Krishna Karwa Moneycontrol Research

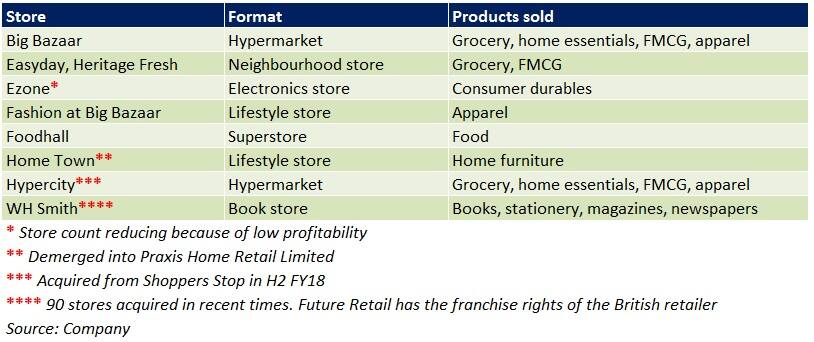

Future Retail is one of India’s largest retailers, offering grocery, fast moving consumer goods (FMCG), consumer durables, apparel and home furniture. The company has 1,035 outlets in 26 states across the country.

Network expansion through large and small-sized stores, increased presence of own brands across all product categories (fashion, food, general merchandise, FMCG), and improving efficiencies will be crucial to the company’s success in the coming fiscals.

Performance review

Some key restructuring measures undertaken by Future Retail over the past 12-15 months include buying Hypercity from Shoppers Stop, spinning off Home Town (the home furniture arm) into a separate entity--Praxis Home Retail, and acquiring Heritage Foods Retail.

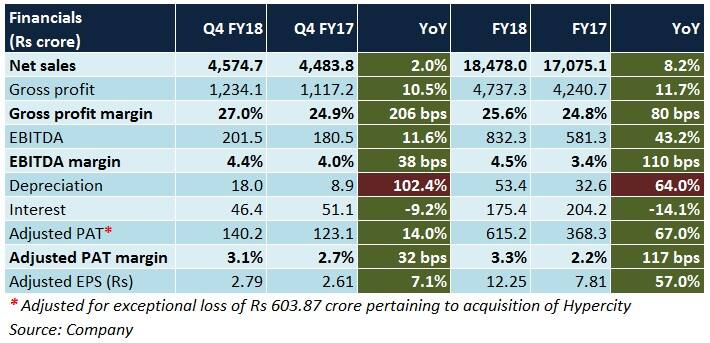

Future Retail’s FY18 performance improved remarkably. Sales growth was good despite a large base. This was primarily led by 188 store additions across all formats (including 19 Hypercity outlets) and Big Bazaar’s 13.4 percent same-store sales growth.

The uptick in margins was mainly attributable to reduction of less profitable electronic outlets (under E-zone) and a higher percentage of revenues (65 percent) from high-margin non-food products (such as fashion clothing, general merchandise, home care and personal care).

What lies ahead?

Convenience stores

Through economies of scale, Future Retail’s existing 666 small format stores (Easyday, Heritage Fresh) may achieve breakeven by FY19. The aim is to increase the count to 10,000 in next 7 years to facilitate last-mile connectivity and focus on private label brands. In FY19, adding 1000 outlets is on the agenda.

Big Bazaar

Sales per square feet at Big Bazaar stores grew 11.5 percent YoY in FY18. Future Retail plans to increase the number of outlets from 285 (as on 31st March, 2018) to 375 over the next 2-4 years.

Fashion at Big Bazaar (FBB)

Post-Goods and Services Tax, unorganised players in the clothing sector will no longer be able to offer a big price advantage to consumers. Buyers may, therefore, prefer purchases from organized clothing retailers like FBB. To make this brand more visible, Future Retail aims to increase its FBB outlets from 61 (at the end of FY18) to 300 in the foreseeable future.

Hypercity

By purchasing 100 percent stake in Hypercity Retail from Shoppers Stop in mid-FY18, Future Retail managed to integrate the former’s operations with its own Big Bazaar brand. Cost synergies through sourcing, distribution and operational efficiencies should aid margin growth.

Future Pay (FP)

Number of users on FP increased four-fold to 5 million at the end of FY18 as compared to FY17. Doubling of average spend per user and higher top-ups over the last 12 months, coupled with impetus towards loyalty programs, underscore the importance of technology in boosting revenue growth.

Some roadblocks

While the small format stores will add significantly to Future Retail's top-line growth, the scale of initial investments needed to establish clusters will be high. Stiff competition from local mom and pop stores and low share of margin-accretive private label (non-food) brands could be the key bottlenecks.

Extended end of season sale (EOSS) schemes, high promotional expenses, increased procurement costs (owing to outsourcing of garment manufacturing operations and steep fabric prices), and declining brand loyalty will be among the major challenges faced by the ‘Fashion Big Bazaar’ segment.

Blending a newly-acquired loss-making entity’s (ie Hypercity) processes with its own profitable unit (ie Big Bazaar) may impact Future Retail’s short-term margins. Moreover, it remains to be seen as to how the company’s envisaged plans of converging online and offline retail translate into better sales.

Should you invest?

Undoubtedly, Future Retail is at the forefront of retailing in India as far as aggressive network expansion strategies are concerned. With a retail footprint of 14.5 million square feet, the company already garners customer footfalls of over 340 million each year.

In spite of some impediments, the company’s emphasis on strengthening its core competencies, phasing out non-core businesses, achieving pan-India regional diversification, and upgrading technological infrastructure should bode well for it in the long-run.

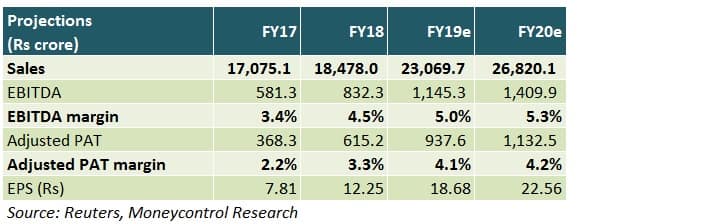

At 26 times FY20 estimated earnings, the stock clearly isn’t a ‘value buy’ in the current bearish market. Given the series of restructuring steps taken by Kishore Biyani lately, it may take a while for earnings to catch up with the valuation. Thus, investors with a long-term horizon may consider gradual accumulation.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.