Despite the seasonally weak December quarter, the three large IT services firms - TCS, Infosys and Wipro - continued to deliver strong growth in the period.

This was driven by continued demand for digital services, as enterprises across the world opened up their purse strings to virtualise in the face of the virus. Going by executive and analyst commentary, the momentum will continue in the coming quarter as well.

Here's a look at how the firms fared in the December quarter.

Revenue

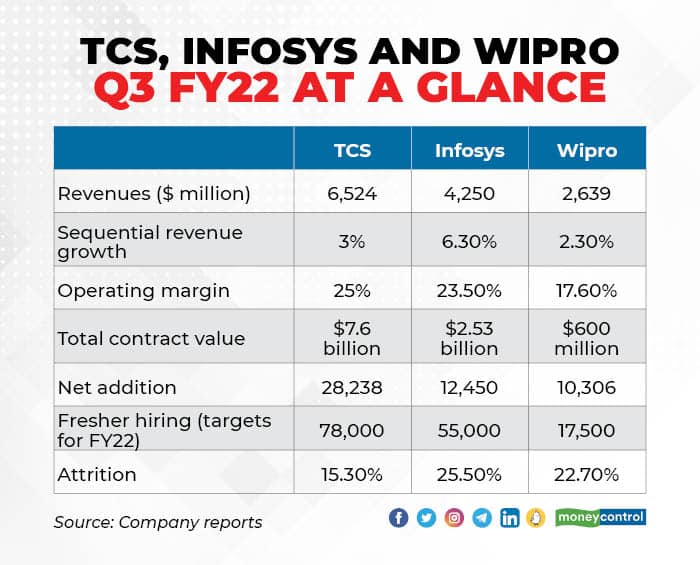

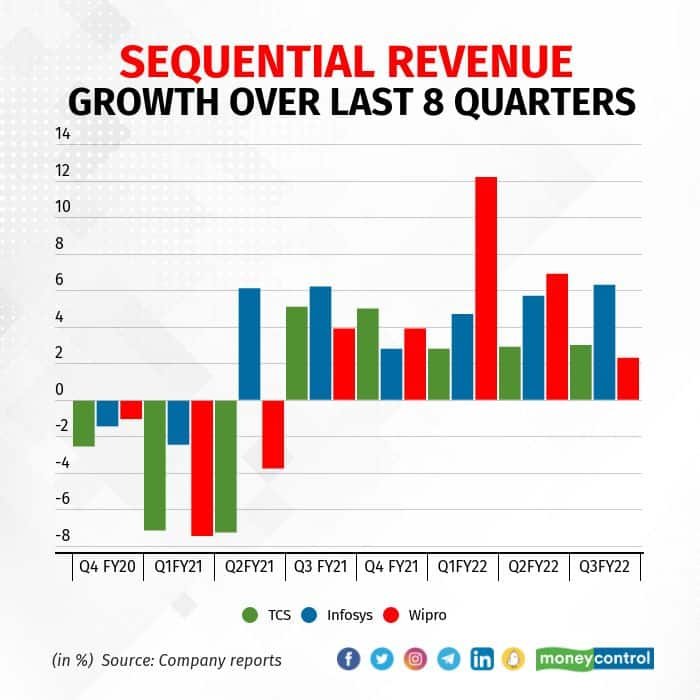

While TCS and Infosys's revenue rates were ahead of market estimates at 3 and 6.3 percent sequential growth respectively, Wipro missed the estimates clocking 2.3 percent growth. However, all the three companies are bullish and expect to end the year with double digit growth.

Infosys increased its guidance for the third time this financial year to 19.5-20 percent, from 16.5-17.5 percent. The company had started the year with a guidance of 12-14 percent. Brokerage Motilal Oswal in its note said, “While we anticipated a more modest guidance raise, growth in the December quarter will ensure that FY22 revenue growth will again beat its latest guidance by 100 basis points. Good revenue growth in the second half of FY22 will also help it deliver high teen growth in FY23, which would be viewed positively by investors.”

Deal pipeline

One of the key trends emerging over the last few quarters is the companies beginning to see a mix of large, medium and small size deals, instead of mega deals of over $500 million.

For instance, in December 2020, Wipro won a $700 million deal with the German firm Metro AG, and Infosys signed its largest ever deal in history with Daimler last year. However, such deals are largely missing from the the last few quarters.

Thierry Delaporte, CEO of Wipro, said during the earnings call that while the mega deals are lacking, deals are coming in chunks instead of one large deal as was the case earlier. As a result, companies are seeing a mix of small, medium and large deals.

According to analysts, the healthy deal pipeline, even in the absence of mega deals, is a positive trend.

