The bidding for the initial public offering of Sona BLW Precision Forgings (Sona Comstar) is set to start on Monday. This is the second-largest IPO in terms of size after PowerGrid InvIT in 2021.

The equity shares are proposed to be listed on the BSE and NSE. Kotak Mahindra Capital Company, Credit Suisse Securities (India), JM Financial, JP Morgan India and Nomura Financial Advisory and Securities (India) are the book running lead managers to the offer.

Here are 10 things to know about the public issue before subscribing it:1) Public IssueBlackstone-backed Sona Comstar is planning to raise Rs 5,550 crore through public offer which comprises a fresh issue of Rs 300 crore and an offer for sale of Rs 5,250 crore by the selling shareholder Singapore VII Topco III Pte. Ltd, an affiliate of The Blackstone Group.

Of which, the company already garnered Rs 2,498 crore from anchor investors on June 11.

2) IPO DatesGlobal automotive supplier Sona Comstar will open its initial public offering for subscription on June 14, and the same will close on June 16, 2021.

To Know All IPO Related News, Click Here

3) Price BandThe price band for the public offer has been fixed at Rs 285-291 per equity share.

4) Lot Size and Reserved Portion CategorywiseInvestors can bid for a minimum of 51 equity shares and in multiples of 51 equity shares thereafter. Retail investors can make a minimum investment of Rs 14,841 and a maximum of Rs 1,92,933.

75 percent of the offer has been fixed for qualified institutional buyers, 15 percent for non-institutional bidders and the balance 10 percent for retail investors.

5) Objects of IssueThe company intends to utilise the net proceeds from the fresh issue for repaying of debt of Rs 241.12 crore, besides general corporate purposes, while the offer for sale money will go to selling shareholder.

6) Company ProfileSona Comstar is a leading automotive technology company engaged in designing, manufacturing and supplying highly engineered, mission-critical automotive systems and components.

It is among the top 10 auto-component manufacturers and supplies products across the countries such as India, US, Europe, and China. In 2020, it was among the top ten players globally in the differential bevel gear market, and also among the top ten global starter motor suppliers in India. It is also one of the two largest exporters of starter motors from India.

It has nine manufacturing and assembly facilities across India, China, Mexico and the US, of which six are located in India.

In FY21, the company derived 75 percent of its income from the sale of goods with end-use in the overseas markets, including 36.1 percent in North America, 26.5 percent in Europe and 7.6 percent in China, and 25 percent of income was derived from the sale of goods with end-use in India.

While battery electric vehicle (BEV) sales, as a percentage of total global vehicle sales, was 3.3 percent in 2020, the company derived 13.8 percent of income from the sale of goods from the BEV market for FY21. The company has increased sales to the electric vehicle (EV) market at a CAGR of 243.6 percent during FY19-FY21.

The company has long-standing relationships of 15 years and more with 13 of its top 20 customers. Some of its key OEM (original equipment manufacturer) customers include Ashok Leyland, CNH, Daimler, Escorts, Escorts Kubota, Geely, Jaguar Land Rover, John Deere, Mahindra and Mahindra, Mahindra Electric, Maruti Suzuki, Renault Nissan, Revolt Intellicorp, TAFE, Volvo Cars and Volvo Eicher.

a) It is one of the leading manufacturers and suppliers to global EV markets.

b) It is one of the leading global companies and gaining market share, diversified across key automotive geographies, products, vehicle segments and customers.

c) The company has strong research and development and technological capabilities in both hardware and software development.

d) It has strong business development with a customer-centric approach.

e) It has consistent financial performance with industry-leading metrics.

f) It has a highly experienced board of directors and management team.

Growth Strategiesa) Sona Comstar intends to capture market opportunity in the growing electric vehicle (EV) space.

b) The company intends to continue to focus on R&D (research & development) to develop new and innovative systems and components.

c) The company aims to achieve a significant global share from existing systems and components.

8) FinancialsAmong the listed top ten auto-component manufacturers in India by market capitalization, Sona Comstar is the highest in terms of operating EBITDA margin, PAT margin, ROCE (return on capital employed) and ROE (return on equity), and one of the top ten auto-component manufacturers in India in terms of operating EBITDA and profit before tax in FY20.

In FY19, FY20 and FY21, the company achieved an EBITDA of Rs 412.24 crore, Rs 325.35 crore and Rs 441 crore amounting to the EBITDA margin of 28.9 percent, 26.7 percent and 28.2 percent, respectively. Its average ROE was 35.6 percent, 35.2 percent and 36.4 percent, and ROCE was 40.3 percent, 29.0 percent and 34.8 percent respectively in the same period.

Its pro forma consolidated income from the sale of goods amounted to Rs 1,488.93 crore in FY21 as compared to Rs 1,180.42 crore for FY20, representing year-on-year growth of 26.1 percent.

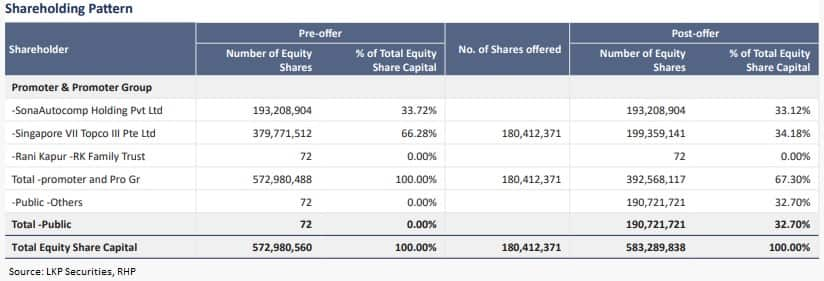

Sunjay Kapur, Sona Autocomp and Singapore Topco are the promoters of the company. While Sunjay Kapur does not directly hold any equity shares in the company, Sona Autocomp presently holds 33.7 percent of the pre-offer paid-up equity, and Singapore Topco holds 66.2 percent stake at the time of filing the RHP.

Sunjay Kapur is the Chairman and Non-Executive Director of the company. He has over 21 years of experience in the automotive industry. He also served as director on the board of directors of various companies and was the managing director of Sona Koyo Steering Systems (now JTKET India Limited).

Vivek Vikram Singh is the Managing Director and Group Chief Executive Officer of the company. He has over 15 years of experience, including six years of experience in the automotive industry. He is responsible for overseeing the production of auto components and systems platform in electric vehicles and hybrids, capital allocation decisions, external shareholder management at the company.

Amit Dixit, and Ganesh Mani are the Non – Executive Directors (Nominee), while Jeff M Overly, Prasan Abhaykumar Firodia, Shradha Suri, and Venkata Rama Subbu Behara (B V R Subbu) are Independent Directors on the board.

Rohit Nanda is the Group Chief Financial Officer of the company. He is a qualified chartered accountant and has significant experience in diverse industries including steel, engineering, pharma, chemical and industrial goods, among others. Prior to joining the company, he was associated with, among others, Usha Martin, MTAR Technologies, Jindal Stainless, SRF and Ranbaxy Laboratories.

10) Allotment, refunds and listing datesSona Comstar in consultation with merchant bankers will finalise the IPO share allotment around June 21, and the funds will be refunded around June 22.

Equity shares will get credited to eligible investors' demat accounts around June 23, and the trading in equity shares will begin with effect from June 24, as per the schedule available in the company's red herring prospectus.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.