Jitendra Kumar Gupta Moneycontrol Research

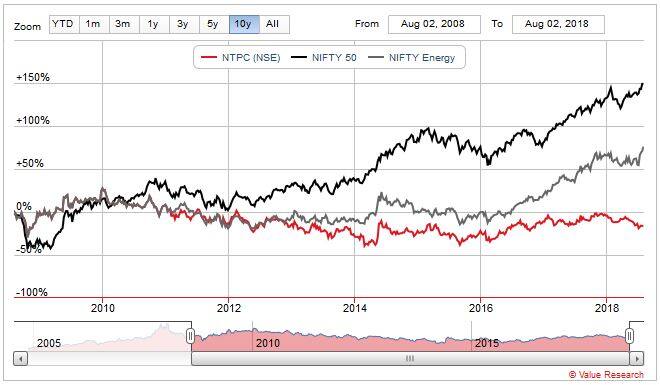

State-owned power utility NTPC has trailed the broader market over the past few years. This is partly because of a downturn in the power sector and resultant stress, which has led to its valuation getting downgraded.

While the situation may be improving because of higher capacity addition, it would still be prudent for investors to lower their expectations.

Mirage of high RoE

The company is permitted to earn a post-tax return on equity (RoE) of 15.5 percent on the capital invested in operational power projects, which is also called regulated equity.

However, due to tax benefits and efficiency-based incentives, the company's core regulated RoE goes up to 22-25 percent, which is quite encouraging for a utility.

While the company's RoE is good, its growth in regulated equity plays a key role in driving earnings, given that it is a capital-intensive business.

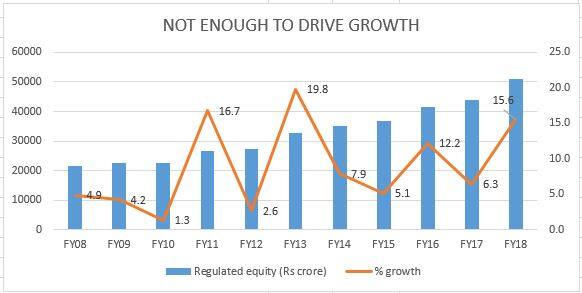

To put things in perspective, NTPC's regulated equity has grown at 9.35 percent over the last five years, and at around 9 percent over the last 10 years, to Rs 50,921 crore as at the end of FY18.

Considering that the company's regulated equity hasn't grown much over the decade or so, it is not surprising that its earnings over the last 10 years grew at a mere 3.8 percent per year, and declined at 4.4 percent per year over the last 5 years.

The key takeaway here is that NTPC has little room to absorb any kind of shock in the form of slippage in capital expenditure, reduction in regulated RoE, performance of subsidiaries, uncertainty over under recoveries, cost of other initiatives like forming joint ventures with other PSUs, etc.

The company has expressed interest in acquiring SJVN, and even NHPC is believed to be under consideration for a takeover by NTPC. Close to Rs 10,000 crore of equity capital (around 10 percent of its net worth), deployed in many of the state subsidiaries, are making negligible or no contribution.

Core business: need magic

The company has big plans to add capacity. It is currently setting up additional capacity of around 20,000 MW. Of this, the company is aiming to add around 5,000 MW each in the year 2019 and 2020.

However, a lot of the capacity addition has been delayed. Slippages in capacity addition would have their bearing on the company's earnings and overall growth.

In FY18, NTPC's capex fell to Rs 24,134 crore, Rs 4,118 crore lower than in the previous year.

Also, the plant load factor at its existing plants has been dropping. During the June quarter, the PLF for its coal-based power plants dropped by 107 basis points to 78 percent.

The PLF for the company's gas-based and hydro power plants has been dropping for the past decade or so. In FY08, it was at 92.2 percent, but fell to 80.2 percent in FY15, 78.6 percent in FY17, and 77.9 percent in FY18.

Valuations: A dividend play at best

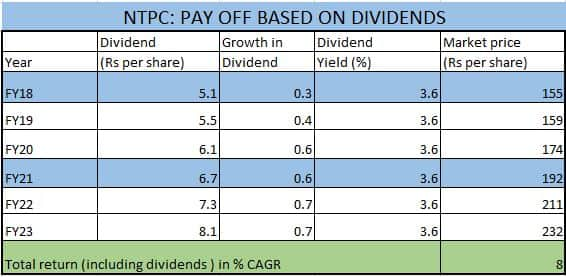

If the company's growth does not improve materially, investors would better off valuing the stock on the basis of dividend alone. And this is precisely why the stock is currently trading at a dividend yield of close to 3.6 percent and at 1.1 times its price-to-book value.

If we factor in a growth of 10 percent in dividend, investors holding on to the stock for a five-year period would earn an annualised return of merely 8 percent.

Of course, these estimates are possibly conservative and based on the current dividend yield and valuation. Overall return would differ in case there is any change in valuation.

The stock is currently trading at its median valuation. At best, it could trade 50-60 percent higher at around 1.6 times book value, and at worst, could trade 10-20 percent lower at around 1 time.

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.