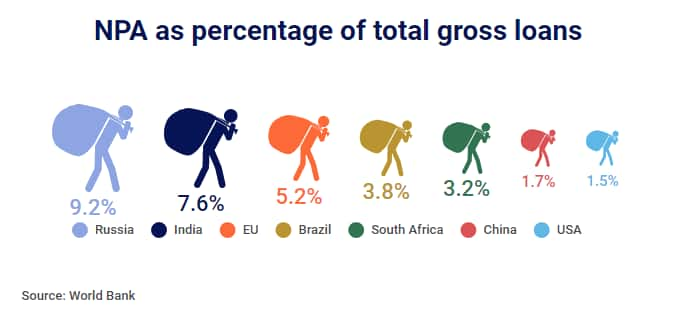

RBI’s decision to identify 12 bad loan accounts for bankruptcy proceedings drew applause from the stock market last month. Shares of PSU banks surged as the government was seen to be moving from ‘recognition’ to ‘resolution’ of the non-performing asset (NPA) problem weighing on the sector as well as the economy.

But, as this week’s developments show, banks may still have to jump through legal hoops as they can hope to recover whatever is left of their money.

And that raises questions on the speed and success of bad loan resolutions with the new legal reforms in the form of insolvency and bankruptcy code (IBC).

On July 5, Essar Steel Ltd moved Gujarat High Court to challenge the RBI’s directive to banks to initiate bankruptcy proceedings against it, as arbitrary.

Essar Steel, with a debt of over Rs 37,300 crore, is one of the 12 companies identified by RBI last month to be immediately referred to National Company Law Tribunal (NCLT). NCLT is a quasi-judicial body to adjudicate matters relating to companies in stress in India

Apart from Essar Steel, the 12 accounts with an exposure of over Rs 5,000 crore include Bhushan Steel, Bhushan Power and Steel, Lanco Infratech, Monnet Ispat and Energy, Alok Industries, Amtek Auto, Electrosteel Steels, and Jyoti Structures.

Lawyers and bankers expect more companies to challenge the RBI move on constitutional grounds of “principle of natural justice” denied to them, which may stall the resolution process.

"RBI may have to give an explanation on criteria to select the 12 accounts," said a senior lawyer, who spoke to Moneycontrol.

"Companies also fear that losing management control while at NCLT may impact their business even more and reduce their valuations," he added.

The Gujarat HC has stayed further proceedings by the NCLT against Essar Steel and the matter will be heard on July 7.

Previously, another company Falcon Tyres had also contested the NCLT proceedings in the Karnataka High Court on different grounds, to which the lenders moved to the Supreme Court, which termed the NCLT timelines as "sacrosanct" and dismissed the stay.

New set of laws and reforms

In May 2016, the government amended the Banking Regulation Act, the DRT or Debt Recovery Tribunal, Sarfaesi Act and passed IBC, empowering RBI to direct banks on bad loans with an aim to improve efficiency and build a robust recovery and resolution mechanism.

With this, the government and Reserve Bank of India had set the ball rolling to fast track the NPA resolution in the banking system saddled with NPAs of around Rs 9.6 lakh crore.

Banks were empowered to take legal action in case of a corporate default without being accused of favouritism and corruption by investigating agencies and subsequent prosecution by the courts during the bankers’ term in office or after their retirement.

Insolvency untried and untested in India

Bankers and experts are cautiously optimistic on the implementation given the infrastructure challenges such as the number of insolvency professionals, their expertise, technical delays by the borrowers, tight deadline of nine months and provision requirement leading to capital challenges for banks among other hurdles.

"Yes, this will bring all bankers on one table and those not willing to go with majority have the option to walk out. But we have had many such reforms earlier, so need to wait on how it gets implemented," said a senior HDFC Bank executive.

"Borrowers could still take advantage of technical gaps and may see legal delays while the infrastructure in the courts, the number of insolvency professionals and their competency will evolve as more cases are tried," the executive said.

Under the IBC, banks have to sort out issues in a time-bound manner of 180 days extendable up to 270 days.

During the 6-9 months, a new class of insolvency resolution professional would take control of the management of the distressed firm or debtor and come out with a resolution plan along with the creditors’ committee. The plan will also be vetted and supervised by a five-member overseeing committee. If the resolution process fails to meet the deadline, the company will be driven to liquidation of its assets.

Nirmal Gangwal, founder of turnaround company Brescon Corporate Advisors says, “Cases with large liability and asset mismatches will mostly be referred under the IBC. If it goes for liquidation, it is a lose-all game but if it finds a resolution, it will be win-win for both banks and corporates. This is a beginning and the law will emerge gradually as cases see a finite decision.”

In the process, the biggest advantage is that bankers will be able to take some hard decisions to take a required hit on the already decayed asset but recover the still sustainable and recoverable part of the public money given as loans. This is better than to postpone the recognition of the NPA. Apart from more authority to banks, a lot of approvals are eliminated and there is immediate action to declare an asset a failure while it is still able to generate some value.

Kalpesh Mehta, a partner at Deloitte says, “Earlier, such legal actions were used only in extreme situations when the asset value is eroded and stripped off its value and the situation is near insolvency or liquidation stage and the loan is hardly recovered.”

Now, if a project is viable, government will allow to take the legal action so that the project can see some revival and turnaround its value maintaining its viability and prevent liquidation.

