Madhuchanda Dey Moneycontrol Research

NIIT Technologies ended FY18 with strong execution in the final quarter that saw robust revenue growth and uptick in operating margin. Deal flow momentum is encouraging and the management’s outlook for FY19 is strong as it expects enhanced spending from key clients. The stock has re-rated and trades at 18.5 times FY19e earnings. We recommend accumulation at current levels.

Quarterly snapshot

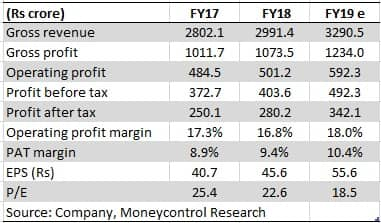

The company reported total revenue of Rs 788.8 crore in Q4 FY18, a quarter-on-quarter (QoQ) growth of 4.3 percent in rupee as well as constant currency terms. Year-on-year (YoY) revenue growth, excluding the one-time settlement impact of Rs 27 crore in the year-ago (Q4 FY17) quarter, was 9.9 percent.

During the quarter under review, growth was led by banking, financial service and insurance (BFSI) as well as manufacturing/media that together contributed close to 74 percent of total revenue. In terms of geographies, the stand outperformer was Europe, Middle East and Africa (EMEA) region.

The company managed to improve its operating margin by 90 bps sequentially to 18 percent. Higher incremental growth from digital segments (from acquisitions like RuleTek and Incessant Technologies) contributed to the margin improvement. The share of digital stood at 26 percent at the end of the fourth quarter and showed a sequential growth of nine percent.

For FY18, the company registered 9.7 percent growth in constant currency revenue and operating margin of 17.4 percent. The share of digital stood at 24 percent, with YoY growth of 27 percent.

NIIT Technologies’ client base is also diversifying with contribution from top five clients now 29 percent, down from 34 percent last year.

Long profitable road ahead

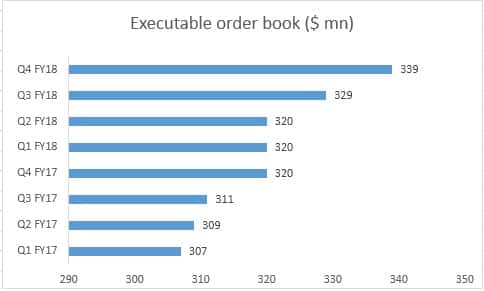

The management’s outlook for FY19 is extremely encouraging. The company had a vastly improved order intake n FY18 and expects FY19 to be even better. Outlook for its key industries like BFSI (especially the wealth management space) and travel and tourism is extremely encouraging. IATA (International Air Transport Association) expects 2018 to be a good for travel and tourism. It has guided for an increase in spending by all its key 20 clients. Spending is seen in areas of digital, data and legacy system transformation.

The management announced seven large deals in FY18 and expects to better the same in FY19. Its organisational restructuring, energising and incentivising the sales force appears to be yielding result.

In view of the improved order outlook and backlog, the company expects at least double-digit revenue growth in constant currency in FY19 along with an improvement in operating margin.

What’s working for the company?

The management has been reducing government business and trying to expand revenue share from its international business. Business from the government segment now accounts for less than a percent. This is aiding margins and reduced days sales outstanding (DSO). Growth in International geographies is strong. Revenue contribution from digital has been improving rapidly and stood at 26 percent of sales, aided by the acquisition of Incessant Tech and then RuleTek. Organically too, this segment has been growing well above the company average each quarter (27 percent growth in FY18). On the back of strong order pipeline, experienced senior management team and energised sales force we expect the momentum of robust performance to continue.

We strongly recommend accumulating NIIT Technologies at current levels.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.