As far as the September earnings season goes, Bandhan Bank is turning out to be a story of extremes.

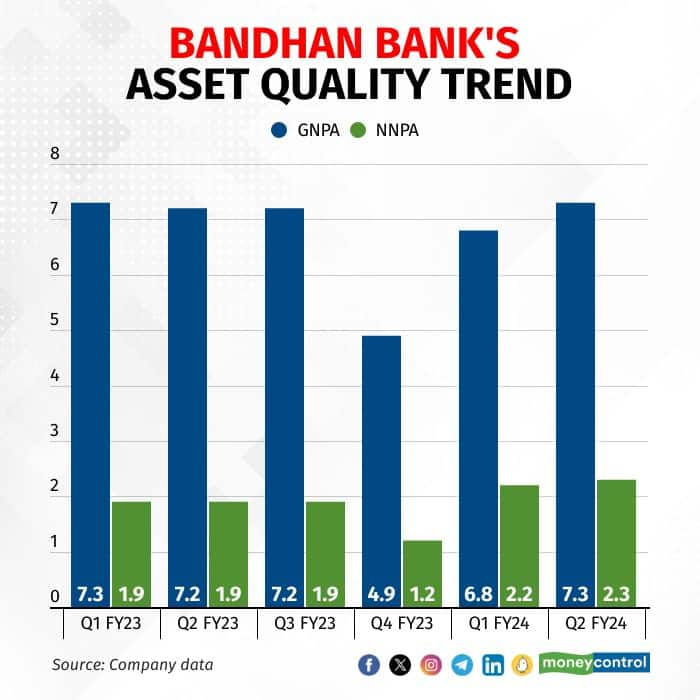

The Kolkata-based lender has clocked the second highest on-year jump in Q2 net profit among banks so far. It also boasts of the highest gross NPA ratio in its league.

And, it is the worst performing private sector bank stock of October.

Just like Indian parents disregard all qualities of their children if he/she doesn’t score well in exams, the Street is unforgiving of lenders who may be posting wonderful numbers overall but fail to maintain their asset quality.

After a 190-bps spike in its gross non-performing assets (GNPA) ratio to 6.8 percent in Q1, Bandhan Bank saw a further 57 bps uptick in the ratio to 7.3 percent. Its net NPA ratio inched up sequentially to 2.3 percent.

To give a sense of the unease in the analyst community, more than half of the dozen-odd questions posed by them at the company’s earnings call revolved around asset quality and recoveries.

The management, led by the bank’s founder MD and CEO Chandra Shekhar Ghosh, was at pains to emphasise that all was well.

The bank’s collection efficiency improved to 98 percent in September and its post-Covid portfolio (consisting of all loans disbursed after June 2021) had a GNPA ratio of just 2.6 percent, they pointed out.

“H2 historically, if you see, has always been a better quarter or better half for us for any financial year, whether it's in terms of new business growth or also the collection point of view," CFO Sunil Samdani said.

“We expect this to reflect in the slippages number also. And, as I mentioned earlier, the recoveries will continue to improve. That has been the trend for last many years. In H2, the recoveries are always better. So, on both counts, we expect the slippages to be lower and recoveries to be higher,” he added.

Mera Gaon, Mera TestA key contributor to the spurt in bad loans was slippages worth Rs 1,000 crore from its Emerging Entrepreneurs Business (EEB) pool, which comprises microloans, micro home loans, micro bazaar loans, and micro enterprise loans.

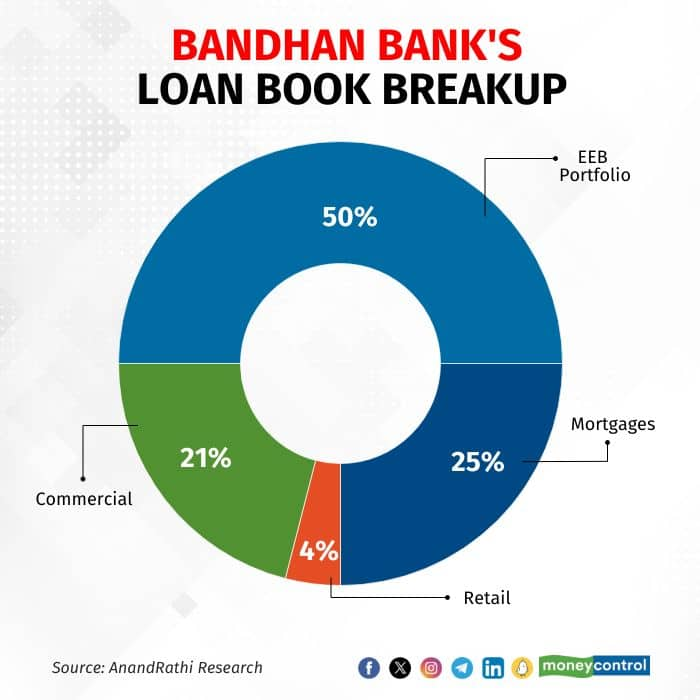

EEB accounts for around half of Bandhan Bank’s total loan book. The EEB book is unsecured, making it all the more important for the lender’s overall health.

“In line with its strategy to foray towards a secured portfolio, the bank continues to build traction in the non-EEB book —commercial banking (+65% YoY) and retail (+80% YoY),” HDFC Securities said in a note on Bandhan Bank, aptly titled ‘Testing patience; searching for stability’.

“While the mortgage portfolio had been lagging for a while, recent evidence points to a pick-up in disbursement trends. The secured loan mix now stands at 44 percent as against the management’s intent to increase it to 50 percent by FY26,” the brokerage house added.

Bandhan Bank is also facing some delays in receiving around Rs 1,700 crore under two government schemes – CGFMU and ECLGS.

The Credit Guarantee Fund for Micro Units (CGFMU) is the Trust Fund set up by the government with the purpose of ensuring payment against default in micro loans, while the Emergency Credit Line Guarantee Scheme (ECLGS) was launched following the Covid-19 crisis to ensure liquidity to MSMEs.

Its operational challenges notwithstanding, some analysts see a glimmer of hope in the bank’s stressed assets position, including its declining Days Past Due (DPD) ratio. DPD indicates the number of days by which a borrower has missed an EMI or credit card payment.

“The overall DPD (1-90 days) data saw a sharp 130bps QoQ drop, which now stands at 4.2 percent, suggesting lower stress pipeline. With normal collection efficiency and the stressed pool adequately provided for, slippages ahead are expected to be normal,” analysts at AnandRathi said.

Others, however, expect the bank to face considerable headwinds in the medium-term.

“With heavy investments in franchise-building, operating efficiencies still seem a little distant (Q2FY24: cost-to-assets at 3.8 percent). The impending margin compression, high competitive intensity for low-cost deposits and continued volatility in asset quality in the core-EEB book continue to remain a challenge,” HDFC Securities said.

Disbursal momentum during the festive season and the pace of recoveries from the stressed portfolio will be the key monitorables even as the franchise continues to search for stability, it added.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.