InterGlobe Aviation Ltd, which operates India’s largest low-cost carrier (LCC) IndiGo, has faced turbulence for over two years due to the feud between the promoters but the upcoming shareholders’ meet on December 30 could potentially make way for a smooth flight.

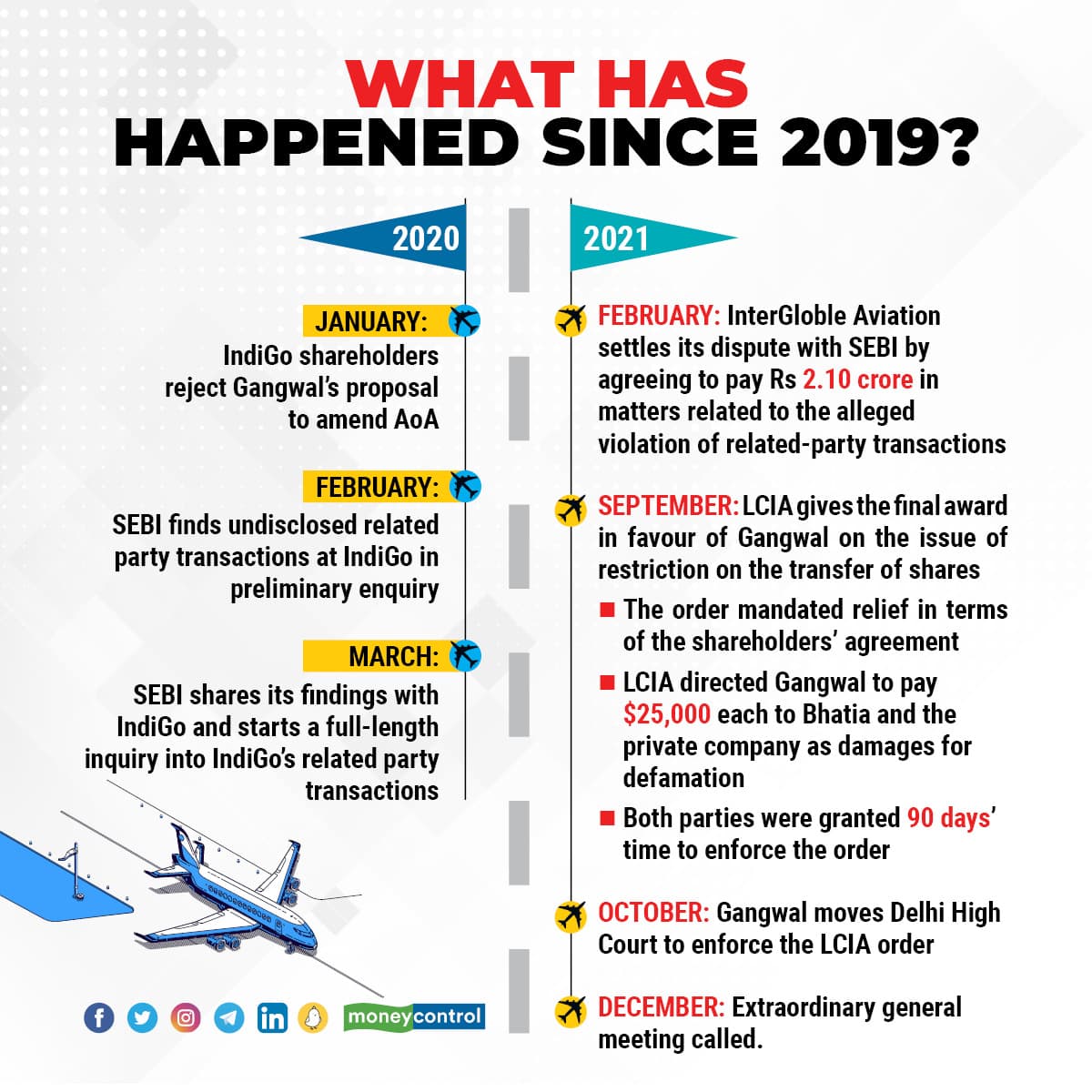

IndiGo’s two largest shareholders, Rahul Bhatia and Rakesh Gangwal, who collectively hold 74.44 percent of the paid-up equity share capital have called an extraordinary general meeting (EGM) on Thursday to amend its Articles of Association (AoA) and remove restrictions on the transfer of promoter shares. If the resolution is accepted, it would end the dispute between the owners.

