Gold reclaimed the $1,900 mark and edged closer to its record high of $1,920 touched in September 2011 amid renewed tension between the US and China and worries over the impact of the coronavirus pandemic on global growth.

Beijing on July 24 ordered the closure of the US consulate in Chengdu in reprisal to Washington’s decision to close the Chinese embassy in Houston, straining the already tense relationship.

US gold futures for August delivery gained $10.50 at $1,900.50 an ounce at 1436 GMT, having touched an intraday high of $1,904.60.

Spot gold in London jumped $15.31, or 0.81 percent, to $1,902.82, having hit an intraday high of $1,906.68.

The dollar index, measured against a basket of six currencies, slipped 0.27 percent to trade at 94.39.

Sunilkumar Katke, Head of Commodities and Currency at Axis Securities, sees the yellow metal trading firm in the short term at $1,950 an ounce on lower interest rates and devaluation in other asset classes due to the stimulus measures announced by many countries across the world.

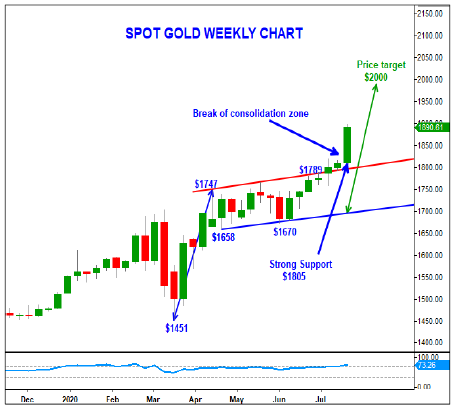

On the weekly technical chart, spot gold has broken out of the consolidation zone and is sustaining well above the breakout level, which indicates that the precious metal is likely to see further bullish momentum.

Prakash Prabhu, Technical Analyst, Motilal Oswal, sees gold targeting $2,000/oz levels. “On the lower side, $1,805 remains a strong short term support. The the bullish momentum is likely to remain intact as long as this support level is held. Immediate support for the metal is in the $1,860-1,865 range. So, traders can buy gold in the $1,860-1,865 range for a target of $2,000 level with a stop-loss below $1,805 level.

Fall in value of other asset class and global uncertainties have also helped gold climb record highs. The yellow metal is traditionally used as a hedge against inflation, and with global economies considering further stimulus to boost growth, it may only fuel inflation further.

The bullion metal has been one of the best-performing assets in 2020, gaining 25 percent in dollar terms and 4.5 percent for the week.

Also read: Gold surges above Rs 51,000/10 gm to record high, gains 4% for the week

The rise in the yellow metal price has been supported by the demand for physical gold and exchange traded funds (ETFs) from fund houses and large investors taking big positions.

For all commodities related news, click here

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.