The merger of country's largest private sector bank HDFC Bank, and mortgage lender, Housing Development Finance Corporation is expected to be completed by July 1, after receiving all the regulatory approvals.

The merged entity will be a behemoth in the Indian banking industry only second to the State Bank of India in terms of assets. Beyond the loan book, there are other key business metrics too that you need to look at for the merged entity.

Moneycontrol analysed other metrics such as deposit base, market capitalisation, and number of employees, among others.

Here are some numbers:Loan book

The loan book or advances of the merged entity is expected to increase by 38.77 percent to Rs 22.21 lakh crore. Prior to merger, these numbers were at Rs 16.00 lakh crore as on March 31, as per investor presentation of bank.

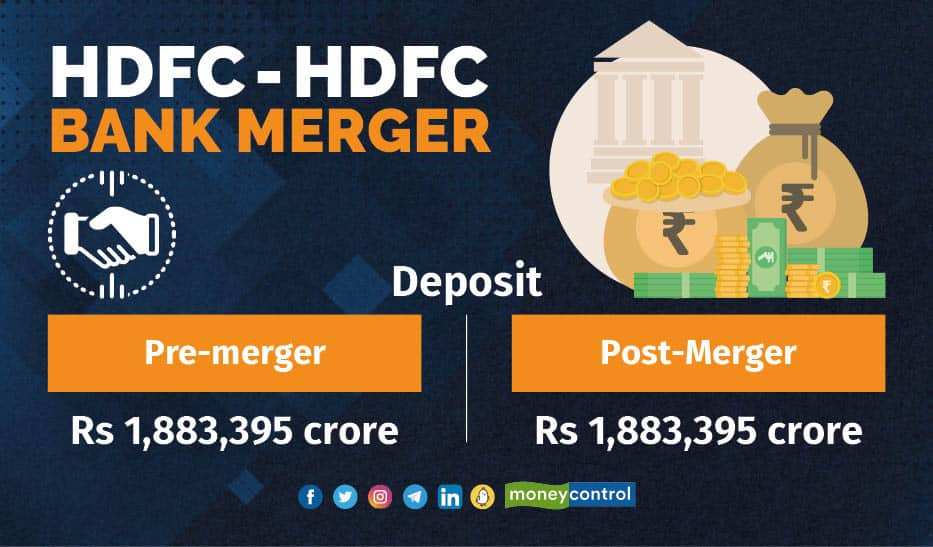

Deposit

The deposit of the bank will be at Rs 18.84 lakh crore after the merger with HDFC on July 1.

Also read: HDFC-HDFC Bank merger: How did the story unfold over time?

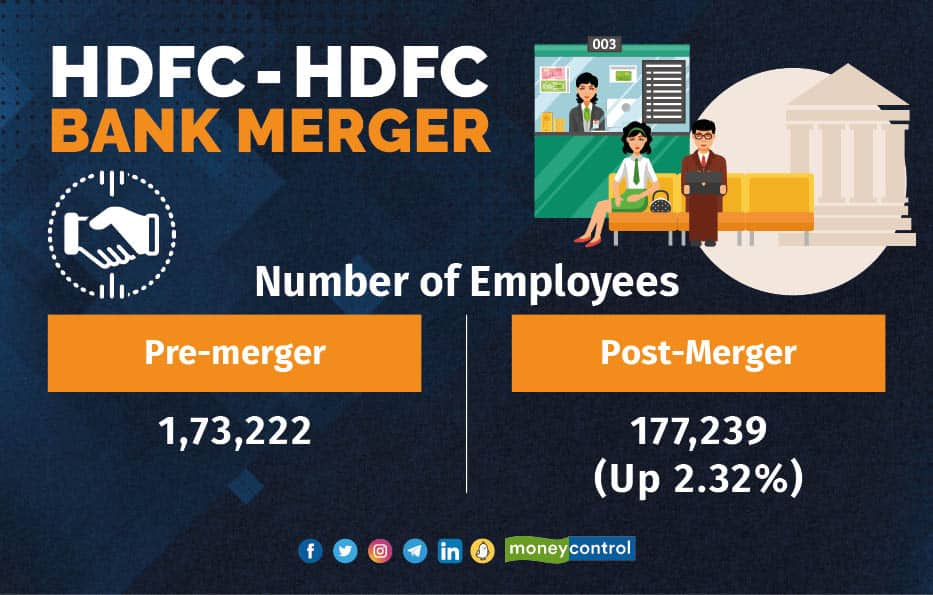

The employees of employees of the bank, which is large number will increase by marginally due to lower employee base of the HDFC. As per numbers, the number of employees of the bank after merger will increase by just 2.32 percent to 177,239. Prior to merger, it stood at 173,222.

Branches

In terms of branches, HDFC Bank have much higher branches than HDFC, hence, after the merger, the rise could be marginal. Analysis showed, number of branches of merged entity will rise by 6.7 percent to 8,344 branches.

Also read: HDFC twins to complete merger process by July 1, says Deepak Parekh

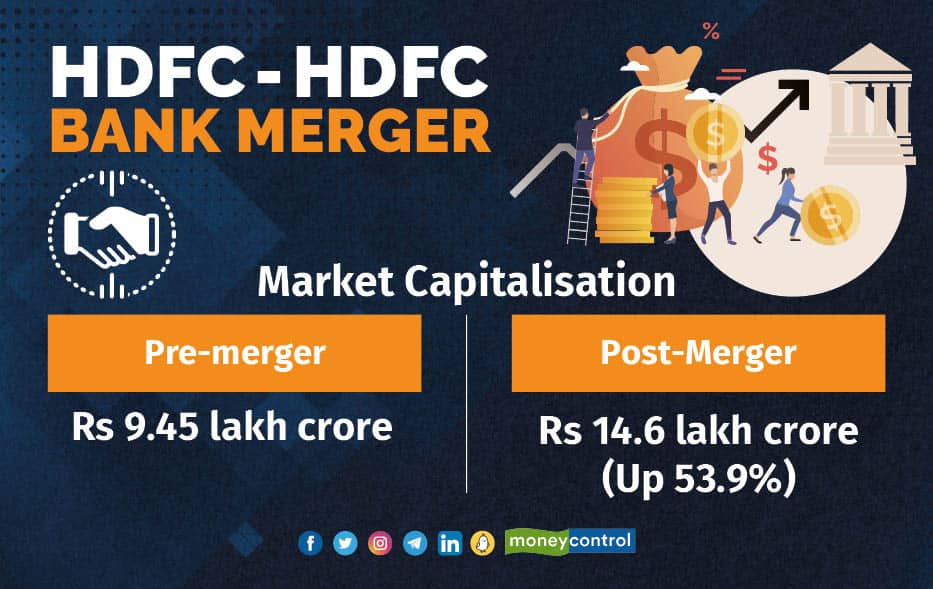

Market capitalisation

Both, HDFC Bank and HDFC have a significant market capitalisation. While, after the merger, market capitalisation could rise more than 50 percent and specifically 53.9 percent. The numbers showed that HDFC Bank’s market capitalisation will rise to Rs 14.6 lakh crore, from Rs 9.45 lakh crore prior to merger.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.