Marie Gold maker Britannia Industries will share its earnings report for the three months ended June on August 5, 2025. The biscuit maker will see a high-single digit growth in net profit, led by volume-driven growth and price hikes.

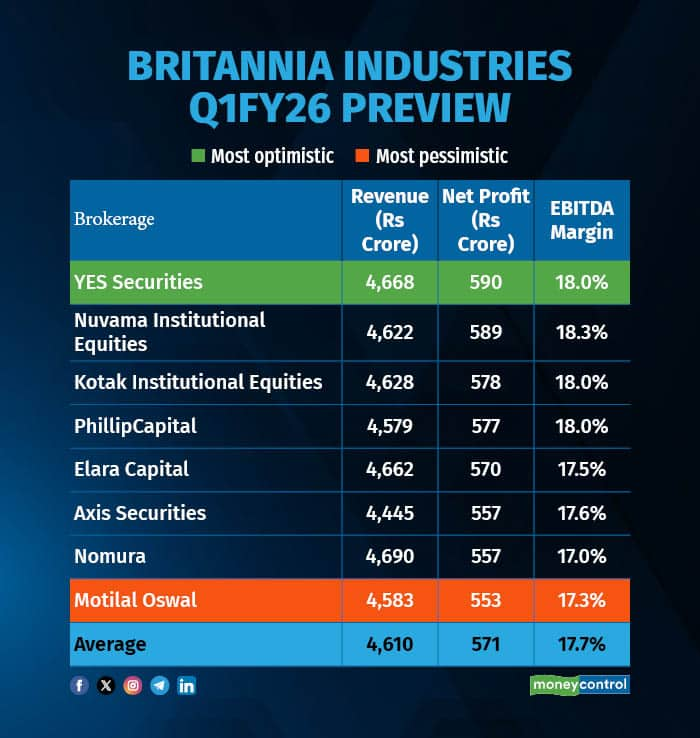

According to a Moneycontrol poll of eight brokerages, Britannia Industries is likely to report a 8.5 percent revenue growth at Rs 4,610 crore. Net profit is likely to come in at Rs 571 crore from Rs 530 crore from the corresponding quarter last year, rising 7.8 percent on-year.

Earnings estimates of analysts polled by Moneycontrol are in a narrow range, so any positive or negative surprises may elicit a sharp reaction in the stock. The most optimistic estimate sees Britannia’s net profit coming in higher by 11 percent, while the most pessimistic projection sees an 5 percent on-year gain.

What factors are impacting the earnings?Earlier, Britannia Industries' management had earlier indicated its aspiration to deliver double-digit revenue growth and profit growth ahead of revenue growth in FY2026.

Volumes: Britannia Industries' volume growth rate is likely to grow between 3 to 5 percent, according to brokerages. YES Securities said, "We don’t see any change in volume growth for Britannia Industries in Q1FY26 compared to 4QFY25 as gradual recovery will be offset by high base, grammage changes and impact from pricing actions."

Margins: As a result of continued inflation seen in key raw materials and high ESOP provisioning gross and EBITDA margins are likely to see some contraction, according to brokerages.

Pricing: Britannia Industries is likely to have taken some pricing action, with Nuvama estimating that the FMCG firm hiked prices by six percent over the past quarter. The price hikes are likely to have contributed to strong sales growth for the three months ended June.

Analysts will closely monitor demand in metro areas as Britannia Industries reported a significant impact from waning urban consumption over the past few quarters. Experts will also pay attention to raw material prices and their effect on EBITDA margins, as well as the heightened competitive pressure from unorganized players.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.