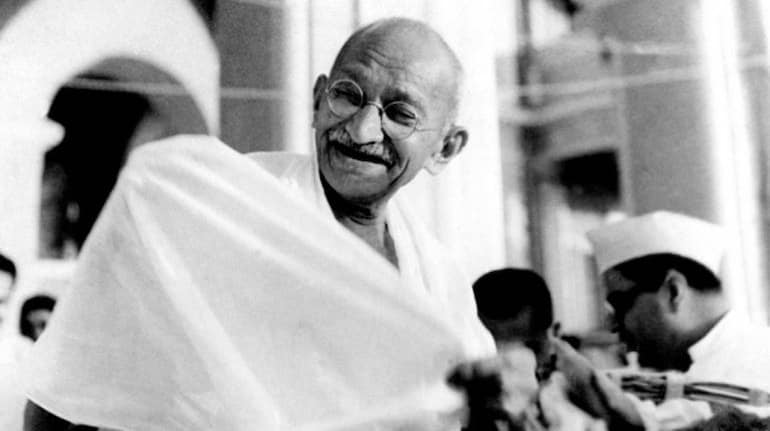

Well-known for his messages of truth and self-reliance, Mahatma Gandhi may also have some financial lessons to give for this day and age. Here are a few of Bapu's mantras to keep in mind before making financial decisions:

The future depends on what we do in the presentKeeping the independence dream alive through patience and persistence, Gandhi’s Salt Satyagraha (1930) played an instrumental part in India’s freedom struggle. The lesson is that long-term investments require some patience in the short term. Eventually, well-thought-out investments will bear fruits.

It is important to make steady and diversified moves. Since there is more to life than living on the fast-track, it is a good idea to keep definite financial goals, both short- and long-term.

The world is sufficient for man's need but not for man's greedHigh risk has to be taken to obtain high returns. However, impulsive investments and speculation can deplete your funds. You should consult a financial advisor and consider your own risk appetite before making a decision.

Dubious schemes that promise large returns, prey on greed. Opt for a trusted fund while balancing the risk-return ratio.

Whatever you do may seem insignificant to you, but it is most important that you do itPeople often postpone investment plans for later because the present consumption seems important. The other reason may be that the sum kept aside for investment seems inadequate.

However, whatever sum saved is significant. Steady investment of even Rs 1,000 can go a long way. Not only will this inculcate financial discipline but prepare a safety net for the future.

Strength does not come from physical capacity. It comes from an indomitable willIt is difficult to get through financial adversities and short term losses have to be borne to achieve the long-term goal of returns. Investment goals are not easy to follow but investors need to hold tight and stick around longer. Therefore, make a commitment and make practical decisions about which instruments you put your money into, despite everyday pressures.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.