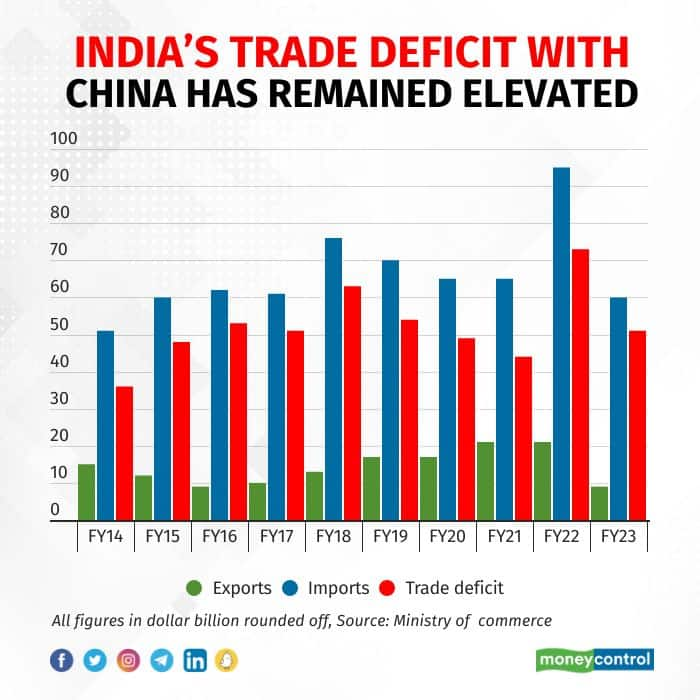

The latest scuffle at the line of actual control between India and China has yet against brought the spotlight on New Delhi's wide trade deficit with its larger neighbour.

China is India’s second biggest trading partner after the U.S. China was, in fact, our largest trading partner in fiscal years 2013-14 to 2017-18 and again in 2020-21, data from the commerce ministry shows.

This, in itself, is nothing to be alarmed about. After all, China is the key supplier of a raft of goods to the rest of the world and India is no exception.

Still, the pandemic and India’s tussle with China in the Ladakh region in 2020 led to calls for decreasing reliance on shipments from that country.

India has been pushing a host of production-linked schemes, offering incentives on annual incremental sales to boost local manufacturing in sectors ranging from automobiles, white goods, pharmaceuticals to solar photovoltaic modules.

The programme is part of the government’s broader goal to help reduce imports and boost exports of manufactured products, an attempt to secure a foothold in the global supply chain that is undergoing a shift from China following the Covid-19 pandemic. India is also aiming to reduce logistics costs and ensure a better climate for foreign investors to come in a set up shop.

These measures should help India benefit from the move away from China and reduce import dependency over a period of time.

Government’s take

Most of the goods imported from China are capital goods, intermediate goods and raw materials and are used for meeting the demand of fast- expanding sectors like electronics, telecom and power in India, according to commerce and trade minister Piyush Goyal.

“The rise in import of electronic components, computer hardware and peripherals, telephone components, etc. can be attributed to transforming of India into a digitally empowered society and a knowledge economy. India’s dependence on imports in these categories is largely due to the gap between domestic supply and demand,” Goyal said in a parliamentary response earlier this month.

Meanwhile, raw materials like Active Pharmaceutical Ingredients and drug formulations from China are used for making finished products like generic medicines, which are exported from India.

Similar is the case with electronic components such as mobile phone parts, integrated circuits, video recording or reproducing apparatus, which are used for making mobile handsets and other items, according to the government.

The PLI schemes have started delivering results and will reduce dependency on imports and make India a competitive destination for drugs/electronics manufacturing and create more domestic champions apart from giving boost to a self-reliant economy, the government said.

To be sure, the rest of the world is also looking at reliable trade partners as countries seek to reduce reliance on Chinese goods.

Still, these are moves that will play out over the medium term. Right now, India continues to import a slew of goods from China, including raw chemicals, intermediates, machinery, and consumer and electronic items.

In April-October of this fiscal year, India imported $60 billion worth of goods from China against $94 billion last fiscal year. The trade deficit with China stands at over $50 billion this fiscal year against $73 billion in the last fiscal.

Here’s a look at the top imports from China in the year ending September 2022, and the on year growth in these shipments:

India’s growing economy will need to continue to rely on imports of key inputs in the foreseeable future. Whether we seek to curb shipments from a particular geography is a political call that needs to be taken.

On the other hand, the government’s economic advisers have been talking about moderating the growth push to ensure that the external account does not worsen. India’s current account deficit is set to breach the red line of three percent of gross domestic product this fiscal year.

Besides geopolitics, economic considerations will also continue to dictate India’s trade with its larger neighbour.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.