After stellar growth for many quarters, Q4FY19 was a speed breaker for L&T Infotech (LTI). FY19 though still ended on a strong note. While the slowdown in its top client might linger on for one more quarter, the robust digital capabilities, diversification in terms of verticals and healthy demand environment, could turn FY20 into another strong year for LTI.

The probability of integration with Mindtree (should L&T succeed in acquiring a majority stake) is not yet factored in and remains a long-term possibility. The weak sentiment for the IT sector in view of the strong currency and weak guidance from a large IT services company could just be an ideal opportunity to accumulate LTI for the medium term.

Source: Company

Key negatives

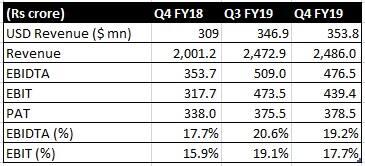

For LTI, the quarter was weaker than usual. Revenue stood at $353.8 million showing a sequential growth of 2 percent. The quarter on quarter growth in constant currency at 1.9 percent was the weakest in the fiscal so far.

Source: Company

The quarter also saw 140 basis points sequential decline in the margin to 17.7 percent. This could be attributed to higher investment in sales, lower utilisation (that had touched an all-time high in the previous quarter) and an appreciating currency.

The softer revenue performance was on account of weakness in its top client. This is also reflected in the poor show of its banking and financial services vertical and the flattish growth performance of the top five clients.

Q1 FY20 is likely to be a soft quarter on account of the weakness in the top client.

Source: Company

The company also saw an increase in the attrition rate to 17.5 percent – up 100 basis points sequentially. This is a number that warrants close monitoring in view of the supply crunch that the industry is facing with respect to highly skilled IT professionals.

Key positives

FY19 ended on a strong note for the company with revenue growth in constant currency at 20.9 percent and margin improvement of 340 basis points to 18.4 percent.

Digital continues to drive growth with the share of digital at 38 percent – up 500 basis points in the year.

A strong performance was reported in verticals such as high-tech, media & entertainment as well as manufacturing. Retail CPG (consumer packaged goods) & Pharma showed strong growth in the year although it was a tad soft in the final quarter.

The company won two large deals in the quarter, one from manufacturing and the other from the insurance vertical with the total value in excess of $100 million.

The management is optimistic on the demand environment and alluded to strong deal pipeline and expects to clock industry-leading growth in FY20 as well, albeit the soft start to the year.

Outlook

The stock has underperformed in the past six months on the back of concerns that its balance sheet might be used to fund the stake purchase in rival Mindtree. While that concern has receded, the soft quarter might lead to consolidation in the stock. Rupee appreciation and weak guidance from a large IT major are added headwinds. However, given the industry-leading performance in the past and presence of the right ingredients for growth, we would advise buying into the stock amid the weakness.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.