Pharmaceutical major Dr Reddy's Laboratories is slated to release its October-December earnings report on January 23. Marking a shift from previous quarters of solid growth, the company's net profit is expected to remain flattish on year, bogged down by margin pressures due to lower Revlimid contribution and subdued growth in the US base business.

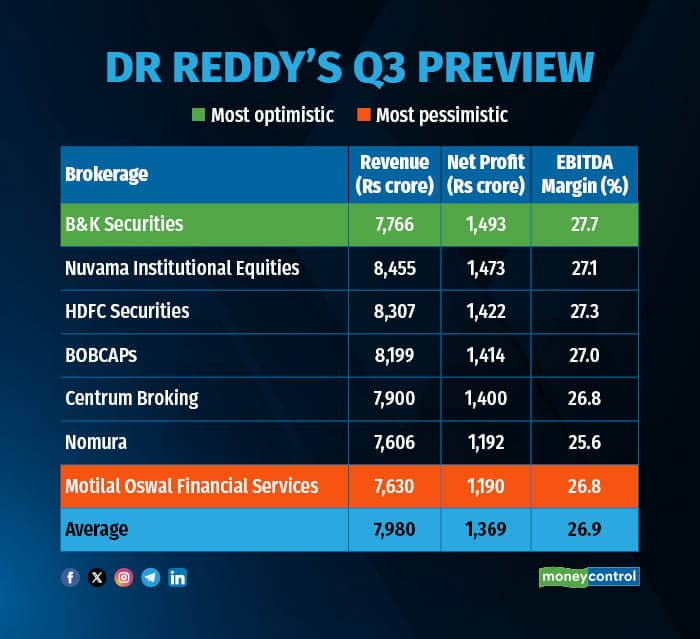

According to a Moneycontrol poll of seven brokerages, Dr Reddy's net profit is pegged at Rs 1,369 crore, largely at par with the Rs 1,379 crore that it reported in the same period last fiscal. Despite that, the company's revenue is estimated to grow 10 percent on year to Rs 7,980 crore in the December quarter as compared to Rs 7,215 crore in the corresponding quarter last year.

However, operational performance is likely to take a major hit, which is seen as the biggest driver denting the company's bottomline. As per the forecasts collated by Moneycontrol, Dr Reddy's EBITDA margin is expected to squeeze sharply to 26.9 percent in Q3 as against 29.3 percent in the year ago period.

Another interesting facet emerging from analysts' forecasts for Dr Reddy's is the wide range of expectations. While the most optimistic prediction, from B&K Securities, anticipates an over 8 percent rise in net profit, the most cautious, from Motilal Oswal Financial Services, projects a near 14 percent decline.

What factors are impacting the earnings?The drugmaker is likely to face margin pressures in Q3, which will squeeze profit growth.

Lower Revlimid sales: Although Revlimid will continue to support performance of large-cap pharma players till FY26, Q3 is likely to see lower sales of the drug for several companies, noted JM Financial. Nomura also estimates a sequential decline in Revlimid sales after it remained elevated in the first half of FY25.

Margin pressure: With the gradual tapering of contributions from Dr Reddy's blockbuster cancer drug Revlimid, which approaches patent expiry in 2026, the company is expected to face margin pressures in Q3. The impact will also be compounded by a high base effect from the last fiscal when higher contribution from the high-margin blockbuster drug bolstered operating performance for the drugmaker.

Muted US growth: Nomura anticipates a 4 percent on year decline in Dr Reddy's US sales for the quarter. "The fall is driven by lower estimates for Revlimid sales and discontinuation of vaginal hormonal contraceptive, Nuvaring due to supply disruption. Furthermore, there is pricing pressure in the US base business," the brokerage stated.

What to look out for in the quarterly show?Analysts will closely monitor updates on Dr Reddy's potential drug approvals and launches in the US over the next 12-18 months to assess its earnings visibility. Investors will be keen to understand the company’s strategies to offset revenue losses from the anticipated void following Revlimid's patent expiry.

Additionally, the progress of Dr Reddy's biosimilars pipeline will remain a key area of interest. Focus will also center on the company’s plans for inorganic growth opportunities and its outlook on margins which will be helpful in gauging its long-term growth trajectory.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.