Attrition

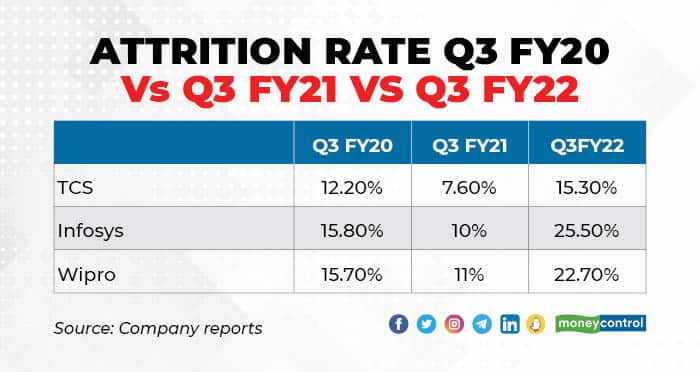

With IT demand so high, technology professionals are more sought after than ever before, and companies are fighting over the limited talent pool, especially in the area of new-age digital skills. This war for talent is one of the biggest challenges for the companies. TCS, Infosys and Wipro reported 15.3 percent, 25.5 percent and 22.7 percent attrition respectively for the quarter ended December 2021. This is after recording one of the lowest rates in the beginning of 2021.

In recent interactions, multiple executives and recruiters have shared that attrition is likely to continue, but is expected to stabilise as more freshers join the productive workforce. An executive with a mid-tier IT firm pointed out that employee churn is expected to come down by mid-2022.

Hiring

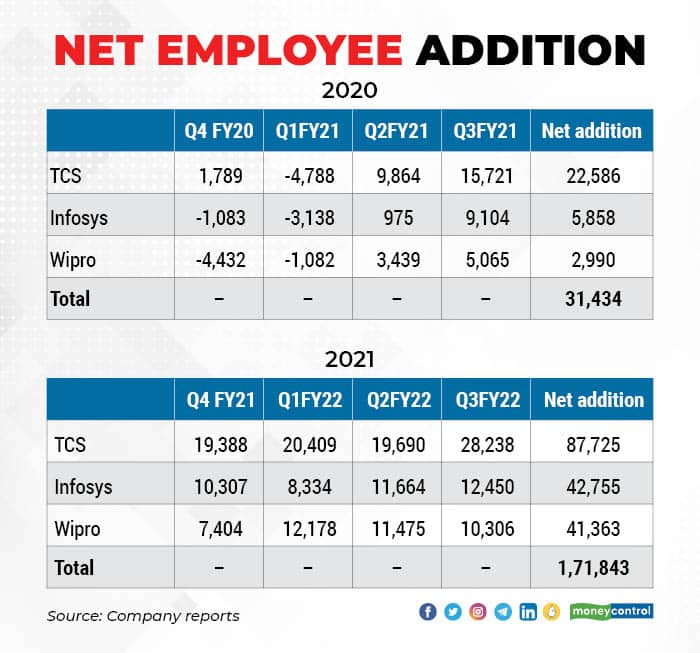

All this is resulting in increased hiring by the IT companies. Three IT companies -- TCS, Infosys and Wipro -- added a record 1.7 lakh employees for 2021, a multi-fold increase from the 31,000 they had hired in 2020.

In the December 2021 quarter alone, the three companies added 50,000 employees, and 1.34 lakh employees between April and December 2021. As demand continues to outstrip supply, and till the fresher workforce becomes productive, this hiring momentum will continue.

This probably explains the record fresher pipeline this year. At 17,500, Wipro’s fresher hiring is 70 percent more than what the company hired in FY21. Infosys will hire 55,000 freshers in FY22, and TCS has on-boarded a record 78,000 campus recruits so far.

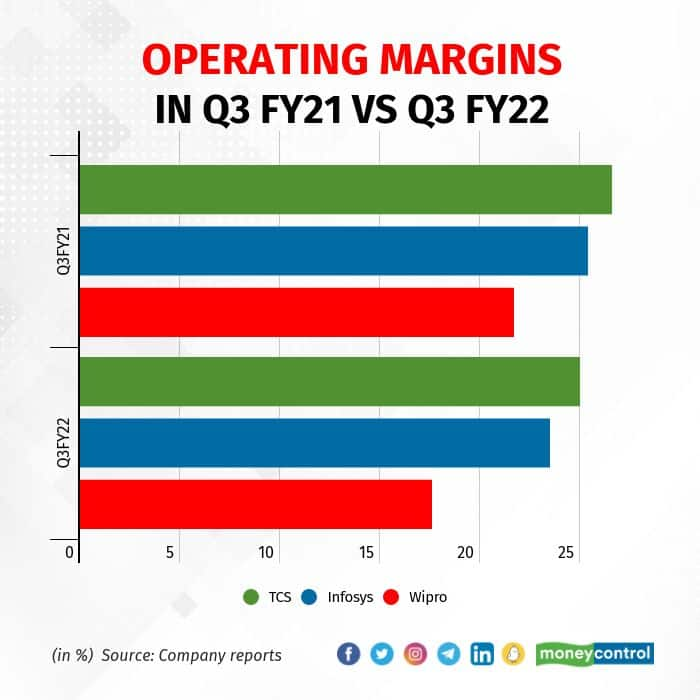

Margins

Operating margins for the IT majors have come down due to rising costs of hiring, subcontracting, and retaining employees. However, this should improve with better pricing for some of the short-term projects.

With the cost of talent with digital skills increasing, all the three IT majors indicated better pricing for projects. TCS in its commentary said that while it will retain the pricing for the long-term projects, it is seeing an uptick in pricing.

Salil Parekh, CEO, Infosys, said that while pricing remains stable for now, it is likely to change in the coming quarters.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.