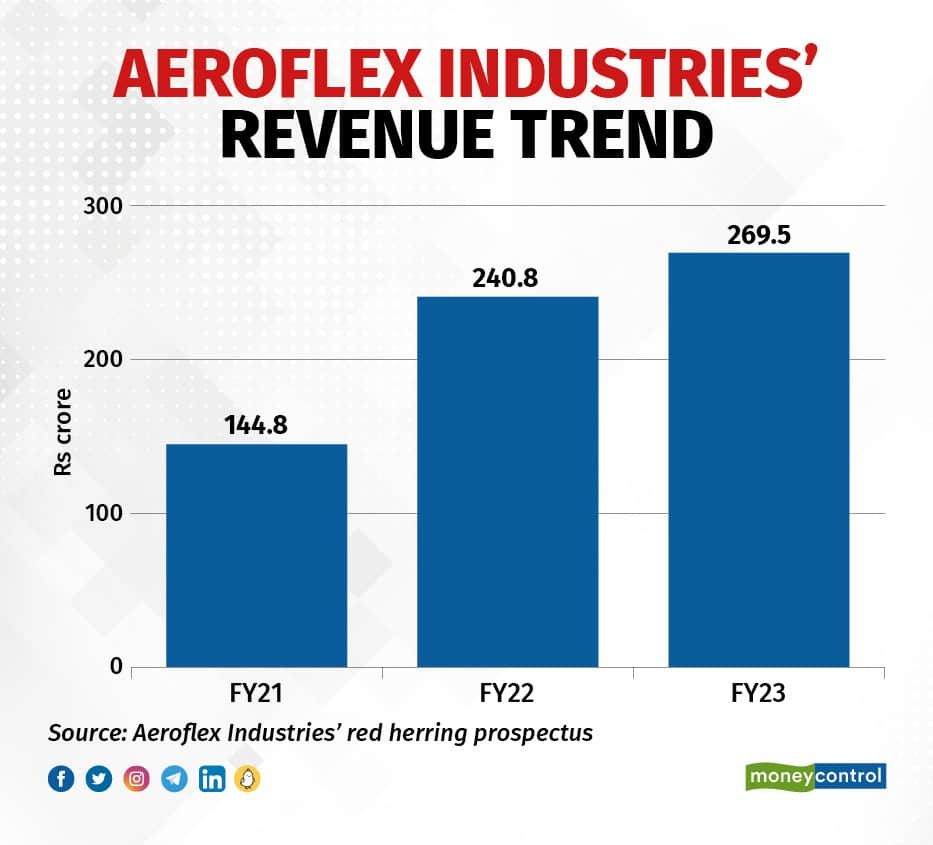

Aeroflex Industries is aiming for an annual turnover of nearly Rs 1,000 crore in five years, managing director Asad Daud said in an interaction with Moneycontrol. That works out to a compound annual growth rate of 30 percent.

The company, which secured backing from marquee investors like Ashish Kacholia and Jagdish Master ahead of its initial public offering (IPO), supplies high-end and specialised hoses as part of its “flexible flow solutions” to industries ranging from the defence sector to aerospace and space ventures. It has also contributed to the fueling of Indian Space Research Organisation’s ongoing Chandrayaan Mission Project that aims to soft-land a rover on the Moon.

Aeroflex first aims to retire its debt through the proceeds from the IPO. Also, an allocation of almost Rs 84 crore has been earmarked for meeting working capital requirements, while an additional 35-40 crore has been set aside for potential acquisitions.

The IPO consists of a fresh equity issue of Rs 162 crore alongside an offer for sale (OFS) of Rs 189 crore.

The company is looking to focus on the defence sector with the intent to replace rubber-based flow solutions in the segment. This market, though still in its nascent stage in India, is the company's targeted area for transformation.

Daud also said that the company planned to diversify across geographies. This initiative stems from the significant impact observed following the Russian-Ukraine crisis on the company's revenue during FY23. In the light of this, the company is committed to maintaining an 80:20 revenue mix, with 80 percent of its revenue coming from exports and the remaining 20 percent from the domestic market.

Aeroflex Industries IPO

Aeroflex Industries IPOThe company, which sources more than 70 percent of its raw material product requirements from China, also intends to reduce the dependence on the neighbouring country by tapping domestic companies.

The company’s IPO was fully subscribed in less than two hours with the non-institutional investors and retail categories oversubscribing by 1.3 and 1.5 times, respectively.

In-line with the stellar traction received by the Ashish-Kacholia backed company's public offer, Aeroflex Industries made a bumper-debut on the exchanges, listing at an 82.78 percent premium over the issue price of Rs 108.

At 10.07 am, shares of Aeroflex Industries were trading at Rs 175.55 on the National Stock Exchange.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.