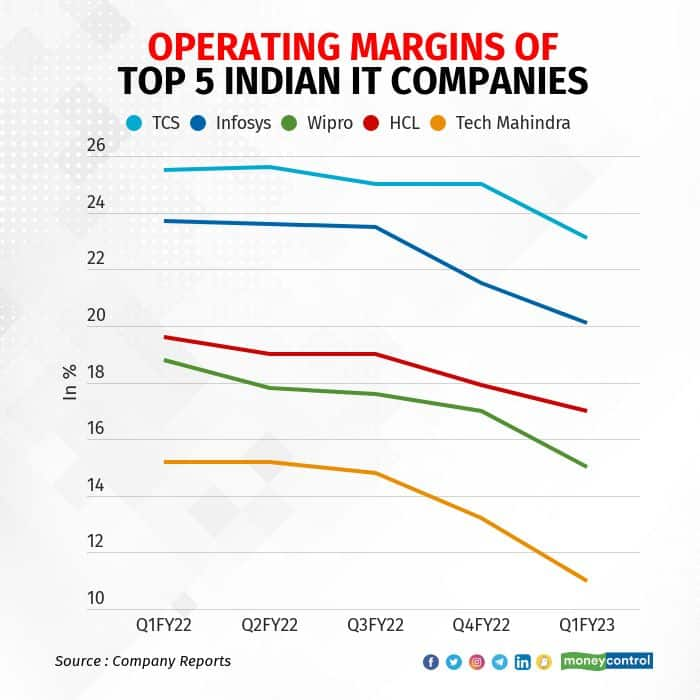

Top Indian information technology (IT) companies across the board reported lower operating profit margins in the first quarter of the financial year as factors including higher costs and fewer deal wins took their toll.

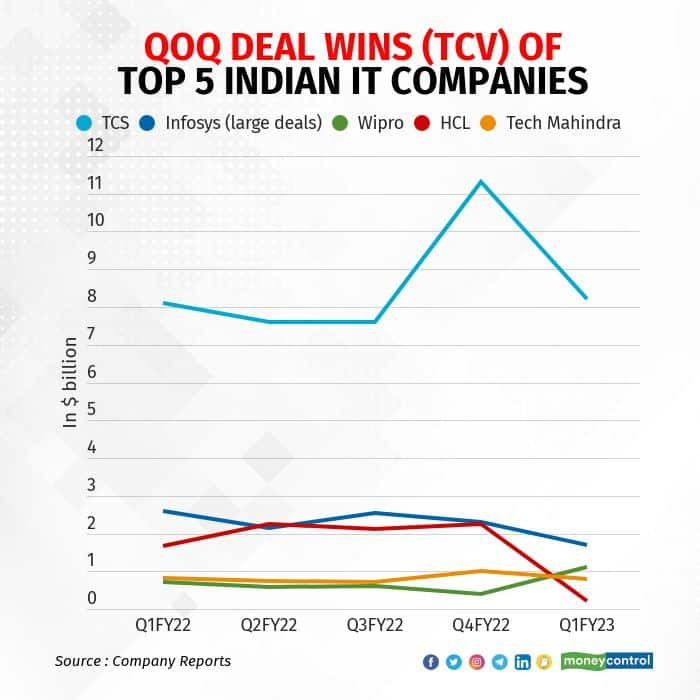

Tata Consultancy Services (TCS), Infosys, Wipro, HCL Technologies and Tech Mahindra reported a steady decline in operating margins and deal wins both on a sequential basis and year-on-year basis in the three months ended June 30.

All five companies missed their profit estimates as well in the first quarter. Profitability was hit as margins came under pressure on the back of supply side pressure, as IT companies gave wage hikes in the three months ended June even as they spent more on sub-contracting.

Analysts believe the IT sector will confront softer demand and higher overhead costs going ahead although company executives maintain a positive outlook, expecting a turnaround on a steady demand pipeline even as they keep a close watch on macro headwinds.

"Results were lacklustre across top IT companies. Deal wins were down, margins took a hit. The deal wins seem to be slowing down and we could be in for pain in FY 24. We expect the demand to fall further by December, consequently the commentary on growth will also be softer," an analyst tracking the sector said on condition of anonymity.

Cost-saving and margin-protecting measures such as off-shoring and controls on travel and operating costs are in reverse mode, said Amit Chandra, Deputy Vice President, HDFC Securities.

