The initial public offering (IPO) of specialty chemical company Clean Science and Technology will open for subscription tomorrow, July 7. This will be the 26th public issue to hit Dalal Street in 2021.

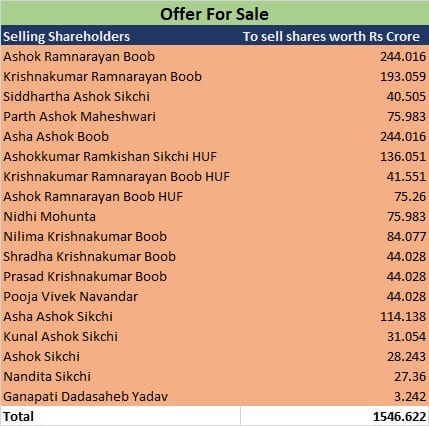

Here are 10 key things to know before subscribing public issue:1) Public IssueThe initial public offering will be a complete offer for sale of Rs 1,546.62 crore by existing selling shareholders including promoters Ashok Ramnarayan Boob, Krishnakumar Ramnarayan Boob, Siddhartha Ashok Sikchi, and Parth Ashok Maheshwari.

The public issue will open for subscription from July 7-9. Anchor investors' book will open for a day on July 6.

3) Price BandThe company in consultation with merchant bankers has fixed its IPO price band at Rs 880-900 per equity share.

4) Lot Size and Reserved Portion CategorywiseInvestors can put in bids for a minimum of 16 equity shares and in multiples of 16 equity shares thereafter. Retail investors can invest in one lot to a maximum of 13 lots given the restriction of investment to Rs 2 lakh. They can invest a minimum of Rs 14,400 and maximum of Rs 1,87,200.

Up to 50 percent of the offer is reserved for qualified institutional buyers, 35 percent for retail investors, and 15 percent for non-institutional buyers.

5) Objects of IssueAs it is a complete offer for sale issue, all the money raised through offer will go to selling shareholders.

Clean Science is among a few companies globally that focus on developing newer technologies using in-house catalytic processes, which are eco-friendly and cost-competitive. This has enabled the company to emerge as the largest manufacturer globally of certain specialty chemicals in terms of installed manufacturing capacities as of March 31, 2021.

The company manufactures functionally critical specialty chemicals such as performance chemicals, pharmaceutical intermediates, and FMCG chemicals. In FY21, exports contributed 67.86 percent to total revenue from operations.

Its specialty chemicals have a wide range of applications that cater to a diverse base of customers across industries in India as well as other regulated international markets including China, Europe, the United States of America, Taiwan, Korea, and Japan.

Its key customers include Bayer AG, SRF, Gennex Laboratories, Nutriad International NV and Vinati Organics.

It has two certified production facilities in India at Kurkumbh (Maharashtra), with a combined installed capacity of 29,900 million tonnes per annum (MTPA) as of March 2021. It has also recently set-up a unit at the third facility adjacent to existing facilities at Kurkumbh (Maharashtra), and has recently been allotted land for the construction of a fourth facility at Kurkumbh (Maharashtra).

7) Competitive Strengths & StrategiesCompetitive Strengthsa) Track record of strategic process innovation through consistent R&D initiatives;

b) Among the largest producers globally of functionally critical specialty chemicals used across various industries and geographies resulting in a de-risked business model;

c) Experienced promoters and senior management with extensive domain knowledge;

d) Strong and long-standing relationships with key customers;

e) Automated manufacturing facilities with proven design and commercialization capabilities and strong focus on environment, health and safety;

f) Strong and consistent financial performance since the last three fiscals.

Strategiesa) To leverage leadership position in the specialty chemicals industry to capitalize on industry opportunities;

b) To leverage R&D capabilities and understanding of catalysis to continue process re-engineering, further enhancing product portfolio;

c) To expand manufacturing capacities of existing products and set up additional capacities for new products;

d) To continue to strengthen presence in India and expand sales and distribution network in international markets.

8) Financials and Peer ComparisonClean Science posted strong results in FY21 with revenue growth of 22 percent YoY and operating profit rising 40 percent. PAT grew 42 percent YoY to Rs 198 crore in FY21. It has a strong earnings track record with 59 percent PAT CAGR over FY18-FY21 and return on equity (RoE) of around 36.8 percent.

In FY21, revenue from operations for sales outside India represented 67.86 percent of total revenue from operations.

Its promoters are Ashok Ramnarayan Boob, Krishnakumar Ramnarayan Boob, Siddhartha Ashok Sikchi and Parth Ashok Maheshwar.

Ashok Ramnarayan Boob and Krishnakumar Ramnarayan Boob are brothers, and Siddhartha Ashok Sikchi is their nephew and cousin of Parth Ashok Maheshwari.

Pradeep Ramwilas Rathi is the Chairman and Non-Executive Director of the company. He holds a bachelor's degree in science from University of Poona and master's degree of science in chemical engineering practice from Massachusetts Institute of Technology, US. He also holds a master's degree in business administration from Columbia University, US. He has close to 25 years of experience in the chemical industry and is currently a director of Sudarshan Chemical Industries, Pune, India.

Ashok Ramnarayan Boob, is the Managing Director of the company. He holds a bachelor's degree in chemical engineering from the Institute of Chemical Technology, Mumbai. He has close to 25 years of experience in the chemical industry and has previously worked as an executive director at Mangalam Drugs and Organics.

Siddhartha Ashok Sikchi, is a Wholetime Director of the company. He holds a master's degree in science from the University of Manitoba, Canada and a bachelor’s degree in technology from the Institute of Chemical Technology, Mumbai. He has over fourteen years of experience in the chemical industry.

Krishnakumar Ramnarayan Boob, is a Wholetime Director of the company. He holds a bachelor's degree in pharmacy from the University of Bombay, India. He has close to two decades of experience in the chemical industry and has previously worked as a director at Mangalam Drugs and Organics.

Sanjay Kothari is the Non-Executive Director on the company's board. Ganapati Dadasaheb Yadav, Keval Navinchandra Doshi, and Madhu Dubhashi is the Non-Executive and Independent Directors on the board.

Pratik Abhaykumar Bora is the Chief Financial Officer of the company. He has been associated with the company since January 2020 and has been promoted to the post of Chief Financial Officer in February 2021. Prior to joining the company, he was associated with Mirae Asset Capital Markets (India).

10) Allotment, refunds and listing datesThe company will finalise the basis of allotment of shares with the designated stock exchange on July 14, while the funds will be refunded as well as unblocked from ASBA account on July 15.

Equity shares will be credited to demat accounts of eligible investors on July 16, and the trading in equity shares will commence from July 19, as per the schedule available in the red herring prospectus.

Equity shares are proposed to be listed on both BSE and NSE.

Axis Capital, JM Financial and Kotak Mahindra Capital Company are the book running lead managers to the offer.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.