Investors' appetite for Paras Defence and Space Technologies' initial public offering was very strong since the day one of subscription as it oversubscribed by 304 times on September 23, the final day of bidding. It is the highest subscription received by any IPO since at least 2007.

The public offer of the defence and space engineering products and solutions provider has received bids for over 217 crore equity shares against the IPO size of 71.40 lakh equity shares, generating bids worth Rs 38,021 crore in three days. The issue was opened on September 21.

The response to the IPO was seen from all kind of investors as the portion set aside for qualified institutional investors was subscribed 169.65 times and that of non-institutional investors subscribed 927.70 times. Retail investors, who have reservation for 35 percent of IPO size, have put in bids for 112.81 times the portion set aside for them.

The company launched public offer for fund raising of Rs 170.77 crore which comprises a fresh issue Rs 140.6 crore and an offer for sale of Rs 30.2 crore by selling shareholders, including Paras Defence promoters.

The small issue size, likely to benefit from the Atmanirbhar Bharat and Make-in-India initiatives, attractive valuations on the long term basis, backed by ace investor Sunil Singhania-owned Abakkus Fund, healthy order book of Rs 305 crore which gives strong revenue visibility, diversified product offerings, increasing focus on defence sector, and only IPO opened for subscription are some of key reasons pointed out by experts for strong investors' interest in the IPO.

Paras Defence is the sole Indian supplier of critical imaging components such as large size optics and diffractive gratings for space applications in India. It manufactures high-precision optics for defence and space applications such as thermal imaging and space-imaging systems. It is the only Indian company to have the design capability for space optics and opto-mechanical assemblies.

"It is a defence sector company, which is currently looking very attractive. This sector has received strong traction from investors due to the government's increased focus on the sector. In the past, though not strictly comparable, MTAR Technologies IPO has yielded very strong returns to investors. MTAR has given around 140 percent return from its issue price of Rs 575, which listed in March 2021," said Astha Jain, Senior Research Analyst at Hem Securities.

Gaurav Garg, Head of Research at CapitalVia Global Research feels with India trying to reduce its dependency on the import of defence equipment, the firm is poised to grow in the near term, and it is well positioned to benefit from the Atmanirbhar Bharat and Make-in-India initiatives. He believes the company's long-term prospects to be favourable, owing to the strong government support and increasing private sector investment in the defence sector.

Sunil Singhania-owned Abakkus Emerging Opportunities Fund 1 has 1.01 percent stake (3.14 lakh shares) in the company at the time of filing prospectus. Later in the anchor book, the fund bought over additional 6.65 lakh equity shares in the company.

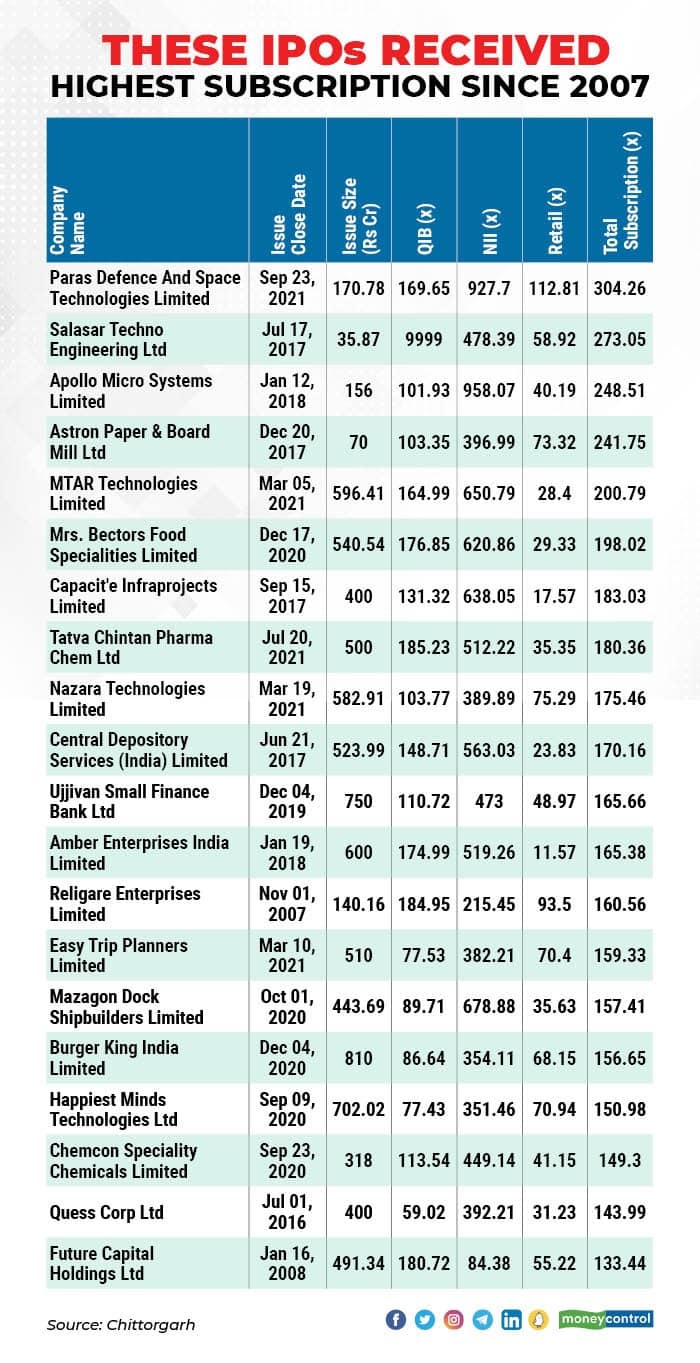

As per data available since 2007, Salasar Techno Engineering was the second IPO that has got subscribed 273 times in July 2017, followed by Apollo Micro Systems (248.51 times) in January 2018, Astron Paper & Board Mill (241.75 times) in December 2017, and MTAR Technologies (200.79 times) in March 2021.

After that, Mrs. Bectors Food Specialities IPO had witnessed subscription of 198 times in December 2020, Capacite Infraprojects 183 times in September 2017, Tatva Chintan Pharma Chem 180.36 times in July 2021, Nazara Technologies 175.46 times in March 2021 and Central Depository Services (India) 170 times in July 2017.

The above data indicated that such kind of enthusiasm for IPO has always seen in the bull market. The benchmark indices are more than doubled from their March 2020 lows, while the broader markets including the BSE Midcap and Smallcap indices rallied 160 percent and 214 percent. Similar kind of momentum was also seen in 2016-2017 before seeing correction from the end of January 2018, during which the BSE Sensex had gained over 50 percent, Midcap around 80 percent and Smallcap 93 percent.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.