India’s economy emerged from the deadly second wave of the COVID-19 pandemic in better shape than predicted by experts and economists within and outside the government.

This has been attributed to the fact that the central, state, and local administrations have learnt to manage lockdowns and containment zones better over the past year. Factories and workplaces continued functioning and inter-state trade did not come to a halt, unlike the nationwide lockdown last year.

Still, there was an impact. Now, the government is cautiously optimistic that with the exception of sectors like tourism and hospitality, the worst is over for most sectors. Moneycontrol assesses some high-frequency data, which the government also tracks, to gauge the strength of the economic recovery.

Economic Growth - GDP

Gross Domestic Product (GDP) at constant prices

Gross Domestic Product (GDP) at constant pricesReal GDP rose 20.1 percent in the first quarter (April-June) of 2021-22, official data released on August 31 showed a record on the back of a low base a year earlier. GDP had contracted by 24.4 percent in the April-June quarter a year ago, when a nationwide lockdown was imposed to curb the spread of the coronavirus. It was the steepest quarterly economic contraction in independent India’s history.

In absolute terms, both real GDP and Gross Value Added for April-June 2021-22 came in lower than in the previous three quarters. The finance ministry is of the view that this is the bottom for this year at least, and while in percentage terms the current and the coming quarters will not match Q1 numbers, they will be higher in absolute terms.

Indirect tax revenue - GST

Monthly GST collection

Monthly GST collectionStory continues below Advertisement

GST collections had stayed consistently above the Rs 1 lakh crore mark from October 2020 to May 2021. However, it slipped to Rs 92,849 crore in June, reflecting the economic disruption caused by the second wave. In April, GST collections were the highest on record, at Rs 1.41 lakh crore. For the rest of the year, officials comfortably expect gross collections to be above the Rs 1 lakh crore mark.

Manufacturing activity - PMI

PMI Manufacturing in past 12 months

PMI Manufacturing in past 12 monthsThe IHS Markit India Manufacturing PMI (Purchasing Managers Index) saw a steady rise throughout 2020, with growth in manufacturing hitting a speed breaker in March 2021. The seven-month low of 55.4 recorded that month was the beginning of a volatile year for PMI, which has not seen two successive months of incremental growth since even as cost inflation has risen for 13 straight months.

A PMI above 50 means expansion, while a score below that denotes contraction. However, PMI is a month-over-month indicator and does not show the change over the previous year.

While there has been only one instance of contraction since then, data for August showed the manufacturing sector was losing steam again. New orders – both domestic and exports –

continued to expand but at a slower pace.

This was blamed on the lingering presence of the pandemic in pockets of the country and the imposition of subsequent curbs by state governments, according to IHS Markit. Worryingly, while the number of new jobs in the sector grew after a period of 16 months in July, manufacturers again reported a hiring freeze in August.

Digital payments - UPI

UPI transactions in past 12 months

UPI transactions in past 12 monthsUnified payments interface (UPI) usage jumped 2.3 times to end FY21 at Rs 5.04 lakh crore, according to data from the National Payments Corporation of India. This came as Indians relied more on digital payments after months of lockdown.

However, there were two blips in this growth rate – in February, when the second wave began, and in April, when it reached a peak. However, from June onwards, UPI transactions have seen an unprecedented jump.

As of August, there were 3.5 billion individual transactions, up from 2.6 billion transactions in April. Surveys by financial payment companies showed that reliance on technology for both daily and high-value transactions increased exponentially during this period. On the other hand, transaction volumes have seen a similar explosion, leading industry experts to suggest that the uptake of digital payments has occurred more at the grassroots level than before.

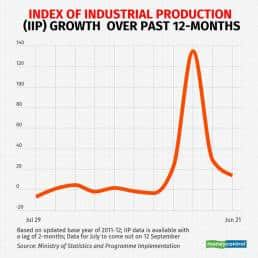

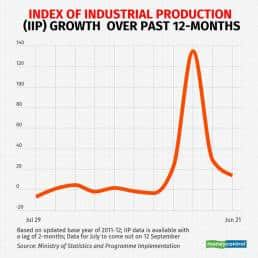

Industrial Production - IIP

Index of Industrial Production

Index of Industrial ProductionThe country’s industrial output, as measured by the Index of Industrial Production, has seen major growth since March 2021 due to the low base effect. After a difficult year marred by nationwide and regional lockdowns, headline IIP numbers have boomed since FY22 began as factories increased operational capacity to cater to exploding demand.

However, experts said the indices for the current months in 2021 are not strictly comparable with the same months of 2020, when the nationwide lockdown was in full force and a majority of factories were shut. With this base effect set to end soon and with a clearer picture emerging, the figures for June have shown that domestic demand,

one of the main drivers of economic growth, has been recovering but slowly.Of the 23 sub-sectors within manufacturing, only six posted year-on-year contraction. Again, due to the low base effect, the crucial capital goods segment, which denotes investment in industry, rose by 25.7 percent in June compared with 78.2 percent in May. All eyes are on the July figures to see if industrial production has reached pre-pandemic levels.

Residential Segment - Housing sales

Housing sales

Housing salesThe residential market in India has risen steadily in terms of both sales and launches in 2021. As many as 99,416 units were sold during the first two quarters of 2021, which is a 67 percent increase from levels in the same two quarters last year, a report by Knight Frank India said.

The number of units launches was recorded at 154,534. Mumbai and Pune led the table in both launches as well as sales due to discounts in stamp duty charges, Knight Frank India said.

Quarterly sales volumes have steadily improved since Q2 of 2020 and surpassed the 2019 pre-COVID quarterly sales average in Q1 and Q2 of 2021.

Considering that April-June is the third consecutive quarter to cross the 2019 quarterly sales average, the domestic market is recovering well.

The increasing sales volumes have also arrested the intensity of the YoY fall in residential prices of most markets. The incidence of developers giving indirect discounts/freebies has been a key factor in spurring sales in 2020, but this has been observed to have reduced significantly in Q1 and Q2 of 2021.

Automobile Sales

Vehicle Sales

Vehicle SalesAutomobile sales in India have risen steadily for the past 12 months, albeit on a low base of 2020. While domestic sales have climbed, they are still lower than pre-Covid-19 levels.

However, the latest numbers suggest that the Indian automotive industry is

gradually getting out of Covid-induced lockdown challenges. In anticipation of the festive season, dealers are getting robust enquiries and order bookings across segments. Consumer sentiment is positive and demand for new vehicles strong.

Gross Domestic Product (GDP) at constant prices

Gross Domestic Product (GDP) at constant prices Monthly GST collection

Monthly GST collection PMI Manufacturing in past 12 months

PMI Manufacturing in past 12 months UPI transactions in past 12 months

UPI transactions in past 12 months Index of Industrial Production

Index of Industrial Production Housing sales

Housing sales Vehicle Sales

Vehicle Sales