The resolution is expected to pass smoothly, given that both the promoters have jointly called the meeting. Once passed, it would allow either side to sell or transfer shares to a third party, without giving each other notice.

While neither party has publicly said that they intend to sell their shares in IndiGo, the resolution would allow both promoters a chance to exit the airline. There are already speculations that Gangwal may dilute his stake.

Why is a resolution important?

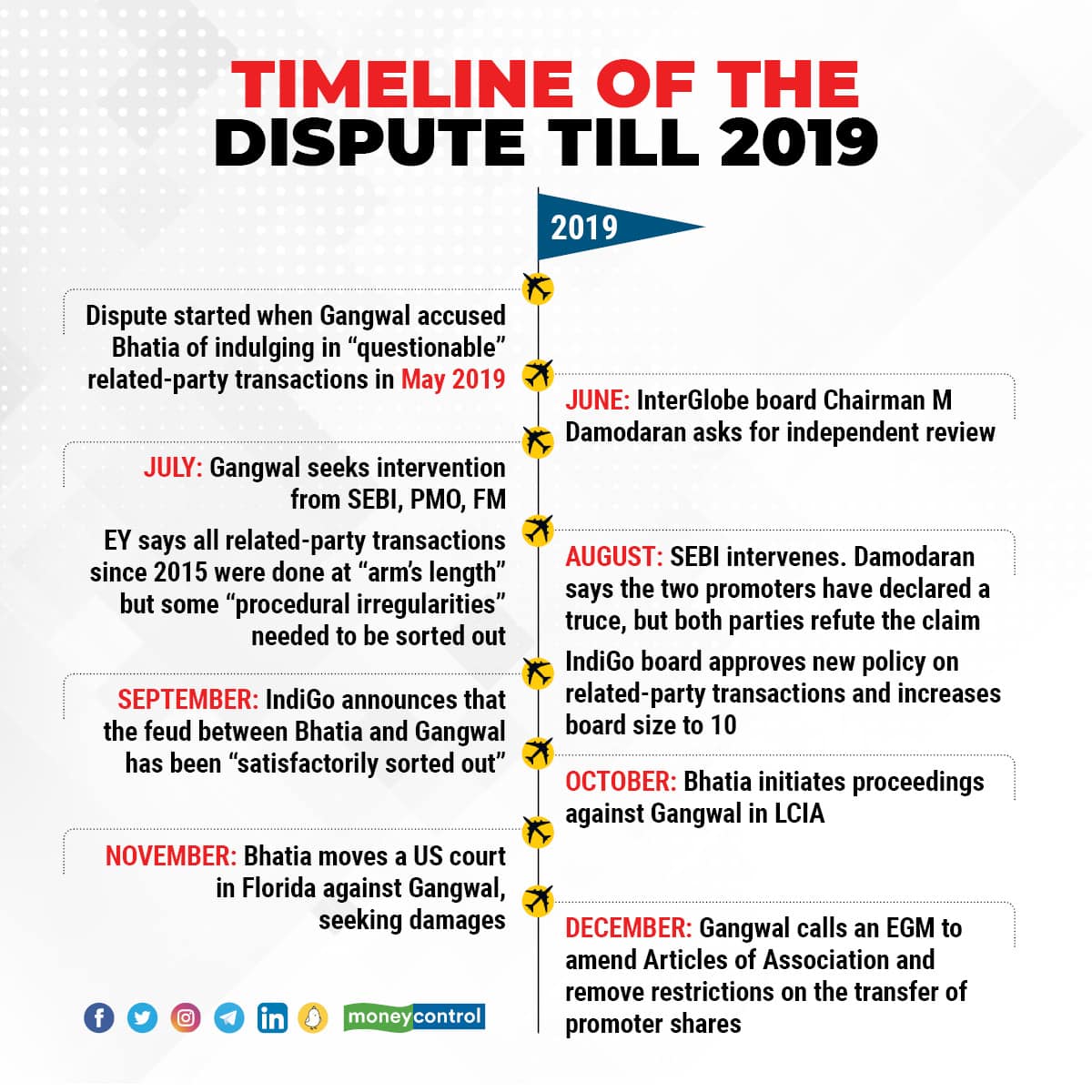

The spat between Bhatia and Gangwal started when the latter accused Bhatia of indulging in “questionable” related-party transactions between InterGlobe Aviation and Bhatia Group entities, more than two years ago.

