s promoters group will be merged into Lux in FY19. Contours of the transaction haven’t been finalised as yet.

Other tailwindsIndia’s innerwear market, valued at Rs 24,000 crore in 2015, is projected to grow to nearly Rs 47,000 crore by 2020. Rising per capita spends on such products, increased brand consciousness among masses, growth in online retail, and availability of purpose-specific products (loungewear, fashionwear, sportswear, casual wear etc) are some of the key earnings drivers for Lux.

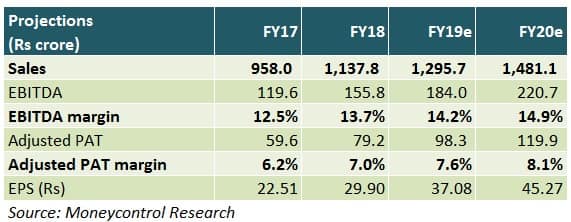

Is Lux investment-worthy?A robust portfolio of brands, consistent earnings performance, minimal capex requirements (maintenance-related only) for the next 2-3 years, and market expansion initiatives should help Lux boost its growth. However, risks associated with high competitive intensity (in case of high-margin premium, mid-premium products) and input cost pressure (in case of low-priced mass products) may play spoilsport.

At 44.2 times FY20 projected earnings, the stock is trading pretty close to its 52-week high at this point. Investors looking to buy the stock should do so on corrections.

For more research articles, visit our Moneycontrol Research pageDiscover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.