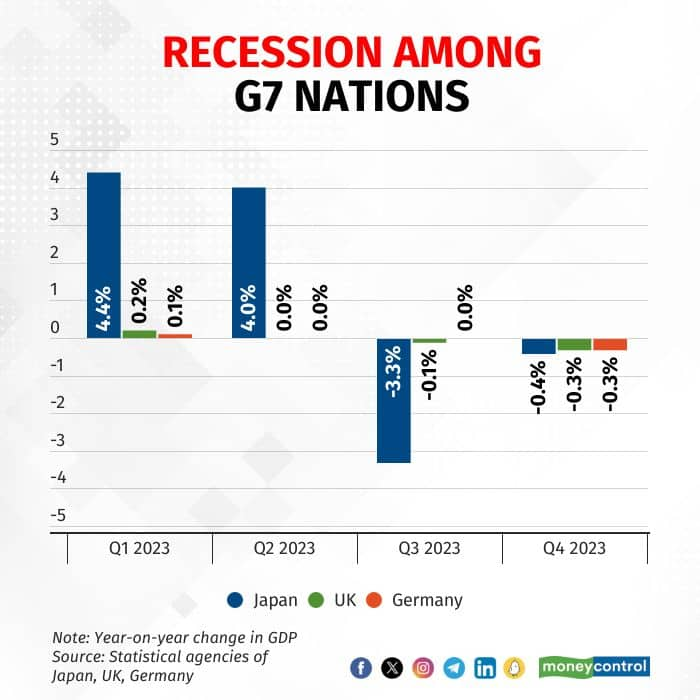

Last week, data from Asia and Europe showed the Japanese and UK economies had slipped into a recession. While this was unexpected for Japan, it was a particularly unpleasant development for the UK with national elections likely to be held in 2024. A third member of the G7, Germany, could also follow Japan and the UK, with the Bundesbank saying on February 19 that the economy was not recovering. But what exactly is a recession?

A technical recessionWhat is commonly known as a recession is defined as two consecutive quarters of year-on-year (YoY) contraction in a country's Gross Domestic Product (GDP). As such, both Japan and the UK have seen their GDP shrink on a YoY basis in July-September 2023 and October-December 2023. The GDP of Germany, meanwhile, contracted by 0.3 percent in the last quarter of 2023 and is expected to shrink again in the first quarter of 2024, according to the German central bank.

This definition of recession is widely called a 'technical recession' and is used most often in the media. Using this definition, India too was in a recession in the first half of 2020-21, when the GDP contracted by 23.4 percent in April-June 2020 and by 5.7 percent in July-September 2020 as the economy ground to a halt due to the nationwide lockdown enforced to stop the spread of the coronavirus.

Is a technical recession truly a recession?To be sure, two consecutive quarters of contraction in GDP is only a thumb rule. In theory, a recession is far more difficult to identify.

The National Bureau of Economic Research (NBER) of the US defines a recession as "a significant decline in economic activity spread across the economy, lasting more than a few months". According to the NBER – which is identifies periods of recession in the US – a more nuanced assessment of economic conditions is required when making such pronouncements and its Business Cycle Dating Committee makes this assessment. Past members of this committee include former Federal Reserve Chair Ben Bernanke.

"There is no fixed rule about what measures contribute information to the process or how they are weighted in our decisions. In recent decades, the two measures we have put the most weight on are real personal income less transfers and non-farm payroll employment," the NBER says.

So, are developed countries entering a recession or not?It really is a matter of definition. With no fixed, official way to say what a recession is, the technical definition of two consecutive quarters of contraction is used most commonly.

Source: National Bureau of Economic Research

Source: National Bureau of Economic ResearchIt is worth mentioning that, given the numerous data points the NBER looks at before deciding whether the US is in recession or not, most of the recessions it identifies end up seeing two consecutive quarters of contraction in GDP. However, there are instances of periods it has termed recessionary that don't comply with this thumb rule.

According to economists, the current shrinking of GDP in the UK, for instance, may be short-lived.

"We think the UK economy is likely to turn a corner in 2024," ANZ Research said in a note on February 21.

"The largest contributors to the fall in household consumption in the second half of last year were lower spending on recreation and culture, miscellaneous goods and services, and transport. These are relatively elastic components of consumption that can rebound as real incomes recover and grow," they added.

Should India be worried?With India posting higher-than-expected growth rates and sporting the tag of the fastest-growing large economy in the world, a recession is not at all a concern. As mentioned above, it took a once-in-a-century pandemic to drag down India's growth rate below zero in two consecutive quarters in 2020.

Also Read: Indian economy continues to sustain momentum of first half of FY24, says RBI Bulletin

However, India is not insulated from the rest of the world, and a slowdown in growth abroad can impact domestic economic activity through trade channels.

The Indian government recognises this fact. So, the finance ministry's Monthly Economic Review report for January, released on February 20, said it is "urgent and important" to make India's exports more competitive and attractive in the face of persisting global uncertainties, referring to the disruptions caused by the ongoing Red Sea crisis.

According to the Reserve Bank of India (RBI), about 48.7 percent of India's merchandise exports and 30.4 percent of imports are exposed to the Red Sea route.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.