Since then, the two are believed to be in disagreement over strategies and ambitions pertaining to IndiGo as well.

Multiple market experts say Gangwal taking a backseat in the operations of IndiGo in the last few years signals he may be looking to dilute his stake in the airline.

Before the feud, Gangwal would often be at the forefront in making most big operational decisions at the airline, such as aircraft orders, leasing and maintenance contracts.

It is also learnt that the two have been in a tussle over appointments of senior management personnel at the airline.

If the feud continues, it would impact the management’s decision-making abilities-- that too in a very dynamic environment the airline is operating in. This won’t augur well for the various stakeholders of the company.

The timing

The resurrection of Air India, Jet Airways 2.0 and the launch of Rakesh Jhunjhunwala-backed Akasa Air will pose a threat to IndiGo and has already forced the low-cost carrier to make some changes. IndiGo cannot afford to have its promoters at loggerheads anymore.

“The next year will see IndiGo performing a balancing act as it tries to maintain its dominance in the domestic market. Having one less headache (promoter feud) will definitely be a bonus,” an official from a domestic aviation consultancy said.

Senior aviation expert Ameya Joshi adds: “The imminent entry of the new airlines has already led to a battle for talent in the industry, which has been reeling under job losses and salary cuts.”

The entry of the new player in the aviation space will also affect landing slots, flight timings and ticket prices.

“Competition in the Indian aviation space is likely to rise in the coming years with three more players expected to start operations in 2022 and the existing players increasing their fleet and adding routes,” said Lokesh Sharma, a senior aviation and defence consultant.

Rising competition, coupled with the uncertainty facing the Indian aviation space due to COVID-19, would be tough for most airlines in India to handle. It will be especially tough for IndiGo as its management do not agree on a path, going forward.

“The dispute between the promoters would not only impact the growth of the company, but could also impact the industry as IndiGo is the market leader, with close to 50 percent domestic passenger market share,” an aviation expert with Goldman Sachs said.

What will minority shareholders watch out for?

Gangwal, a former CEO of US Airways Group, and family together own 36.61 percent in the airline. This amounts to around Rs 27,900 crore, based on the airline's market capitalisation, and his stake is eyed by both international and domestic investors looking to enter the Indian aviation space.

For any overseas competitor eyeing the Indian market, IndiGo appears to be the first port of call. So, the promoters of IndiGo can actually monetise their stake at a premium, if they so wish.

Against this backdrop, it is highly improbable that the promoters will indulge in a public spat that will have a bearing on the image of the company and hit its operational performance.

“If the dispute carries on and a resolution is not reached between the promoters, this will keep impacting the airline’s shares and can also affect its credit profile in the long run,” an official working at Credit Analysis and Research Ltd (CARE) said.

The bourses can be unforgiving. In 2019, the airline’s shares had fallen nearly 20 percent on a day when Gangwal had approached Securities and Exchange Board of India (SEBI) over alleged corporate governance issues at the airline.

In January 2020, when the promoters had called an EGM to pass the same resolution, the shares of IndiGo had declined 8 percent over a week on the BSE.

That the shareholders are hopeful of a resolution this time is evident in the share prices rising 6.6 percent since December 6, when the airline had announced its upcoming EGM. Shares of the airline had also risen 5 percent intra-day on December 7 after the announcement.

If the feud continues, shareholders may churn the portfolio in favour of other airlines like GoFirst and SpiceJet for a more stable return.

“The dispute has entered a level where internal resolution is almost a negligible possibility. If the airline’s shares keep facing uncertainty due to the promoter dispute as more details emerge, this would impact the valuations and corporate governance premium of the airline,” an analyst from Credit Suisse said.

Prabhudas Lilladher, in its report on December 16, said that it prefers IndiGo’s share to its competitors in the aviation space due to the airline’s superior balance sheet, industry-leading cost structure and strong management.

“We value the stock at 9 times and arrive at a target price of Rs 1,950. However, we believe the current market price bakes in most positives and with near-term uncertainties on the back of the possible spread of the Omicron variant, we recommend awaiting better entry points. Maintain HOLD,” the brokerage had said in its report.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.