Year 2023 turned out to be a standout year for India, and the world took notice of India’s resilience in the face of an impending slowdown globally, Axis Mutual Fund said in its Annual Outlook 2024 report.

In the report, Ashish Gupta, CIO, and Shreyash Devalkar, Head of Equity, Axis Mutual Fund, highlighted that, in 2024, all eyes will remain focused on global growth, inflation and monetary policy outcomes in major economies.

While the government will reduce the fiscal deficit and aim to achieve the target of 5.9 percent in FY24, according to the report, this could be challenging.

“Tighter fiscal deficit and easy monetary policy could provide the right backdrop for falling yields. This will further be aided by the inflows of more than $24 billion through the global index inclusion. The current account deficit could narrow further, given the balance of payment surplus of $30 billion, and if crude /commodity prices remain lower,” the report said.

Overall, India has the ingredients to set further momentum over the medium to long term, Gupta and Devalkar highlighted. The big picture suggests that India could benefit from long-term factors such as improving infrastructure, manufacturing and the China-plus-one strategy, formalisation of the economy and rising digitisation.

Here are six highlights from the equity market in 2023:

1. Small- and mid-caps outperform

After a slow start, Indian equities witnessed “spectacular gains” – led by enhanced earnings outlook, robust macroeconomic backdrop and improvement in balance-sheet strength of corporates. Small- and mid-cap stocks were at the forefront, with large domestic inflows into the segments. In 2023, domestic inflows into funds were around $2 billion, with most inflows into mid and small-cap funds.

2. Return of FPIs

Year 2023 saw foreign portfolio investors (FPIs) returning to the Indian equity market with around $18 billion, after almost two years of outflows. According to the report, the sectors that were the biggest beneficiaries were “industrials, consumer discretionary and financials while energy and technology saw outflows”.

3. $4 trillion club

.

.According to the report, the outperformance in equities led to India joining the “coveted $4 trillion club”. India is the fifth global economy to do so. Currently, its market cap-to-GDP ratio stands at ~1.25, indicating that the indices have raced pass India’s nominal GDP, the report said.

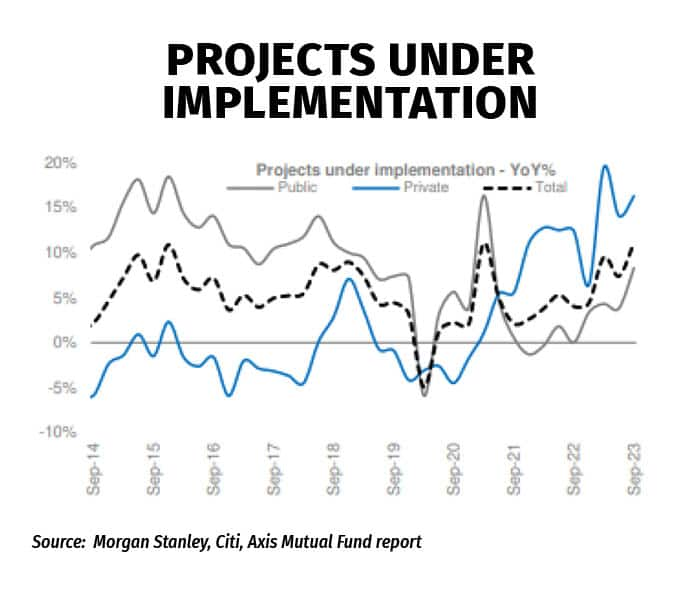

4. All eyes on capex

While there has been a pick-up in private capex, overall capex has mostly been concentrated in sectors like refineries, power, steel, etc. According to the report, the capex trajectory could get a boost (after elections), on the back of strong corporate balance sheets, cash flows and a favourable policy environment.

Also read: Five reasons why you can bet on Indian manufacturing

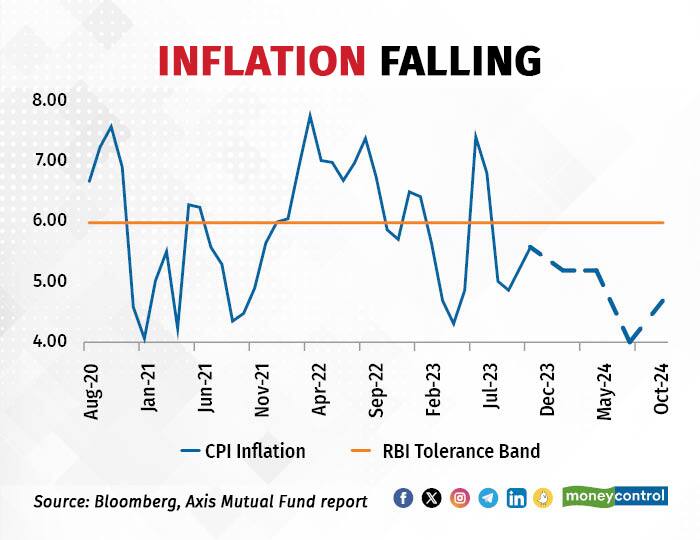

5. Inflation to cool down

While 2023 saw inflation fall from near double digits to low single digits, according to the report, 2024 could likely see gradual declines that will be further supported by falling crude oil prices.

Also read: Eye on elections: Should you prefer industrials or consumption stocks ahead of the polls?

6. Challenges continue for rural consumption

While urban consumption has been robust across segments, rural consumption continues to struggle due to uneven monsoon. While the performance of the urban segment has been in line with expectations, the report adds that the segment could face tighter credit conditions and moderating employment in the formal sector. While election-related spending could boost demand, consumption could also be impacted by the tightening of regulatory norms for unsecured lending by the RBI, the report added.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.