Power Grid Corp of India is expected to record a modest on-year growth in Q3 revenue on slow capacity build-up, while its net profit may fall because of a rise in transmission costs. The company is set to announce its Q3 FY24 results on February 7.

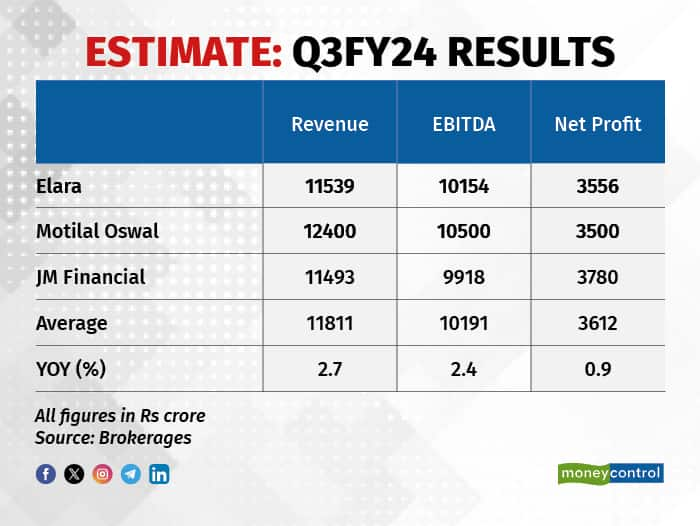

The PSU power transmission company is expected to see its fiscal third quarter revenue grow 2 percent on-year to Rs 11,811 crore, according to an average of three brokerage estimates. Net profit is expected to fall 0.9 percent to Rs 3,612 crore, according to estimates.

Earlier, in Q2FY24, state-run power transmission firm reported a 4 percent on-year increase in net profit to Rs 3,781.42 crore, while its total income for the same period grew 1.6 percent on-year to Rs 11,530 crore.

Power generation buoyant in Q3, but capacity shortage may have hit Power GridAccording to brokerages, power generation remained buoyant in Q3FY24 on the back of surging demand during the festive season. “Rising power demand, widening peak deficit, incremental renewables addition, the requirement to add incremental thermal capacity (as peak shortages increase) and expansion into new ventures (pumped storage and green hydrogen) are some key drivers for the sector, an Elara Securities report said.

Power Grid has 12 ‘buy’ calls against five ‘sell’ and four ‘hold’ calls at present. Analysts at Elara Securities said in a recent note that India’s transmission capex is progressing at a slower pace. Further, private sector participation in transmission is higher, adding to the competition.

“Power Grid Corporation's (PGCIL) work-in-hand has remained stagnant at Rs 500,000 crore since FY2020 and much lower than the peak in FY2016. While work in hand may grow, project conceptualisation, award and conversion to earnings may take a long time,” said the note.

Also read: Energy Budget: Power PSUs get 17% more budgetary allocation

Pressure on Power Grid margins on higher costs

JM Financial analysts also expect Power Grid to report a “flattish quarter” with net sales at Rs 11,500 crore, and an EBITDA margin decline of 156 bps to 86 percent. JM Financial has a buy call with a target price of Rs 235.

In a November 2023, Q2 earnings report, Elara analysts maintained a ‘reduce’ call on the stock as they saw limited earnings growth due to low capex and capitalization. In the Q2FY24 earnings call, the company mentioned that the cumulative Capex in the 1st half of the year was Rs 4,246 crores against the yearly target of Rs 8,800 crore.

Also read: Power Grid board approves raising Rs 2,200 crore via bonds

On the other hand, Bank of Baroda Capital analysts maintained a ‘buy’ call on Power Grid in a November 2023 report. They assigned a target price of Rs 210 "given its superior ROE and lowest risk profile within the power sector".

Jefferies continues to have a ‘buy’ call on Power Grid with a target price of Rs 270.

As of February 3, the Power Grid stock was trading at Rs 270. Over the last one year, the stock has gained 72 percent and gained over 180 percent over the last five years. It has beaten the NSE Nifty 50, which has gained 23.3 percent during the year.

Power Grid Corporation is a Schedule ‘A’, Maharatna company which operates under the Ministry of Power (with 51.34 percent government holding) and is engaged in bulk transmission of power.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.