Most Indian consumers’ association with Paytm started with the company’s wallet, which made digital payments easier way before the Unified Payments Interface (UPI) was even conceived.

Even today, many Indians identify Paytm as a digital payments company although it has grown its business across e-commerce and financial services.

Paytm, founded by Vijay Shekhar Sharma, is set for a Rs 18,300 crore initial public offering (IPO), India’s largest. The IPO will open on November 8, followed by a listing expected to value the company at an impressive $20 billion.

Ahead of the IPO, Moneycontrol takes a look at what exactly is Paytm’s business model and what are its revenue streams.

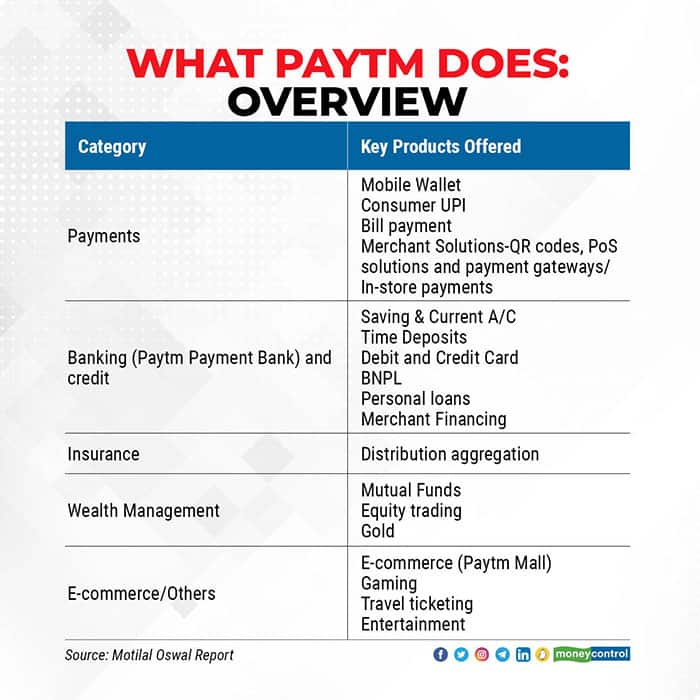

Paytm, i.e. One97 Communications Ltd, has three key business segments – payment services, commerce and cloud services and financial services. Overall, the company has 120 million annual transacting users and 22 million merchants on its platform and a total of 337 million consumers.

The Paytm app serves as a super app for customers, allowing them to make online and offline bill payments, money transfers, access e-commerce offerings, ticketing services, Paytm Payments Bank and make investments, buy insurance or gold or take loans and get credit cards.

The company’s total revenue from operations in the financial year 2021 was Rs 2,802 crore across businesses.

Payment and financial services together are the largest contributor to Paytm’s revenue, making up 75 percent of financial year 2021 revenue. The revenue from these businesses is Rs 2,109 crore.

Paytm has payment offerings for both customers and merchants. According to RedSeer data quoted in its share sale prospectus, the company is the largest payments platform in India with a total gross merchant value (GMV) of over Rs 4 lakh crore in the last financial year

Paytm’s market share in overall mobile payments transactions is about 40 percent; it addition, it has a market share of 65 to 70 percent in wallet payments transactions, according to RedSeer.

The company’s customers have a choice of payment instruments including Paytm Wallet, Food Wallet, bank accounts, Fastag, Buy Now Pay Later (BNPL) and equated monthly installment (EMI) options apart from cards.

UPI has led the digital payments adoption in India, but it has a very small share of transactions through Paytm Payments Bank. The company only has a 14 percent share in monthly UPI transactions although it remains the third-largest player.

For the merchant ecosystem, Paytm enables payments through its flagship payment gateway, all-in-one QR codes, Soundbox and point of sales (PoS) machines.

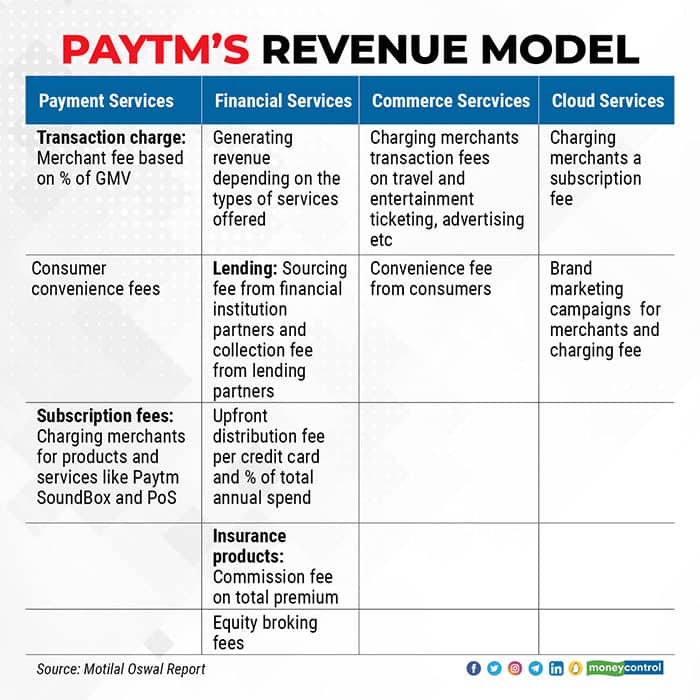

Paytm earns money through transaction fees and take-rates charged to merchants based on the percentage of GMV, which is a key revenue driver for the company. It also charges customers convenience fees.

The company also earns revenue through a subscription-based model for certain merchant products and services like Paytm SoundBox and PoS.

Financial servicesThe company offers mobile banking services through Paytm Payments Bank with a total of 65 million accounts and deposits worth Rs 5,800 crore. It also has a lending vertical, including Paytm Postpaid which is a BNPL (buy now, pay later) offering; the company has disbursed three million loans and post-paid products till date.

A report by Motilal Oswal Financial Services says that the share of the lending business is expected to increase sharply in Paytm’s core revenue over the next couple of years.

Paytm Insurance Broking is an insurance marketplace with products across auto, life and health insurance, and policy management and claim services. The insurance arm, Paytm Insurtech, raised Rs 920 crore on October 27 from global reinsurance firm Swiss Re, a few months after it acquired Raheja QBE General Insurance. Paytm has a total of 11.3 million insurance customers.

Lastly, the financial services arm offers wealth management through the Paytm Money app including gold purchases, mutual funds and futures and options trading. The total assets under management from these businesses is Rs 5,200 crores.

Across financial services, Paytm’s revenue comes from sourcing fees charged to financial institution partners and collection fees for loans, distribution fees from credit cards, commission fee on insurance premiums and equity broking fees.

Paytm’s third line of business allows merchants to connect with customers, offers cloud services to enterprises, telecom companies, and digital and fintech platforms, ticketing services and gaming; it houses Paytm First, which is a subscription-based rewards and loyalty programme.

According to RedSeer data, Paytm sold movie tickets across 5,700 screens in financial year 2020 and was the second-largest booking platform in India in terms of movie tickets sold.

The vertical contributes 25 percent of Paytm’s revenue; it earned Rs 693 crore from sales at the end of financial year 2021.

The revenue is generated mainly by charging merchants in the ticketing business transaction fees and consumers convenience fees. The platform also charges merchants and enterprises subscription fees in its cloud business.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.