“In a scenario when you are heavy with cost and demand seems to be softening, your margins take a hit and you will take a while to adjust to the new cost structure,” Chandra told Moneycontrol.

In the second half of the year, Chandra sees topline growth normalising and margins starting to expand, and believes margins will bottom out either in Q1 or Q2.

Cost savings will accrue from replacing lateral hires who are leaving with freshers, he said.

As people with 3 to 5 years of experience leave, their work is either being subcontracted or they are being replaced by costlier hires, exerting double impact on company margins.

Employee costs

Samir Sekaria, Chief Financial Officer (CFO) at TCS, said on an earnings call that salary increases that kicked in from April 1 had a 1.5 percent impact on the operating margin.

“Continued supply-side challenges entailed additional expenses, such as backfilling expenses and higher subcontractor usage. This and normalizing travel expenses negated various operational efficiencies, resulting in an operating margin of 23.1 percent, a sequential contraction of 1.9 percent,” Sekaria explained.

He added that the Q1 margin was subdued, and the company was looking at “clawing it back.” The company’s aim is for a margin in excess of 25 percent.

TCS Chief Executive Officer (CEO) Rajesh Gopinathan said the demand environment and workforce attrition was leading to increased operating costs.

“Attrition is not totally unanticipated but it is continuing and we think that probably it will take another few more months before it will start to come down. So, till then the margin pressures will continue but we hope to sequentially improve from where we are,” he added.

Attrition, salary hikes

Infosys CEO Nilanjan Roy said the industry doesn’t operate in a vacuum, and attrition trends were similar across the industry, and that the levels had started to come down. The company’s salary hikes for senior employees, which will happen in July, will impact margins a little, but not at the level in Q1, he said.

Demand dipped in Q1 because of seasonality factors, but supply-side pressures continued, resulting in cost of talent acquisition and transition, HCL Technologies CFO Prateek Aggarwal said.

Aggarwal said higher travel, visa and outsourcing costs, and employee retention and attrition costs had dented margins. HCL’s margin during Q1 was 17%, having declined over the last five quarters. The company maintained its margin guidance of 18-20%.

“Bill rate enhancements, successes in pockets are expected to pick up steam in the next few quarters and cost initiatives in terms of fresher billing and pyramid optimization as well as utilization improvement, offshoring of work, automation initiatives, and optimizing the outsource spend, subcontractor costs are the levers that we are banking on to get back into the guided range on margins,” Aggarwal said.

Wipro CEO Thierry Delaporte said during an analyst call that he believes the operating margin had bottomed out, and blamed the lower Q1 margin on investments.

CFO Jatin Dalal said the company was using the pyramid model, which involves having more employees with less experience at the bottom, which will help keep costs low, and fewer employees higher up, to improve margins.

“That is the only lever which can reduce the cost pressure that we have seen in the last 18 months,” he said, adding that attrition moderating should help as the company had been paying new employees a premium to replace those with similar capabilities and experience.

Tech Mahindra CFO Rohit Anand said the Earnings Before Interest and Tax (EBIT) margin in the first quarter had fallen 220 basis points on a sequential basis to 11% because of factors including higher salaries, deal transition costs and seasonality.

Is deal pipeline drying up?

“Margins have bottomed out but growth numbers are still to moderate, I think the bigger risk is to the growth number,” said Chandra of HDFC Securities.

Girish Pai, Head of Research at Nirmal Bang Institutional Equities, told Moneycontrol, “On deal wins, it seems to kind of be cooling off and seems to indicate probably that there is a demand issue developing. When you discuss issues regarding this with the management, they generally say that as of now, things are okay. HCL Tech made an interesting comment that the demand situation is looking better than what it did three months back.”

Pai said his team was the first to downgrade the IT sector even before the fourth quarter results in early April 2022. “We had said that FY23 margin is going to be a problem, and demand is going to be a problem in FY24,” he said.

Analysts noticed that the latest commentary by IT companies on demand had become muted to what they were saying three months back.

“The way I see this sector play out is there's a lot of time-wise correction. There's been one price correction and we keep reacting to the news flow coming from the US. So, my take is that the US news flow will incrementally deteriorate as we go towards the end of 2022. It'll probably weaken substantially in the first half of 2023,” Pai explained.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.