Corporate bond fundraising surged to a 68-month high in December due to an increase in requirements for companies and banks amid stable yields on these instruments, dealers said.

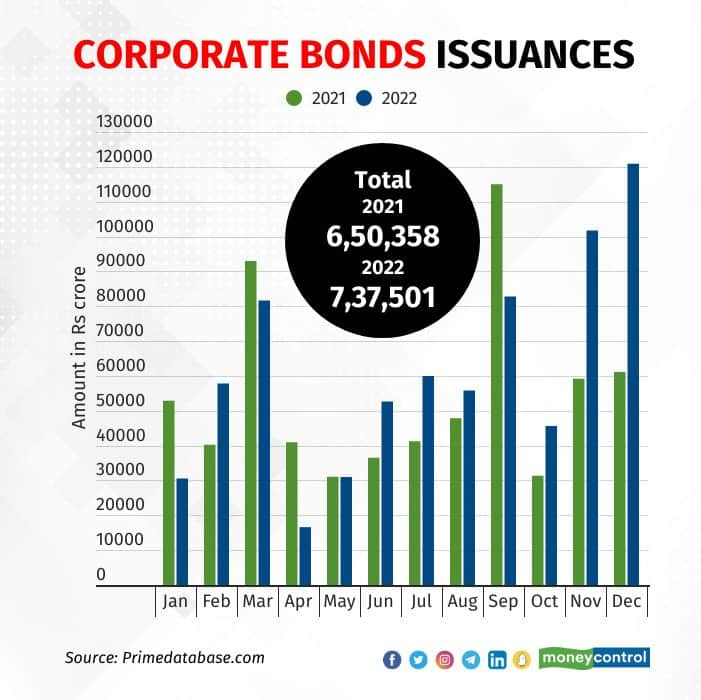

The amount raised from corporate bond issues rose to Rs 1.21 lakh crore in December from Rs 1.02 lakh crore in November, according to Prime Database. Fundraising in December increased by 18.8 percent month-on-month and 97.8 percent on-year.

“With interest rates increasing, bank loans are no longer going to be as cheap as they used to be,” said Vivek Iyer, partner, and leader, of financial services risk, at Grant Thornton Bharat, an assurance, tax, and advisory firm. “Refinancing through the issuance of corporate bonds is an effective way of financial risk management, which is what organisations are doing.”

Ankit Gupta, the founder of BondsIndia.com, said companies held back borrowing over the past three years because of the uncertain interest rate scenario. However, the Reserve Bank of India's stance now seems more at ease and has given companies an opportunity to borrow more money.

Dealers said the rise in issuances by banks through tier-I and tier-II bonds has also led to an increase in borrowings. Banks have borrowed aggressively due to an uptick in credit demand and to meet regulatory requirements.

“This has also been enabled by a lot of banks borrowing money via tier-I and tier-II bonds. December itself saw Rs 22,534 crore raised via tier-I and over Rs 22,700 crore raised via tier-II bonds,” Gupta added.

The fundraising in December was the highest since March 2017, when the borrowing was Rs 1.31 lakh crore, the data showed. The fundraising in 2022 was Rs 7.38 lakh crore, which is 13.4 percent higher than in 2021.

Housing Development Finance Corp, Small Industries Development Bank of India, National Bank for Agriculture and Rural Development, LIC Housing Finance, and Power Finance Corp. were the top five issuers in 2022, accounting for over 26 percent of the total amount raised in 2022.

Stable yields

Yields on corporate bonds remained stable in December, tracking the firm yields on government securities. This was because most negative factors had already been discounted by traders, the dealers said.

“Investors are of the perception that the high-interest rate period is over. So investors are keen on investing in the currently available bonds, keeping the yields mostly stable,” Gupta said.

Also read: Retail investors may stay cold to a private placement of bonds despite cut in lot size

Yields on corporate bonds moved in a 7-10 basis points (bps) range in December, with three-year and five-year bonds trading at 7.45-55 percent and 10-year bonds at 7.52-62 percent.

Government bond yields also remained range-bound in December in the absence of major triggers, except during the RBI’s monetary policy announcement, when yields rose marginally.

Currently, the yield on the 10-year benchmark 7.26 percent 2032 government bond is 7.3212 percent. Bond yields and prices move in opposite directions.

Also read: Year-ender: Better fundamentals likely to keep bond yields range-bound next year

Way ahead

Iyer said bond issuances will continue to increase and so will yields for the next 15 months, given the global slowdown amid uncertainty, unless the Russia-Ukraine war ends, which will change trajectories significantly.

Gupta said apart from the markets, wherein the yields seem somewhat stable, the regulatory environment is highly supportive of new investors. Yields are expected to remain stable going forward due to the expected increase in the investor base.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.