While a slew of companies are dealing with the coronavirus outbreak and the subsequent impact on sales, India’s largest insurer Life Insurance Corporation of India (LIC) said that it was well in line to meet its annual policy sale targets.

LIC said that it had sold 21.42 million policies as of March 17, 2020 as against 21.40 million sold in FY19.

“We are confident of crossing the target of 25 million policies well before March 31,” said LIC in a statement.

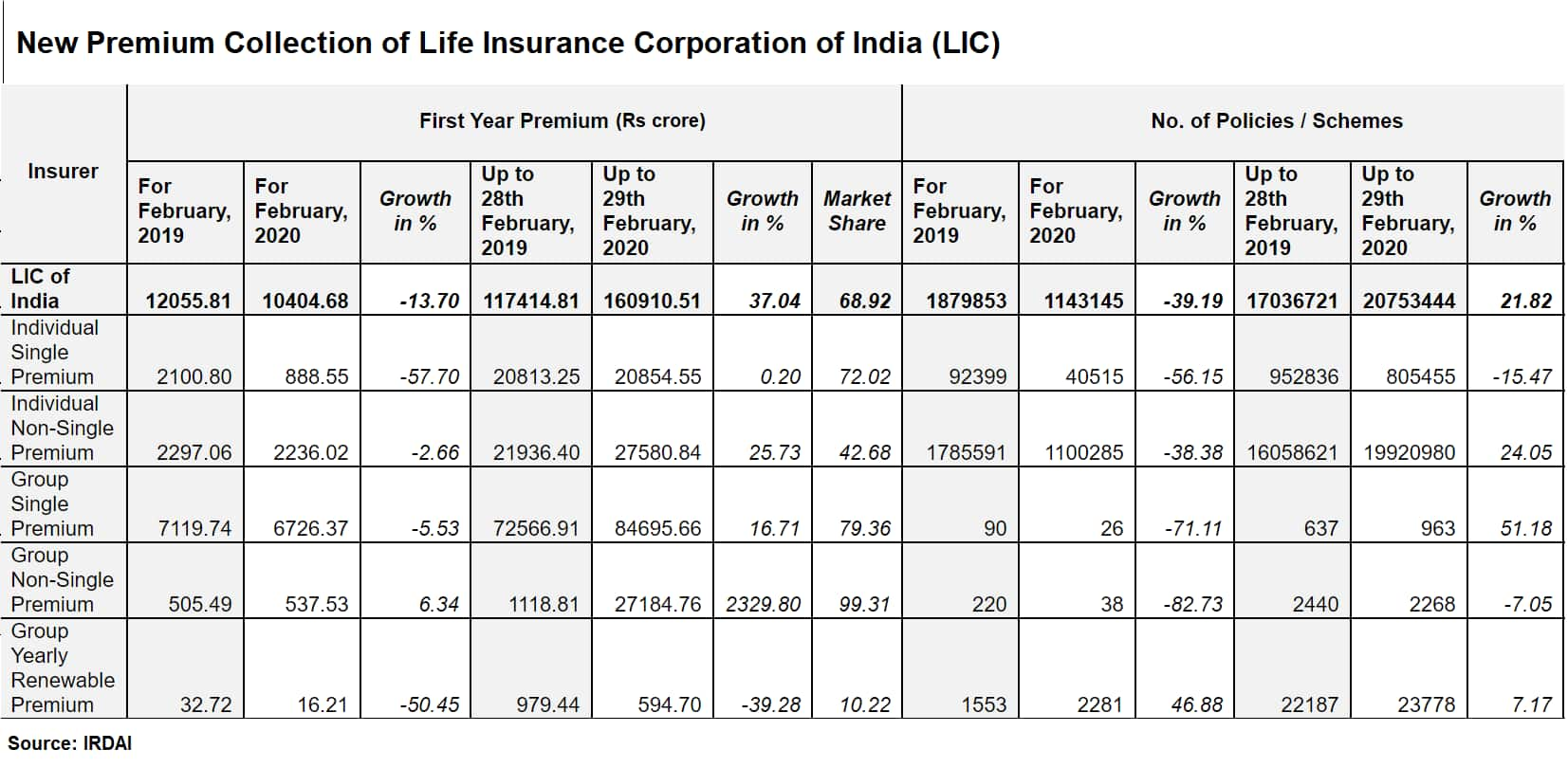

However, it is to be noted that monthly business data showed that LIC had a 13.7 percent decline in new premium collection in February 2020 (compared to February 2019) to Rs 10,4040.7 crore. This was due to a 39.2 percent drop in the number of policies/schemes sold.

Industry experts say that the numbers could be down because of companies cutting down on group insurance.

Private life insurers, saw a 32 percent year-on-year (YoY) growth in February 2020 to Rs 8,128.5 crore even though policy sales dipped by 3.7 percent in the same period. This could be because of the higher ticket-size policies being sold.

But, for the April 2019 to February 2020 period, LIC saw a 37 percent YoY increase in its new premium collection to Rs 1.6 lakh crore. Private insurers saw a 27.4 percent YoY rise in new premiums to Rs 72,576.7 crore.

LIC saw a 21.8 percent YoY increase in new premium collection for 11 months of FY20. The last quarter is the most crucial for life insurance companies because this is when there is a rise in policy sales due to salaried individuals buying policies for tax-saving purposes.

The COVID-19 outbreak has led to the shutdown of gyms, schools, colleges and malls across the country in a bid to minimise the spread of infection. Both the central and state governments have advised individuals to largely work-from-home and avoid non-essential travel.

At this juncture, purchase of new policies as well as renewal premium could get impacted. While insurance is sold online, it is less than 15 percent of the total Rs 2.3 lakh crore new business premium collected by insurers.

Insurance purchase involves either an agent visiting the home for documentation and payment collection or individuals visiting insurance/bank branches to buy a policy/pay premium.

For LIC, while February 2020 was a slow month, March seems to have been better. The insurer has not shared premium collection data for March 2020.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.