India's top private and public sector banks increased the amount of loans that were written off in the July-September quarter.

Five of the seven top banks that have declared their quarterly results posted a higher level of write-offs compared with a year earlier, according to a Moneycontrol analysis of data from 14 banks. The seven banks are HDFC Bank, ICICI Bank, Axis Bank, Union Bank of India, Punjab National Bank, IndusInd Bank and Canara Bank.

Banks write off loans when there is no scope of recovering them from borrowers. Typically, banks need to set aside 100 percent of the written-off loan amount as provisions, which impacts their profitability.

Also read: Banks see sharp growth in unsecured loans even after RBI caution

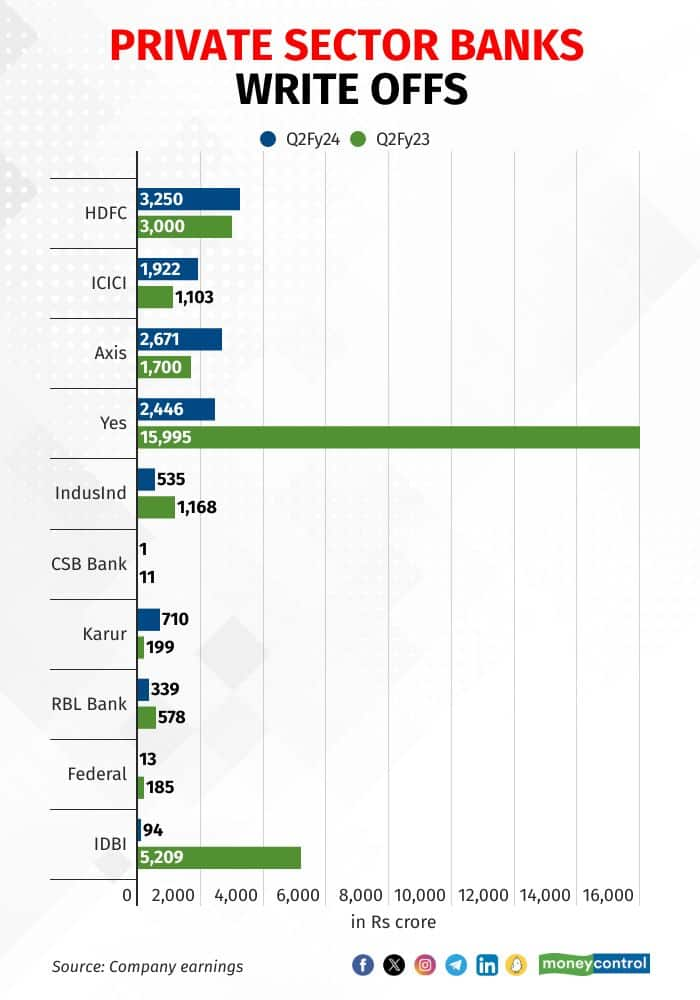

HDFC Bank, the country’s largest private lender, wrote off Rs 3,250 crore of loans in the July-September quarter compared with Rs 3,000 crore a year earlier.

ICICI Bank’s loan write-off rose to Rs 1,922 crore from Rs 1,103 crore a year ago. Axis Bank wrote off Rs 2,671 crore compared with Rs 1,700 crore.

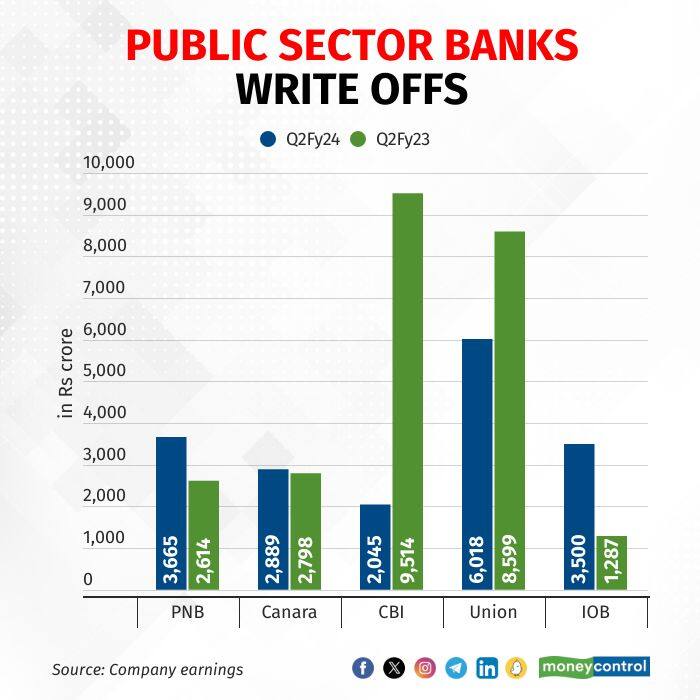

Among state-run banks, Punjab National Bank, the loan write-off figure jumped to Rs 3,665 crore from Rs 2,614 crore, while for Canara Bank it increased to Rs 2,889 crore from Rs 2,798 crore.

The big banks that did not increase their write-offs were IndusInd Bank – Rs 535 crore versus Rs 1,168 crore – and Union Bank of India, at Rs 6,018 crore from Rs 8,599 crore.

Mixed trend

The trend in write-off numbers was mixed for other midsize and small banks that have announced their results.

Central Bank of India’s write-off for the period was at Rs 2,045 crore, falling from Rs 9,514 crore a year earlier. IDBI Bank’s write-off plunged to Rs 94 crore from Rs 5,209 crore in a year. Yes Bank’s write-offs fell to Rs 2,446 crore from Rs 15,995 crore.

Also read: Recovery continues to be less in IBC cases, data from banks, CareEdge show

The loan write-off numbers for RBL were Rs 339 crore compared with Rs 578 crore, and for Federal Bank, they were Rs 13 crore against Rs 185 crore. CSB Bank had loans worth Rs 1 crore written-off in July-September FY24 compared with Rs 11 crore in the corresponding quarter last year.

Karur Vysya Bank wrote off loans worth Rs 710 crore compared to Rs 199 crore last year. Indian Overseas Bank’s write-offs were at Rs 3,500 crore compared with Rs 1,287 crore.

Data from the Reserve Bank of India showed that banks wrote off bad loans worth over Rs 2.09 lakh crore in FY23, taking the total loan write-off by the banking sector to Rs 10.57 lakh crore in the past five years.

The write-offs helped banks to lower the level of their gross non-performing assets – or borrower defaults on loans – to a 10-year low of 3.9 percent of advances in March 2023.

Experts said some banks had difficulties in recovery and resorted to higher write-offs than last year. A senior executive of a bank who did not wish to be identified said that recoveries among some banks have been less compared to other ones.

“Now that some banks have shown higher write-offs in this quarter, we may see them working on maintaining the business flow,” said Anand Dama, head BFSI, Emkay Global Services.

According to Vijay Singh Gaur, lead analyst, BFSI, CareEdge, banks have recorded good asset quality numbers that would now lead them to work on recovery and business maintenance

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.