Banking experts continue to raise concerns on the difficulties involved in trying to price the assets that are half-completed or held up due to pending government approvals.

Many buyers are willing to participate and a consensus on pricing can be drawn now with a neutral expert in the form of insolvency professional getting involved. Whether it would be successful or not, Mehta says that any law when introduced for the first time, does not have any precedent and could have teething problems.

But this is very similar to what has been tested in Europe and the US (Chapter 11) which ring-fences bankers while promoters may have a lot at stake if the asset goes for liquidation.

IBC’s challenges

“Nothing has changed (with the IBC),” KC Chakrabarty former deputy governor of RBI told Moneycontrol. According to Chakrabarty, the quantum of stressed assets in the banking system could be as high as Rs 20 lakh crore

“We have allowed corporates to borrow money and treat that as equity.

Companies have joint structures today and each corporate today has 300 independent unlisted structures; no one knows what is the total leverage (sic),” he says.

Rating agency Moody’s Investors service said the effectiveness under the IBC will be limited because once a resolution is initiated, control of the company shifts from existing management to insolvency professionals, though the management team in some cases will continue to play a role in preserving day-to-day operations.

Failure of old mechanisms

MS Sahoo, chairman of the insolvency and bankruptcy board of India (IBBI), says “There are 70,000 matters pending before the DRTs… Assuming one fourth of these cases will move to NCLT, 15,000 will move to the tribunal on Day 1. Whether NCLT has that kind of capacity is the question.”

Post-1991, multiple agencies and schemes have been devised to tackle the burgeoning NPAs. Initially, DRTs and the SARFAESI Act (Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest).

However, both have failed to recover big loans due to inadequate infrastructure and legal framework aiding delays.

As on October 25, there are 95,537 cases pending in 32 DRTs, including the cases carried over from last year and new ones added this year. Only 9,918 were disposed of this year, of the total 105,455 cases. The amount involved in these cases is over Rs 4 lakh crore.

A former State Bank of India (SBI) managing director called DRTs a quagmire and said it was a pain to talk to the DRT officials. “There is no adequate staff at the DRTs, nearly half of the judges’ seats are vacant. Those who are occupying seats have no incentive for them to take decisions.

Banks are restricted in their legal expenses while borrowers take advantage of this situation and splurge cash to delay the decision making benefiting from legal loopholes.”

For instance in March last year, SBI Chairman Arundhati Bhattacharya said its relentless pursuit for recovery of nearly Rs 7,000 crore worth loans owed by Kingfisher Airlines from liquor baron Vijay Mallya, has been stymied by the legal process with the bank having to face 180 adjournments and 500 hearings across courts and tribunals.

The consortium of 17 lenders were facing over 20 cases related to the now defunct airline’s dues totaling worth over Rs 9,000 crore including loans, interest, service tax and other dues. The banks have also seen five failed auctions in its attempt to sell the Kingfisher House while Mallya’s Kingfisher Villa in Goa was sold in April this year in a bilateral deal after three failed auctions.

Similarly, former Congress MP’s sons T Venkattram Reddy and T Vinayak Ravi Reddy, promoters of media firm Deccan Chronicle Holdings Ltd., which has defaulted on over Rs 4,000 crore worth loans to 18 lenders, have stalled possession of their mortgaged properties by banks. The Reddy brothers are charged in bank fraud cases and despite attaching some of those properties, banks are yet to take possession while the Enforcement Directorate is taking some steps ahead.

DRTs were constituted to protect the NPAs from banks but they have become the first line of defence for the borrowers. Instead of expediting the recovery process, they started delaying the process aided by borrowers’ interventions through courts.

Later, CDR (corporate debt restructuring), CRILC (Central Repository of Information on Large Credits), JLF (Joint Lenders’ Forum), 5/25 scheme, asset sale to ARCs (asset reconstruction companies), SDR (strategic debt restructuring) and S4A (scheme for sustainable structuring of stressed assets) were also weaklings in their own way while catering to large influential corporates.

Starved of capital, ARCs have hardly been able to make any successful efforts to turnaround most bad loans bought from banks.

Largely the other mechanisms also either extended more time for borrowers or were fed with more money as refinancing and promoters didn’t have much skin in the game and kept buying more time to retain their control.

Prevention better than cure

TM Bhasin, former Indian Bank Chairman and currently one of the two vigilance commissioners in the CVC, said, “Bankers need to learn recovery before lending. They must know when and whom not to lend. There is a skill gap and orientation with regards to recovery and legal aspects that need to be strengthened for bankers.”

He adds that bankers have to learn to say ‘no’ to unbankable loans. Bhasin claims he was the only banker to recover the Rs 100 crore loan amount from Kingfisher Airlines and refused to lend any further as Indian Bank’s chief.

Though the government has been actively talking about the clean up of NPAs and efficacy of steps towards merger of banks to help weaker banks, given that public sector banks account for 80 percent of the bank advances and NPAs, it is important that government plays a proactive role as owners to clean the mess without impacting the economy.

More importantly, government needs to show a greater sense of fiscal responsibility and eschew populist decisions that adversely impact bank balance sheets.

RBI has said it will take more steps and within the next year or two aim to grapple with the problem in full capacity.

It remains to be seen if, in Acharya’s words from a speech this year, banks will remain something that "one can bank upon".

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.